- Australian Dollar rises on stronger Chinese Yuan and higher ASX 200 on Monday.

- Australia’s government has committed to backing a minimum wage increase aligned with inflation in 2024.

- CNY experienced a significant upward movement due to FX intervention, with Chinese major state banks observed selling USD/CNY.

- Fed Atlanta President Raphael Bostic revised his earlier forecast of two interest rate cuts this year, now expecting only one.

The Australian Dollar (AUD) starts the week by recovering its recent losses registered in the previous session. The AUD/USD pair trades higher on Monday despite a slight decrease in the US Dollar (USD) amid higher US Treasury yields. Investors are expected to closely monitor the Australian monthly Consumer Price Index (CPI) data for February and the US Gross Domestic Product (GDP) for the fourth quarter of 2023.

The Australian Dollar receives upward momentum as the ASX 200 Index extends its winning streak, led by gains in the mining and energy sectors. Additionally, the Aussie Dollar is bolstered by a stronger Chinese Yuan (CNY), with the People’s Bank of China (PBoC) setting the mid-rate for the onshore yuan significantly higher than expected.

The US Dollar Index (DXY) undergoes a correction after hitting a five-week high of 104.49 in the previous session. The US Dollar (USD) might face downward pressure as ongoing United States (US) data shapes expectations for the start of the Federal Reserve (Fed) easing cycle, anticipated to commence in June. The Federal Reserve (Fed) has downplayed higher inflation readings, with Chairman Jerome Powell reassuring markets that the central bank will not hastily react to two consecutive months of increased inflation figures.

Daily Digest Market Movers: Australian Dollar appreciates on stronger CNY, ASX 200

- Australian Employment Change for February surged to 116.5K, surpassing expectations of 40.0K and the previous figure of 15.3K.

- Australia’s Unemployment Rate came in at 3.7%, lower than the anticipated 4.0% and the previous 4.1%.

- Australia’s government has pledged to support a minimum wage increase aligned with inflation this year, recognizing the ongoing challenges faced by low-income families amid rising living costs.

- China’s Premier Li Qiang stated on Sunday that the nation’s low inflation rate and low central government debt ratio provide significant leeway for macroeconomic policy adjustments.

- Federal Reserve Bank of Atlanta President Raphael Bostic revised his earlier forecast of two interest rate cuts this year, now expecting only one, citing persistent inflation and stronger-than-expected economic data.

- During the press conference, Fed Chair Jerome Powell stated that an unexpected rise in unemployment could lead the Federal Reserve to consider lowering interest rates.

- S&P Global Services PMI showed a slight decrease in March, dropping to 51.7 from 52.3. The expected reading was 52.0. Manufacturing PMI rose to 52.5 against the expected 51.7 and 52.2 prior. Composite PMI showed a slight dip to 52.2 from 52.5 prior.

- Initial Jobless Claims for the week ending on March 15 came in at 210K, below the 215K expected and 212K prior.

