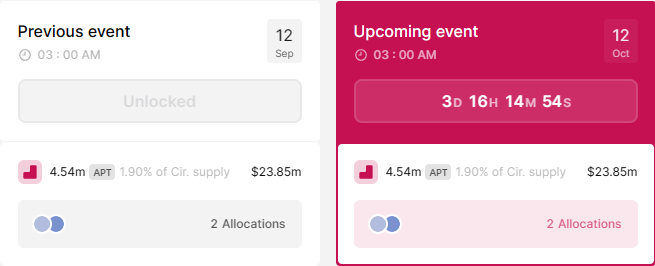

- Aptos price could record increased volatility this week, with 4.54 million APT tokens worth $23.85 Million due for unlocks on October 12.

- Ahead of the previous unlocks on September 12, the price dropped 15% but corrected 7% post-event, thus volatility.

- Large token unlocks typically free up liquidity and increase selling pressure on assets within two weeks of the unlock event.

Aptos (APT) price has not shown any directional bias for almost 1.5 months now, juggling between a fixed market range. However, investors have been active in responding to developments in the Apto ecosystem, and this could intensify this week as community members prepare for another event on the calendar.

Also Read: Counterfeit Aptos token deposited on Upbit leads to APT withdrawals being temporarily suspended

Aptos price braces for volatility

Aptos (APT) price has been oscillating between the $6.22 and $4.95 market range. One incident has contributed to this volatility, the cliff token unlocks that happened on September 12. The situation would have been worse for APT holders had the FTX exchange’s $3.6 billion crypto liquidation gone a different way.

On October 12, the Aptos ecosystem will be unleashing 4.54 million APT tokens to the market, worth approximately $23.85 million. With large token unlocks freeing up liquidity and increasing selling pressure on assets, APT holders should brace for increased volatility around Aptos price. Tentatively, the reverberations of such an event span the market within two weeks of the unlock event.

Aptos token unlocks

Aptos price outlook ahead of token unlocks event

In the previous unlocks event on September 12, Aptos price recorded significant price fluctuations within two weeks of the event as tokens were allocated to the foundation and the community. Notably, while the foundation may not be willing to sell, community members could very well cash in for a quick profit.

Ahead of the event, however, Aptos price could fall, akin to the previous event where APT value dropped 15% before rising 7% before and after the event respectively. The dip came as token holders rushed to avoid being caught as part of exit liquidity.

On this account, Aptos price is likely to start falling this week, potentially reaching the $4.95 support floor. Such a move would constitute a 5% slide below current levels. Already, the Relative Strength Index (RSI) is pointing to this effect, slipping below the 50 midline with an overall bearish inclination. A break and close below $4.95 could begin a new downtrend towards the $4.89 range low.

APT/USDT 1-day chart

Conversely, increased buying pressure could send Aptos price north, possibly breaking above the 50-day Exponential Moving Average (AMA) at $5.59. A decisive candlestick close above this moving average would invalidate the bearish thesis. In a highly bullish case, the gains could extend for APT to hit the $6.22 market value, 20% above current levels.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Source