- Bitcoin price sustained above the $23,000 level despite macroeconomic headwinds and profit-taking by traders.

- BTC price held steady above the $23,000 level breaking above the cost basis of its three key holder cohorts.

- From the on-chain perspective, Bitcoin’s capitulation has unfolded and bulls helped the asset hold above key psychological level, fueling a bullish narrative.

Bitcoin price recovered from its decline after the announcement of US Nonfarm Payrolls data. The asset sustained above the key psychological level of $23,000. On-chain metrics point at a continuation of Bitcoin price rally in the long-term.

Also read: Alt season to propel Shiba Inu price next, here’s what SHIB holders can expect

Bitcoin price sustains above $23,000 despite macroeconomic headwinds

Bitcoin price crumbled under pressure following the announcement of US Nonfarm Payrolls. Number of jobs added by the world’s largest economy came in 2.5 times higher than expectations, making traders wary of the US Central Bank’s next rate hike to curb inflation.

Bitcoin price wiped out gains from the beginning of February, after hitting the $24,000 briefly. While Bitcoin is struggling to make a comeback to the $24,000, bulls have defended the $23,000 level.

Bitcoin on-chain metrics support the bullish narrative

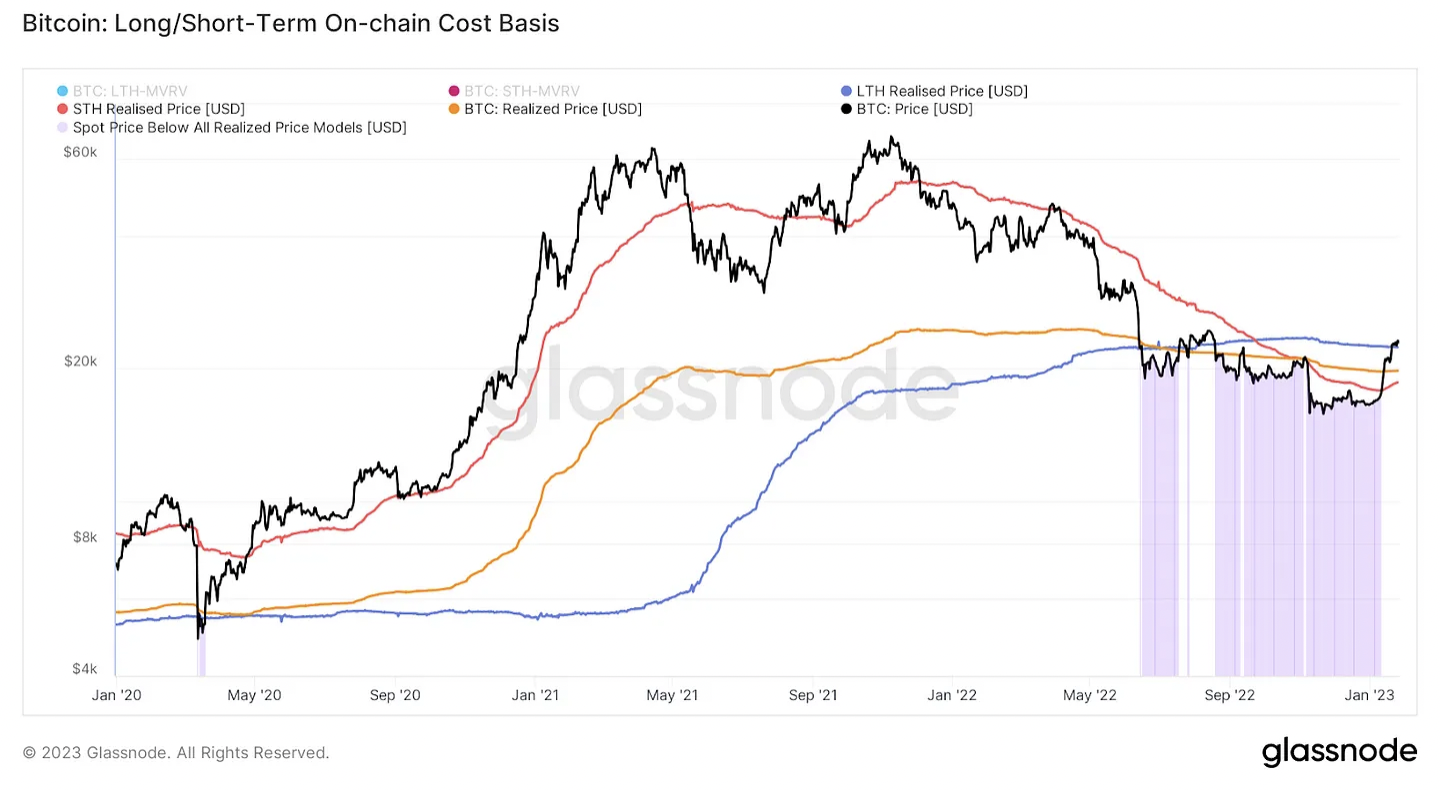

Bitcoin’s realized price, Short-term holder realized price and Long-term holder realized price are the on-chain metrics that give a clear understanding of whether various cohorts of the market are profitable or underwater.

