- Bitcoin price is holding well above $69,000 threshold despite analysts speculating bearish calls.

- Rumors have it that Morgan Stanley will approve BTC ETFs on their platform soon.

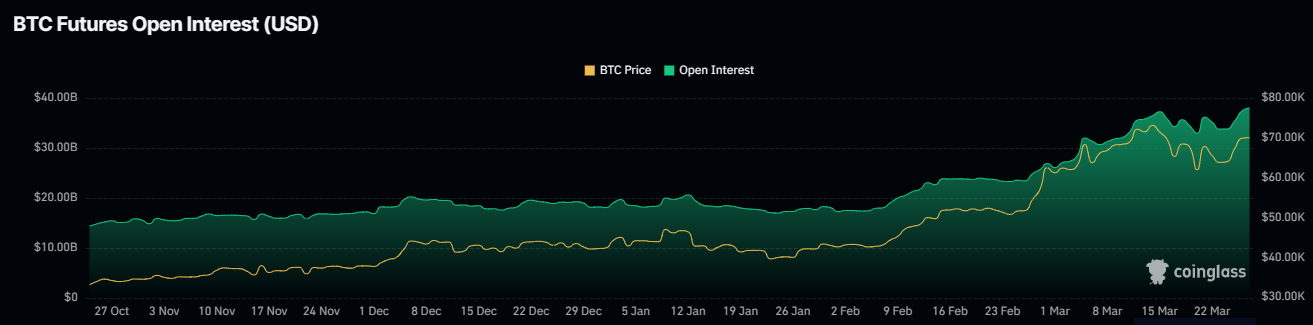

- Bitcoin nears a big sell wall with rising open interest signaling incoming volatility.

- 95% of BTC supply is now in profit as long-term holder cohort ramping up distribution pressure

Bitcoin (BTC) price continues to hold above the $69,000 threshold for the third day as markets anticipate the month of April, which will bring the much-anticipated BTC halving. Before this landmark event, however, analysts were split about the next direction of BTC, with most biases leaning toward a short-term drop.

Also Read: Bitcoin price is stuck beneath $73K as BTC long-term holders ramp up distribution pressure

Morgan Stanley could approve Bitcoin ETFs on their platform

After reports citing SEC filings that $150 billion market cap investment bank Morgan Stanley filed to buy Bitcoin exchange-traded funds (ETFs) , rumors have it that the financial firm could approve BTC ETFs on their platform soon.

JUST IN: Rumour that Morgan Stanley will approve #Bitcoin ETFs on their platform in the next 2 weeks are getting stronger.

Early this month Morgan Stanley filed with the SEC that 12 of their funds may buy Bitcoin ETFs.

Morgan Stanley has $1.5 Trillion in assets under… pic.twitter.com/tn7aYchoU0

— Bitcoin Archive (@BTC_Archive) March 27, 2024

One crypto community member, @AP_Abacus, who boasts upwards of 43.6K followers on X, cites sources from within Morgan Stanley, others from within BTC ETF firms, and legal insiders adjacent to both.

UPDATE: expecting a top ten US bank to approve multiple #Bitcoin ETF’s imminently.

**Source(s): @PNCBank is set to approve the availability of $BTC ETF’s across their WM platform.

— Andrew (@AP_Abacus) March 27, 2024

Morgan Stanley approving BTC ETFs on its platforms would have a number of impacts:

- Make it easier for a larger number of investors to gain exposure to the cryptocurrency market through a regulated and familiar investment vehicle. This increased accessibility could potentially attract more mainstream investors to the digital asset space.

- A major financial institution like Morgan Stanley would add a level of legitimacy and credibility to the crypto market, dispelling some of the skepticism and concerns surrounding Bitcoin, thus wider acceptance by institutional investors.

- Pave the way for more institutional participation, increased liquidity and greater market stability.

In a previous article, we indicated that BTC long-term holders are ramping up on distribution pressure, meaning they are exerting selling pressure on the asset. Coinciding with heightened realized profit, as there has been an increased number of Bitcoin holders who are able to sell their coins at a profit compared to when they acquired them, Glassnode reports that more than 95% of the Bitcoin supply is now in profit.

Meanwhile, Bitcoin price continues to approach a big selling wall, marked by a liquidity zone extending from $74,000 to $75,000. Within this price range, there are enough buyers and sellers present to potentially facilitate quick and efficient trades.

Open Interest is also up almost 13% in three days, moving from $33.81 billion to $38.02 billion between March 24 and 27. This indicates a growing market activity and hints that the market is due to witness some volatility.

BTC Open Interest

Open Interest, funding rate FAQs

Bitcoin price outlook amid rising open interest and rumors about Morgan Stanley

Bitcoin price sits above the $69,000 threshold, but this support is not solid amid rising bearish pressure. The subdued Relative Strength Index (RSI) indicates this, signifying falling momentum. Nevertheless, the bulls maintain a strong presence in the BTC market, as seen with the sustained series of green histograms of the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD).

Increased bullish momentum could send Bitcoin price further north, potentially as high as to reclaim its $73,777 peak. Clearing this blockade could set the tone for BTC price to foray into the liquidity zone between $74,000 and $75,000.

BTC/USDT 12-hour chart

However, if the bears can haul BTC to close below the $69,000 threshold on the 12-hour time frame, it could encourage more sell orders. An extended fall could see Bitcoin price find support due to the 50-day Simple Moving Average (SMA) at $67,627.

In a dire case, the pioneer cryptocurrency could roll over to find support at $61,701, or worse, extend a leg south to $59,224 before the bulls can scale a recovery.

Source