- Bitcoin price stood virtually unchanged above $30,000 following the release of CPI, while the USD index noted selling pressure falling to 101.6.

- Berkshire Hathaway CEO Warren Buffet labeled Bitcoin a “gambling token” after previously calling it “rat poison squared”.

- Bitcoin is defending its “inflation hedge” and safe-haven status with the support of its maximalist community.

Bitcoin, the world’s biggest cryptocurrency, has been targeted by one of the world’s biggest investors Warren Buffet for a long time now. Buffet has been criticizing digital assets ever since the crypto market emerged to be significant and continues to do so even as Bitcoin is standing the test of time.

Warren Buffet’s problem with Bitcoin

Bitcoin certainly grew in prominence among institutions and retail investors but failed to impress everyone. A member of the anti-Bitcoin community, Warren Buffet, has openly advised against investing in the digital asset. In the past, the Berkshire Hathaway CEO has even gone so far as to call BTC “rat poison squared”, and more recently, he labeled it a “gambling token” as well.

Buffet’s stance on never holding any cryptocurrency derives from his lack of understanding of digital assets. He admitted to the same in an interview with CNBC in May 2022, stating,

“I get in enough trouble with things I think I know something about. Why in the world should I take a long or short position in something I don’t know anything about?”

Buffet also stated that he believed Bitcoin holds no intrinsic value as it only serves the purpose of transmitting money. He noted that it doesn’t qualify as currency since it is not a durable means of exchange or a store of value, comparing crypto to a cheque, as they fundamentally perform the same function of transmitting money.

However, the reality of the situation differs from the 92-year-old investor’s opinion, as in the last couple of months, the situation has significantly changed.

- After crashing to the lows of $15,500 last November, Bitcoin recovered and retained its safe-haven tag, recently rallying against the worsening macroeconomic conditions.

- Investors like MicroStrategy, who went deep into the digital asset, buying 140,000 BTC worth over $4 billion, emerged profitable once Bitcoin price breached the $30,000 mark this week.

- Banks, too, are leaning into Bitcoin indirectly as Bank of America and Fidelity Management recently purchased $85 million worth of MicroStragey’s MSTR shares, which is tied to BTC itself.

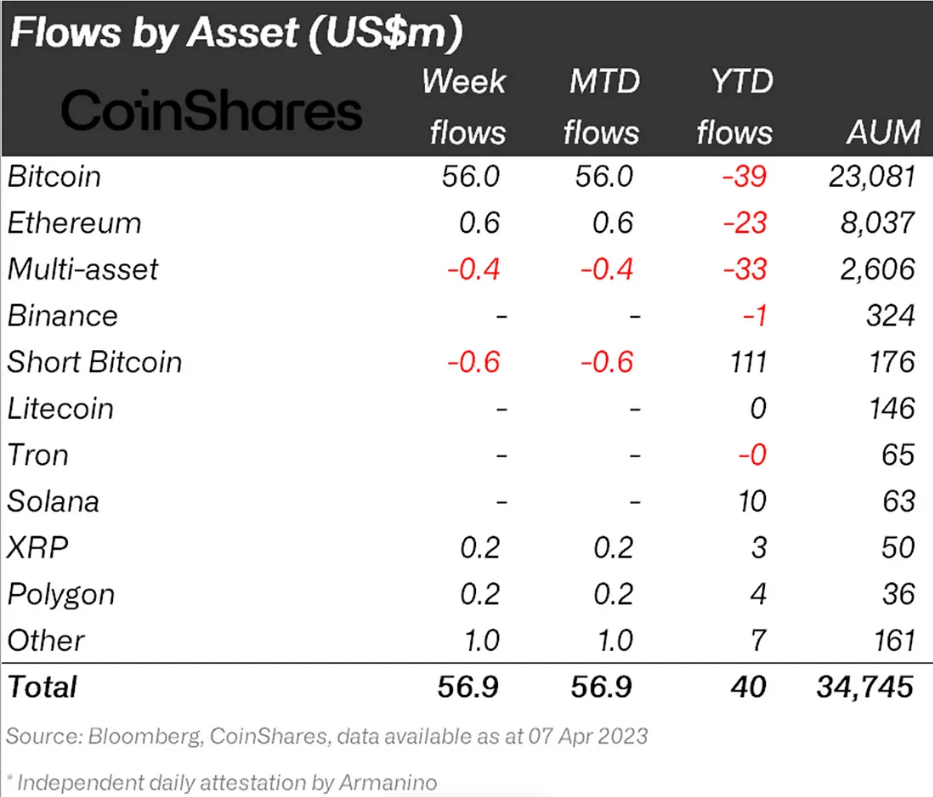

- Additionally, institutions are continuing to pour money into the asset, with the week ending April 7 observing inflows worth $56 million in the case of BTC.

Institutional inflows

Bitcoin price stands the test of time

On April 12, the Consumer Price Index (CPI) came in at 5.0% year on year against expectations of 5.2%, declining from February’s 6%. The core CPI YoY met expectations and stood at 5.6%.

Although month-on-month, the inflation rate was up by 0.1%, it fell beneath the expected 0.3%. Soon after, the CPI data was released. The US Dollar Index faced selling pressure and, at the time of writing, stood at 101.6, down by 0.45%.

Bitcoin price, on the other hand, initially stood unchanged at $30,200, sliding only 0.69% to $30,100 after the release. But on the whole, BTC lived up to its “inflation hedge” status along with Gold, which after shooting up by nearly 1%, came down to post a green candle of 0.25%.

BTC/USD 1-day chart

Thus, even though the broader market impact on Bitcoin might result in minor fluctuations every now and then, on a macro scale, the digital asset has untethered itself from the TradFi markets.

Furthermore, the Bitcoin supporters are completely unbothered by TradFi players’ statements, and their bullish stance will end up being a driving factor in BTC’s rally going forward. These social cues happen to bear a significant impact on an asset and the market as a whole.

You can read more about how social cues dictate market trends here – Why these social cues could be forecasting a local top for Ethereum and the broader crypto markets.