Experts at Bitcoin Pro consider it key since when Bitcoin breaks above the cost basis of all three cohorts, it has a collective psychology effect when most market participants are no longer underwater.

Bitcoin: Long/Short-term on-chain cost basis

With BTC above $23,000, market participants in all three segments are no longer underwater. This highlights the importance of this level for market participants.

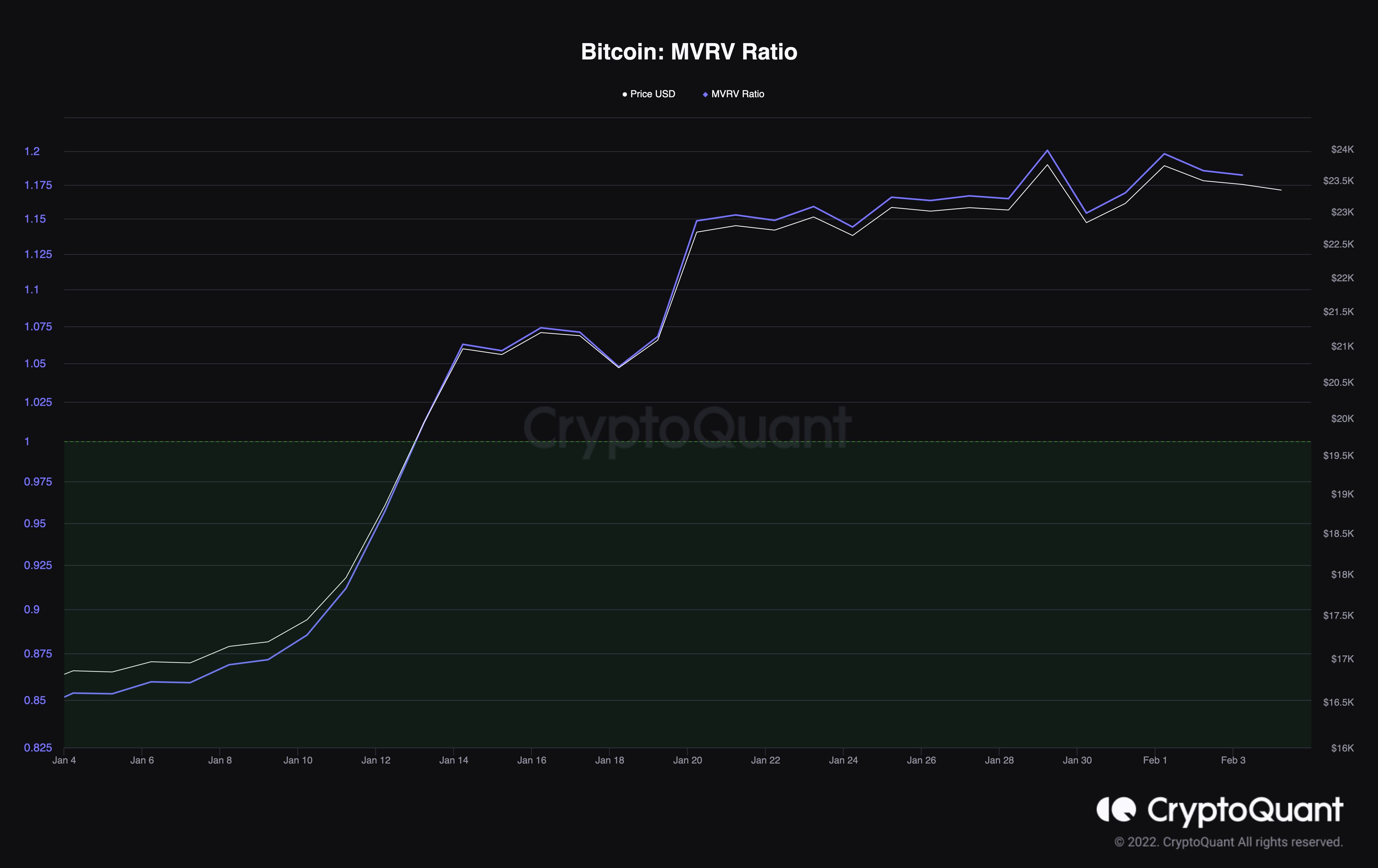

Bitcoin Market Value to Realized Value (MVRV) is an on-chain indicator that can be used to get a sense of when price is above or below “fair value”, and to assess market profitability. Currently, MVRV Ratio is 1.18, fairly close to 1.

When MVRV Ratio is below 1, it historically signals bear market bottoms and smart money accumulation. Since MVRV is at 1.18, it fuels the narrative of accumulation by market participants.

Bitcoin MVRV ratio

From an on-chain perspective, capitulation, a mass sell-off of BTC has clearly unfolded. Bitcoin holders defended the $23,000 level and there are signs of sustained uptrend in BTC, despite macro headwinds.