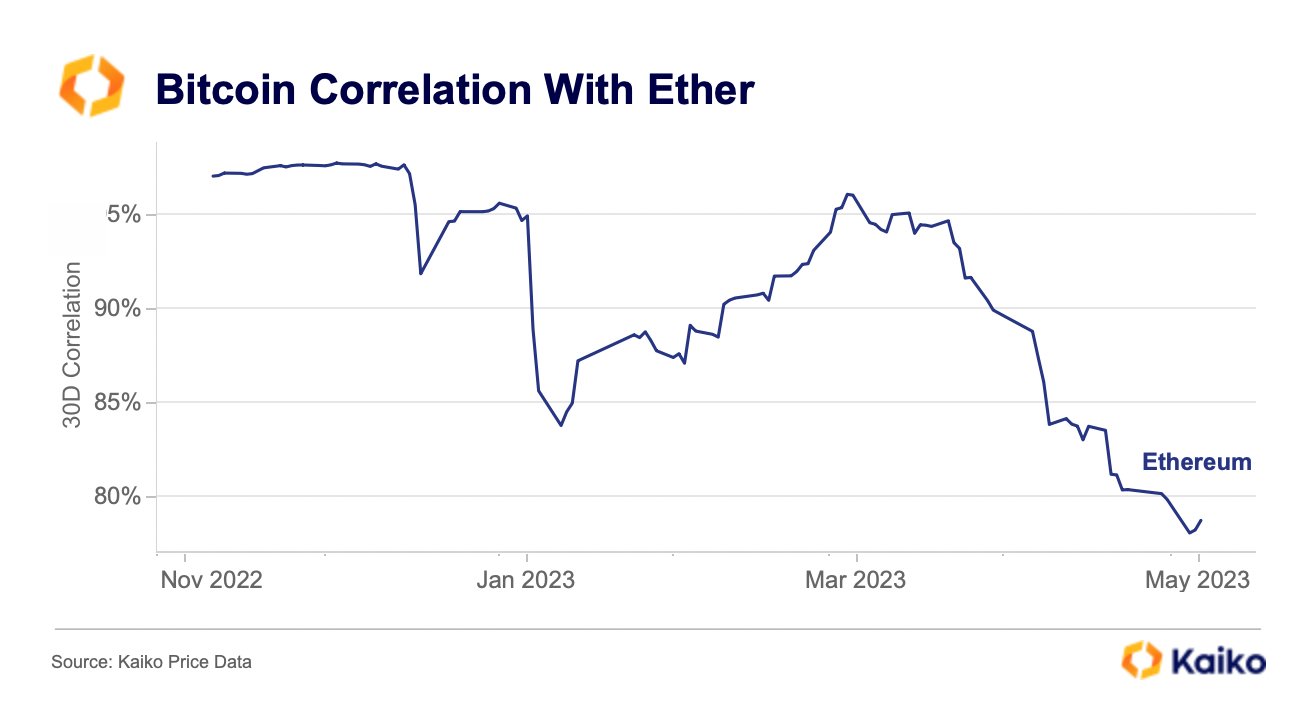

- Bitcoin and Ethereum 30-day rolling correlation declined to 78%, for the first time in 18 months.

- Bitcoin is outperforming other cryptocurrencies amidst the banking turmoil and changing macroeconomic outlook.

