- Bitcoin veteran trader who predicted the 2023 crypto bull run predicted a massive BTC price rally to $50,000 on one condition.

- Bitcoin miners are still under pressure with rising hashrate, raising concerns of rising selling pressure on BTC.

- Experts argue that Bitcoin’s run up to $30,000 did not trigger the mania of bull markets in previous cycles, drawing a comparison.

Crypto analyst who predicted the bull market of 2023 has commented on Bitcoin’s uptrend. The expert believes BTC is primed for a run up to the $50,000 level, however this a likelihood of a correction in the asset soon.

Also read: Here’s what dYdX whales know about the token’s bullish potential

Expert predicts massive run in Bitcoin price

The expert that predicted the bull run that started in the beginning of 2023 has commented on BTC’s price rally. DonAlt, a technical analyst, evaluated the Bitcoin price chart and predicted a BTC price rally to the $50,000 level. The analyst’s thesis marks four key phases, the bear market, “whatever”, indecision and bull market.

According to DonAlt’s thesis, Bitcoin is currently in the phase of indecision. This phase is followed by a bull run in BTC price.

BTC/USD 1W price chart

Therefore, DonAlt predicted a pullback in Bitcoin price after the asset crosses key resistance at $33,000.

Bitcoin rally to $50,000 is not likely a straight path

DonAlt has predicted a correction in Bitcoin price, on its path to the $50,000 bullish target. The analyst’s explanation is the phase of the Bitcoin price cycle, “indecision.”

BTC/USD 1D price chart

The expert expects the asset to pullback and coil ahead of the explosive move to $50,000 within the next few months of 2023. The analyst marks the support at $19,500, $32,290 and resistance at $62,500 as the three key levels in the Bitcoin price chart.

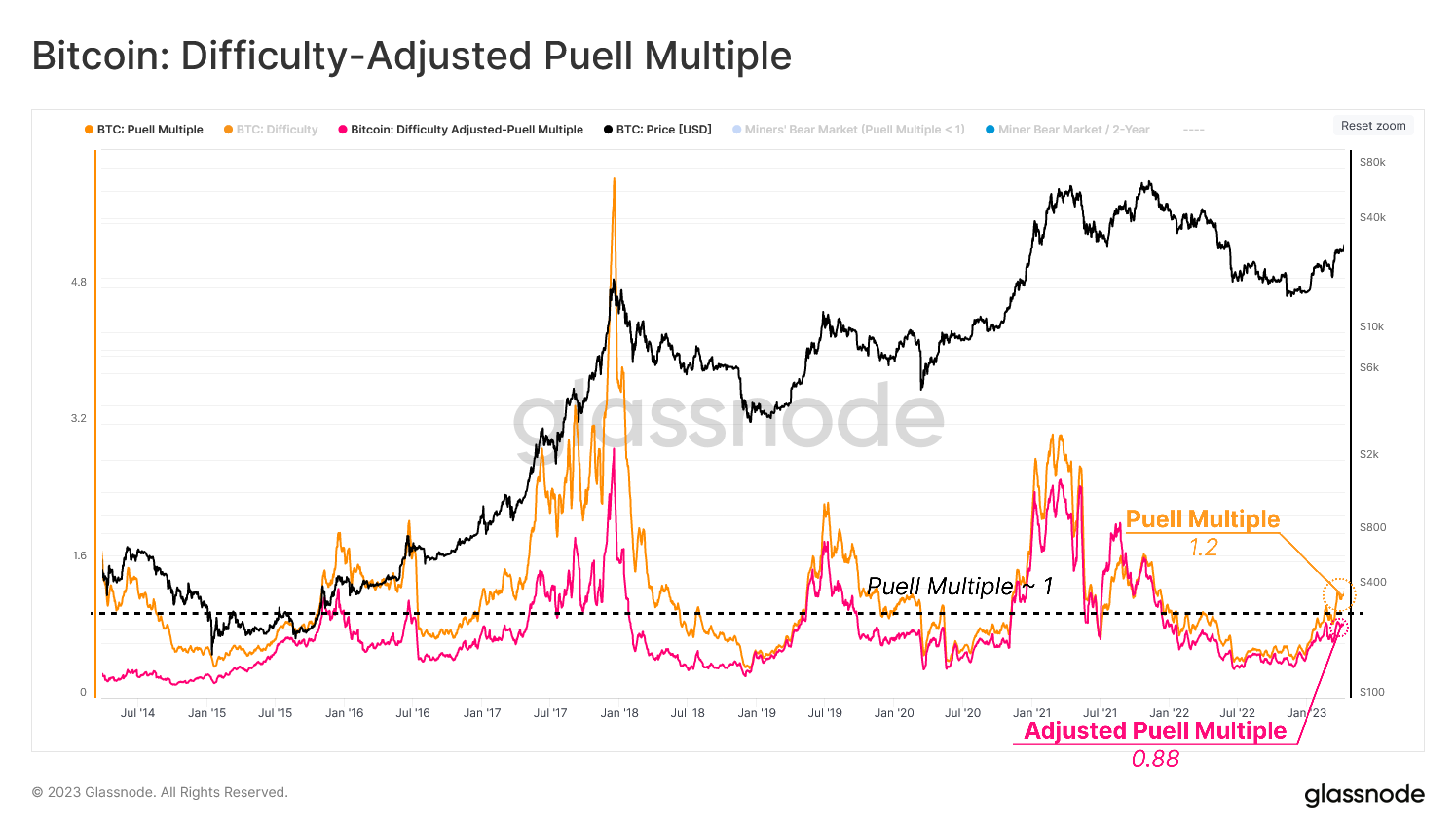

It’s important to note that with the Bitcoin price above $30,000, miners are still under pressure. To ascertain the challenges weighing on miners, the metric “Difficulty Adjusted Puell Multiple” is used. While the Puell Multiple measures the ratio between daily Bitcoin miner revenue (in USD) and 365-day moving average (MA), it does not take into consideration the difficulty of mining the asset, measured by the hashrate.

The difficulty adjusted Puell multiple measures the profitability of miners, while taking the difficulty of mining Bitcoin under consideration.

Bitcoin miners under pressure, what this means for BTC

Miners typically sell their Bitcoin rewards to cover their operating costs. This is one of the key reasons why miner profitability and state of miners in the network has an impact on the asset’s price.

Bitcoin difficulty-adjusted Puell Multiple

According to the difficulty adjusted Puell multiple, miners are currently under pressure, with Bitcoin price above $30,000, since the hashrate has climbed considerably. The metric is at 0.88, a value below 1 signals that miners are not yet profitable.

When comparing the current Bitcoin price rally to bull markets in previous cycles, experts note that the “mania” surrounding BTC price action is missing.

Bitcoin price rally lacks the “crypto mania” of previous bull runs

In addition to the on-chain metrics and technical indicators, the sentiment among traders is key to an asset’s price rally. Experts have identified a lack of “mania” or mass bullishness among market participants in BTC’s recent run up to $30,000.

Oliver Linch, the CEO of Bittrex Global told attendees at a crypto conference in Paris:

The sentiment here doesn’t seem like the last few weeks mean that we can pretend that the last 10 months never happened.

Bitcoin’s price rally does not wipe out the events of the past ten months, the losses suffered by market participants and the loss of confidence among retail and institutional investors through the tumultuous events.

Simon Taylor, head of strategy at Sardine argues the mania or gusto previously seen when the asset climbed to a key level between $30,000 and $40,000 is missing, while there is quiet behind-the-scenes progress in Bitcoin. This implies that BTC’s recent rally is inconsistent with previous bull markets and there is scope of a likely correction in the asset.