- BlackRock remains in the lead on metrics of trading volumes with $226.9 million recorded on Tuesday.

- Eric Balchunas thinks the firm could dethrone MicroStrategy from its helm as the biggest BTC holder.

- The ETF specialist also anticipates IBIT overtaking GBTC as liquidity king as Grayscale sends $400 million worth of Bitcoin transactions to Coinbase.

The US Securities & Exchange Commission (SEC) ushered in a new era for the cryptocurrency space on January 10, approving several exchange-traded fund (ETF) applications in one go. Subsequently, the battle shifted from marketing via commercials and ads to marketing via fees and discounts. The latest is performance scores in trading volume metrics with markets watching to see who will be the next liquidity king.

BlackRock to MicroStrategy, IBIT to usurp GBTC

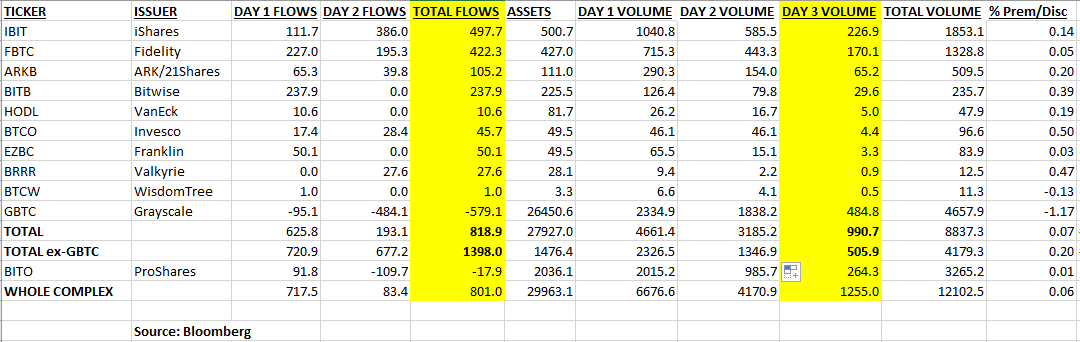

In the race for the next liquidity king, asset management firm BlackRock (IBIT) is coming up as the next front-runner, recording $226.9 million in spot Bitcoin ETFs trading volume on Tuesday, January 16. Second and third in line are Fidelity (FBTC) and Ark 21Shares (ARKB), recording $170.1 million and $65.2 million, respectively.

Spot BTC ETF trading volumes in millions of dollars

With the growing interest in digital assets suggesting a shifting investment landscape, Bloomberg Intelligence ETF specialist Eric Balchunas says BlackRock dethroning MicroStrategy (MSTR) as the world’s largest Bitcoin holder is a matter of when, not if.

It comes as BlackRock is already at around half a billion dollars ($500 million), holding up to 11,439 BTC against MicroStrategy, which holds 189,150 BTC, worth approximately $5.9 billion, which is equivalent to about 0.9% of the entire BTC supply. With BlackRock’s rise, the race for Bitcoin supremacy marks a shift toward mainstream digital currency acceptance.

Further, Balchunas says BlackRock’s IBIT, the leading spot BTC ETF on trading volume metrics, could usurp Grayscale Bitcoin Trust (GBTC) on liquidity metrics.

LATEST: Day Three volume so far half a billion for the Newborn Nine which is healthy, about the same pattern dropoff rate as $BITO (which again was the most successful organic launch in ETF history). $IBIT keeping lead to be one most likely to overtake $GBTC as Liquidity King. pic.twitter.com/hoatfSmNpN

— Eric Balchunas (@EricBalchunas) January 16, 2024

This comes after Grayscale sent up to $400 million worth of transactions to the Coinbase exchange, with all signs pointing to customer redemptions.

This is days after data from Arkham Intelligence showed that Grayscale sent 4,000 BTC worth $183 million to a Coinbase Prime deposit address, suggesting that investors may be switching their assets to other ETFs or selling normally.

Notably, Grayscale Bitcoin Trust held over $25 billion worth of Bitcoin, which had been locked up for years since there was no option for selling. With the recent spot BTC ETF approvals, which inclined toward cash creates, the redemption option opened. This provided leeway for GBTC holders to exit the trust after years, which means selling the BTC on the open market.

Source