- Bitcoin price reclaimed $36,000 but could see further correction due to the bearish divergence noted over the last three weeks.

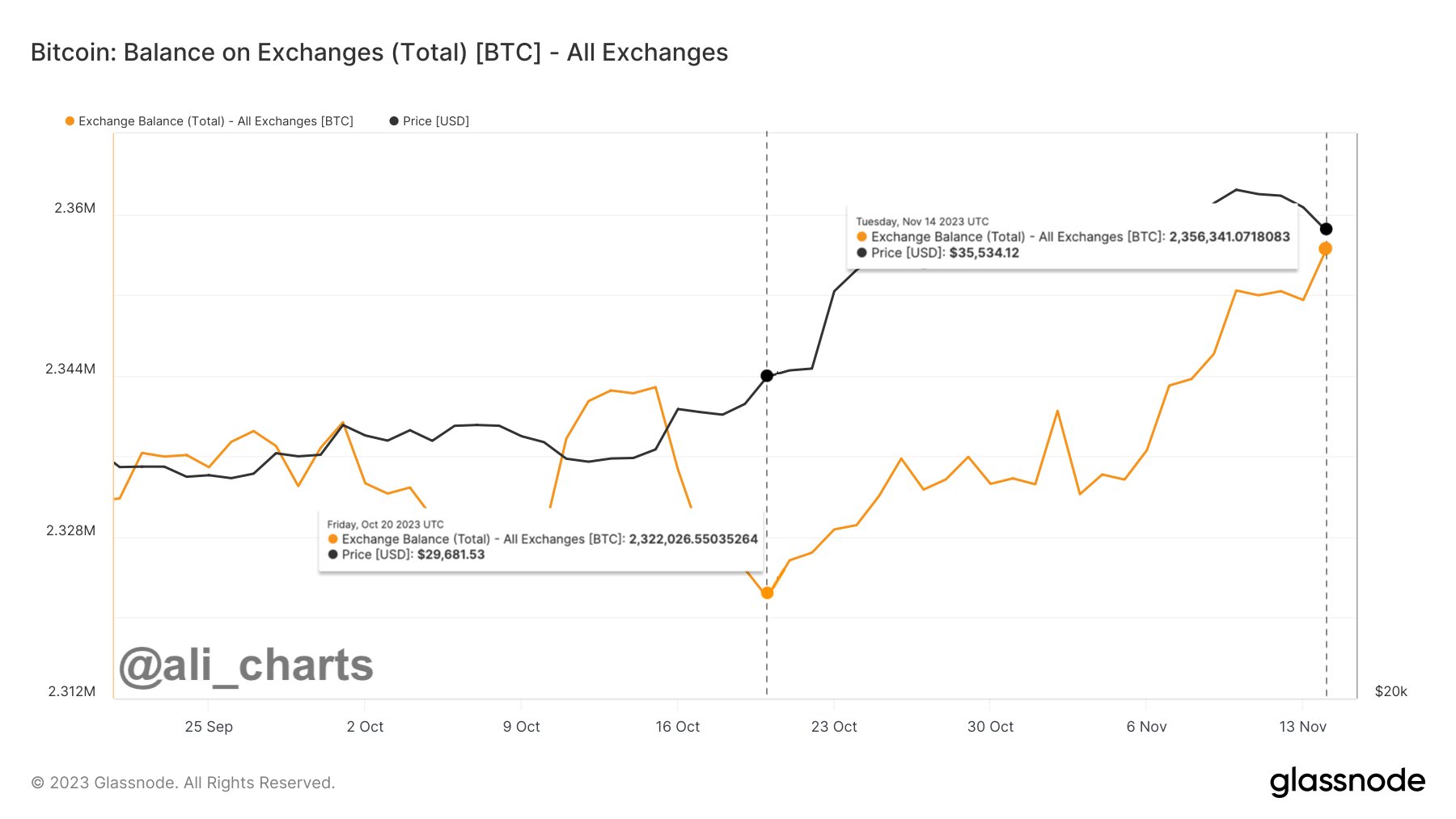

- Investors have sent over 34,000 BTC worth over $1.12 billion to exchanges in the past 30 days.

- Analysts suggest there is a less than 50% chance for spot Bitcoin ETF to be approved in this window marked until November 17.

Bitcoin price has confirmed the formation of a bearish divergence after the recent decline. The result of this divergence would be Bitcoin (BTC) likely falling before it can resume the macro uptrend.

Investors, however, seem too eager to book profits, which is evidenced by the inflow of BTC into the exchanges. They might have to wait a little longer, given that the spot Bitcoin Exchange Traded Fund (ETF) applications might still have a while before they are approved.

Spot Bitcoin ETF approval likely to be delayed

At the moment, the spot BTC ETF applications are the biggest catalyst for Bitcoin price, but it looks like they might not be approved in this window. This window, which began on November 8 and extends to November 17, marks the deadline for the Securities and Exchange Commission (SEC) to provide a decision on the ETF applications.

Okay, we’re nearing in on deadline dates for 3 spot #Bitcoin ETF applications. I want to get ahead of it because there’s a pretty good chance we’ll see delay orders from the SEC. Delays WOULD NOT change anything about our views & 90% odds for 19b-4 approval by Jan 10, 2024 pic.twitter.com/LE7sOlHAHM

— James Seyffart (@JSeyff) November 14, 2023

According to Bloomberg ETF analyst James Seyffart, the chances of approval this week are less than 50% and greater than zero. However, he maintained his stance on the 90% probability of the applications being approved by January 10, 2024.

SEC delaying the decision by the next deadline – November 17 – would mean that the regulator would have to rule on the 12 applications by January, which is now the next major period where Bitcoin price could rally.

Bitcoin price to see some decline

Bitcoin price climbed back to $36,000 on Wednesday, trading at $36,050 at the time of writing. Over the past four days, BTC has declined by about 4.7% after failing to breach the $38,000 mark. The rise noted in the last three weeks marked a bearish divergence as the Relative Strength Index (RSI) formed lower highs as BTC price registered higher highs.

Bearish divergences suggest that the market is bullish, but the momentum is slowing, which tends to result in a price decline. This was noted with the recent fall, but Bitcoin price will likely see further drawdown before it can begin a recovery towards $38,000.

This will be achieved if BTC manages to bounce off the crucial support level of $33,901, which will act as a boost for the cryptocurrency to breach the $36,833 barrier, invalidating the bearish divergence.

BTC/USD 1-day chart

However, if Bitcoin price falls through this support level, the bullish thesis would be invalidated, pushing BTC to tag $31,507 or lower.

Bitcoin investors might hold off selling

Bitcoin investors had been expecting good news this week regarding the spot BTC ETF approvals. In line with this optimism, BTC holders had prepared to sell off their holdings as soon as price rallied. This is evinced by the inflow of 34,000 BTC worth over $1.12 billion into exchanges.

Bitcoin exchange balance

Inflows suggest that the sentiment of selling for booking profit or offsetting losses is likely, and given the recent rally, in the case of BTC, it might be the former.

However, with the possibility of the ETF approval this week standing at less than 50%, these investors might refrain from selling their BTC. Should Bitcoin price bounce off $33,901 and climb higher, some of these 34,000 BTC might be offloaded, but the larger chunk of profit booking will likely take place in January following the decision on the 12 applications.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Source