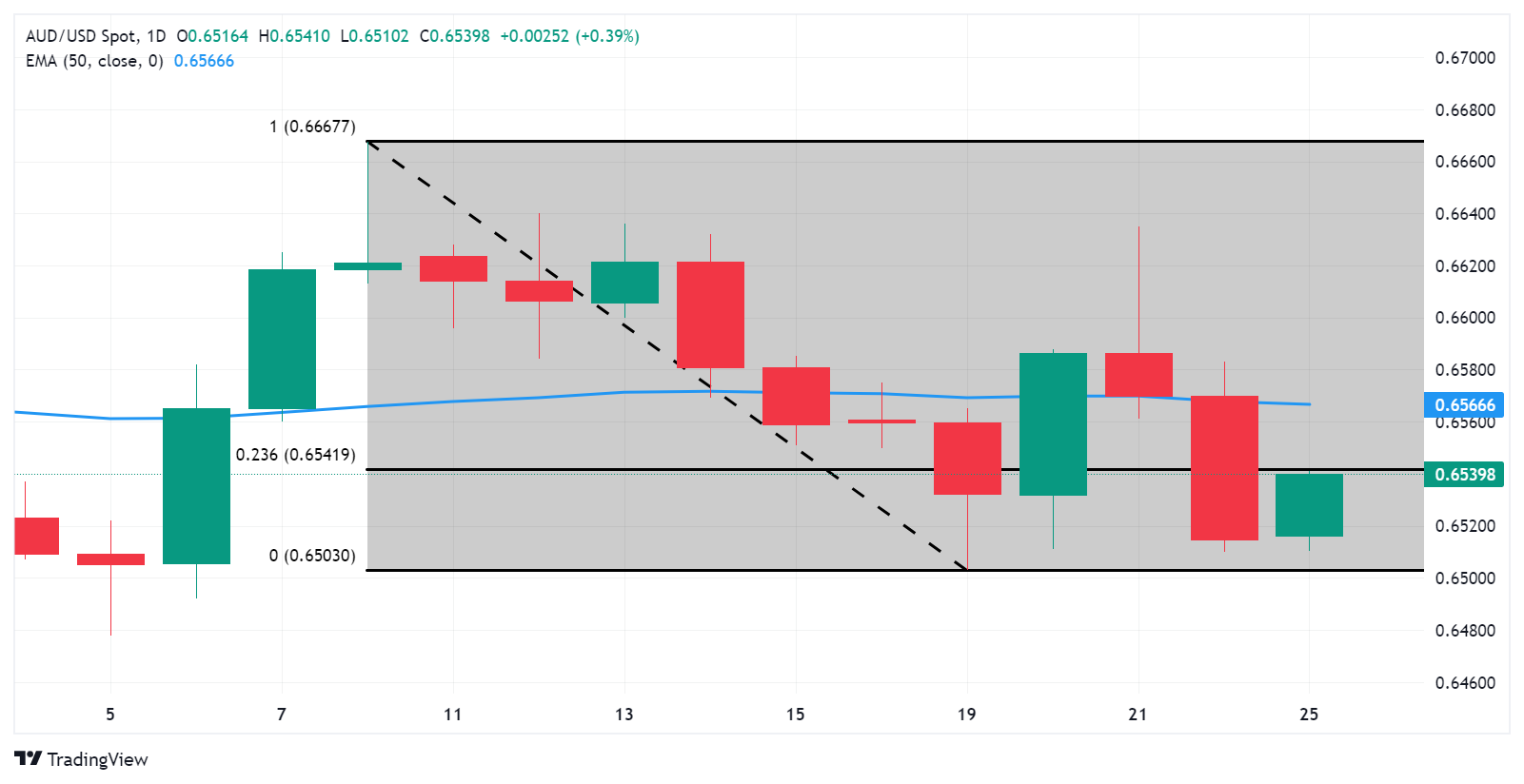

Technical Analysis: Australian Dollar hovers below 0.6540 followed by the 23.6% Fibonacci

The Australian Dollar trades near 0.6540 on Monday. The immediate resistance appears at the 23.6% Fibonacci retracement level of 0.6541, followed by the major barrier of 0.6550 level. A breakthrough above the latter could lead the AUD/USD pair to navigate the area around the 50-day Exponential Moving Average (EMA) at 0.6566, following the psychological barrier of 0.6600. On the downside, the key support appears at the psychological level of 0.6500. followed by March’s low at 0.6477.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.11% | -0.14% | -0.14% | -0.37% | -0.09% | -0.35% | -0.05% | |

| EUR | 0.13% | -0.02% | -0.02% | -0.24% | 0.02% | -0.18% | 0.07% | |

| GBP | 0.14% | 0.02% | 0.00% | -0.22% | 0.04% | -0.16% | 0.08% | |

| CAD | 0.13% | 0.02% | 0.00% | -0.22% | 0.04% | -0.17% | 0.08% | |

| AUD | 0.37% | 0.24% | 0.23% | 0.23% | 0.25% | 0.02% | 0.31% | |

| JPY | 0.08% | -0.02% | 0.04% | -0.02% | -0.26% | -0.24% | 0.06% | |

| NZD | 0.30% | 0.23% | 0.21% | 0.21% | -0.02% | 0.24% | 0.30% | |

| CHF | 0.06% | -0.07% | -0.09% | -0.08% | -0.31% | -0.03% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate, and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.