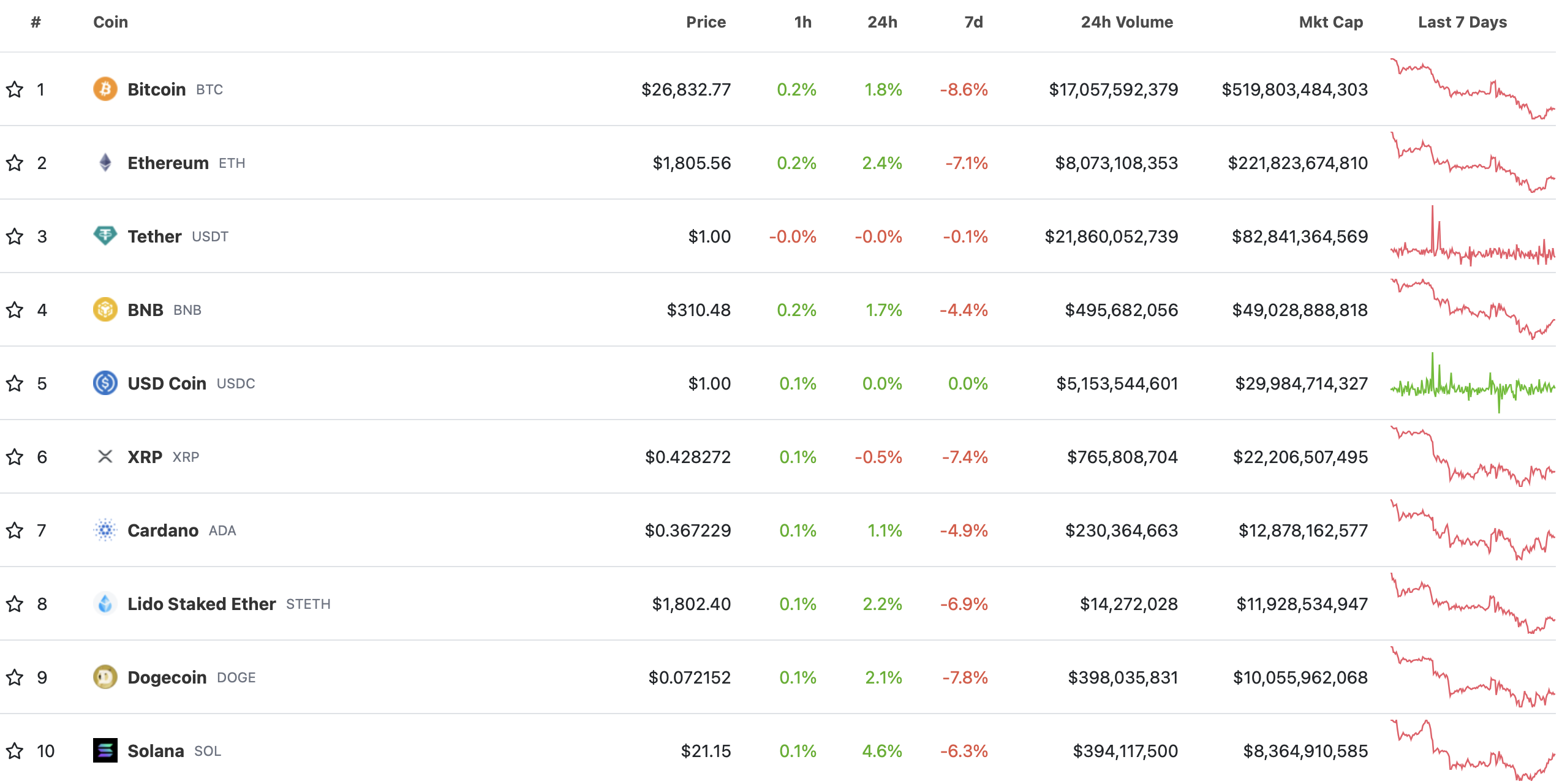

- Ether and other assets in the top 30 are struggling to recover from their recent pullback.

Based on data from crypto intelligence tracker Kaiko data, the 30-day correlation between the two largest assets by market capitalization has declined below 80% for the first time in a year and half.

Also read: Ethereum blockchain hits roadblock in finalizing blocks, ETH price continues recovery

Bitcoin and Ether correlation nosedives, what’s next

Typically, when the correlation between Bitcoin and Ethereum drops, the assets’ prices do not react in a similar manner to macroeconomic conditions and other catalysts. While Bitcoin price has fallen out of correlation with US equities, climbing higher during the banking crisis and increasing regulatory scrutiny.

Bitcoin correlation with Ether

As the 30-day rolling correlation between Bitcoin and Ethereum declined to 78%, altcoin lagged behind in its recovery.

Crypto assets in the top 30 are struggling to recover from their recent pullback while Bitcoin attempts to make a comeback above $27,000.

Cryptocurrencies in the top 10 by market capitalization

Ethereum ecosystem tokens and Layer 2 assets are correlated with ETH. With Ethereum’s declining correlation with Bitcoin, ETH and ecosystem tokens could see a drop in volatility response to macro market-moving events.

Since the two crypto assets’ correlation dropped for the first time since November 2021, it is a significant event and experts are closely watching prices and on-chain activity for signs of recovery.

Bitcoin price wiped out its US CPI-induced gains, while Ethereum price noted a modest 2.5% climb since Friday. Ether and its ecosystem tokens are poised for recovery with the rising ETH deposits in the Shanghai contract.