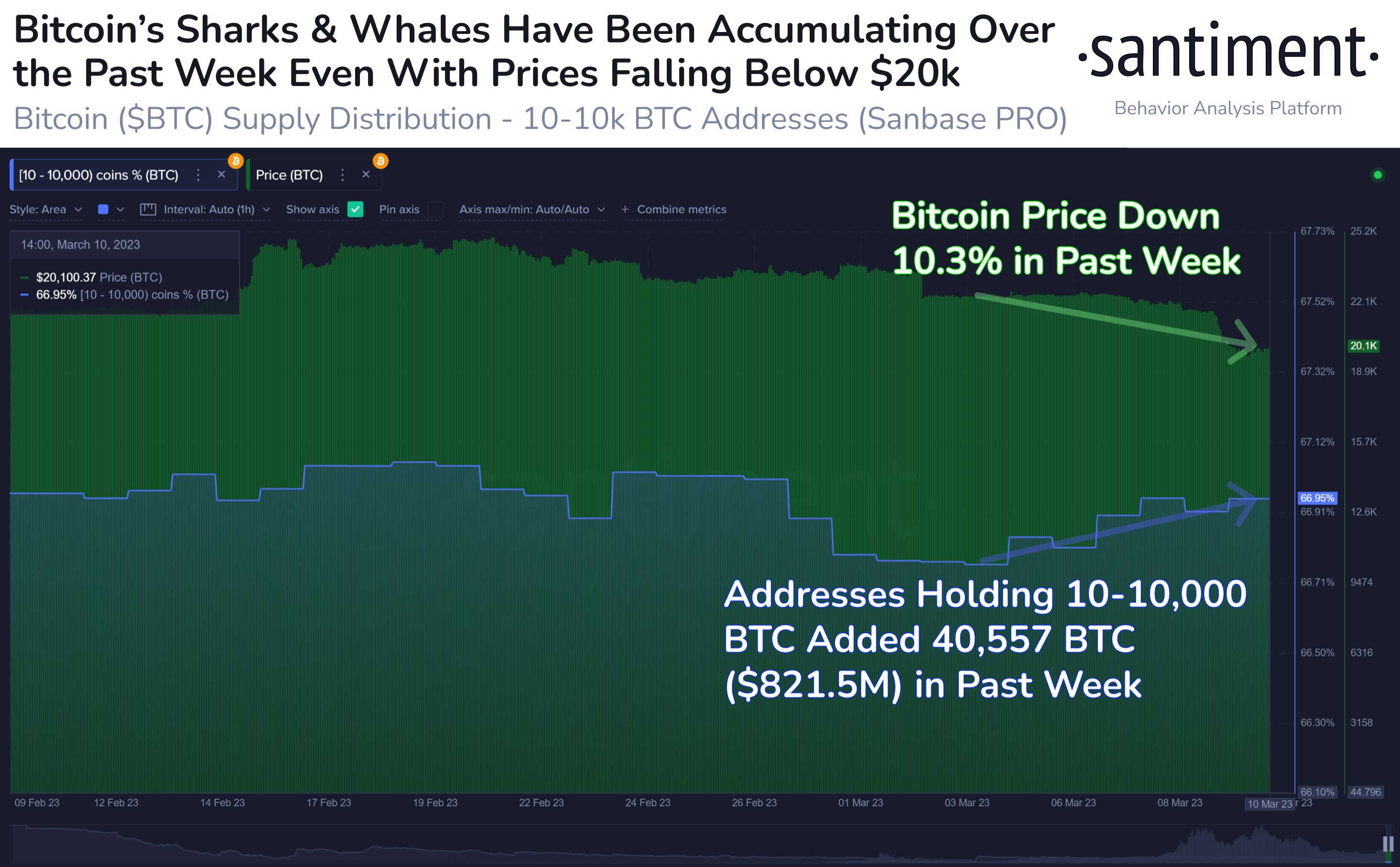

- Bitcoin sharks and whales, holding between 10 and 10,000 BTC have collectively accumulated $821.5 million worth of the asset.

- During the recent BTC price drop below $20,000, large wallet investors on Bitcoin network started to “buy the dip.”

- Bitcoin price is close to the psychological level of $20,000, BTC is trading at $19,963 at press time.

Large wallet holders on the Bitcoin network are scooping up BTC after the asset’s drop below the $20,000. Despite the uncertainty among crypto market participants whales continued their BTC accumulation, implying confidence in Bitcoin recovery.

Also read: Will Circle’s stablecoin suffer same fate as UST: Binance and Coinbase react to USDC depeg

Bitcoin accumulation by sharks and whales continues

Based on data from crypto intelligence tracker Santiment, Bitcoin network’s large wallet investors, its shark and whales have continued BTC accumulation. Analysts at Santiment noted that wallet addresses holding between 10 to 10,000 BTC have collectively scooped up $821.5 million in Bitcoin.

The recent mid-sized market crash has triggered Fear, Uncertainty and Doubt (FUD) among crypto market participants. Despite Bitcoin price drop below $20,000, whales continued BTC accumulation, implying confidence in the asset’s recovery.

Bitcoin accumulation by sharks and whales

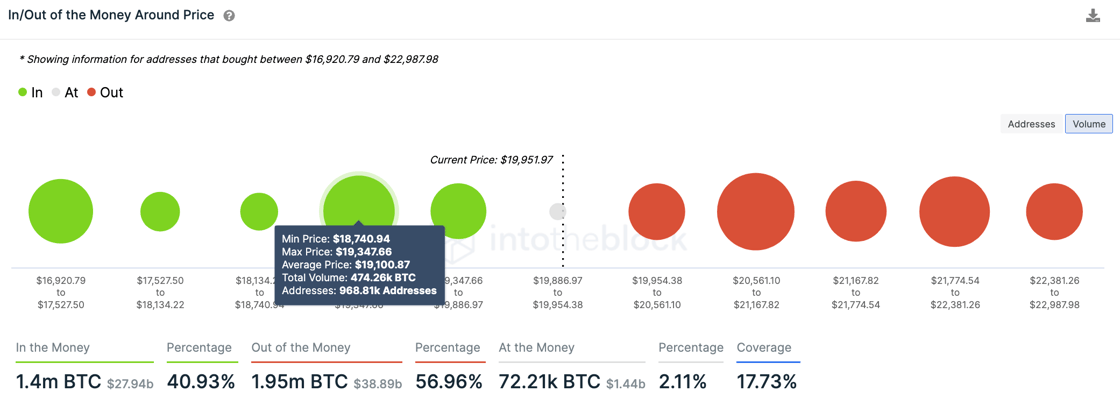

The largest asset by market capitalization found support below $20,000 at the $19,000 level. Based on data from IntoTheBlock, a whopping 474,000 BTC worth $9.5 billion was purchased at $19,000.

Bitcoin price finds strong support at $19,000

This makes it a concentrated buying zone, where buyers step up when prices hover near the psychological barrier of $20,000.

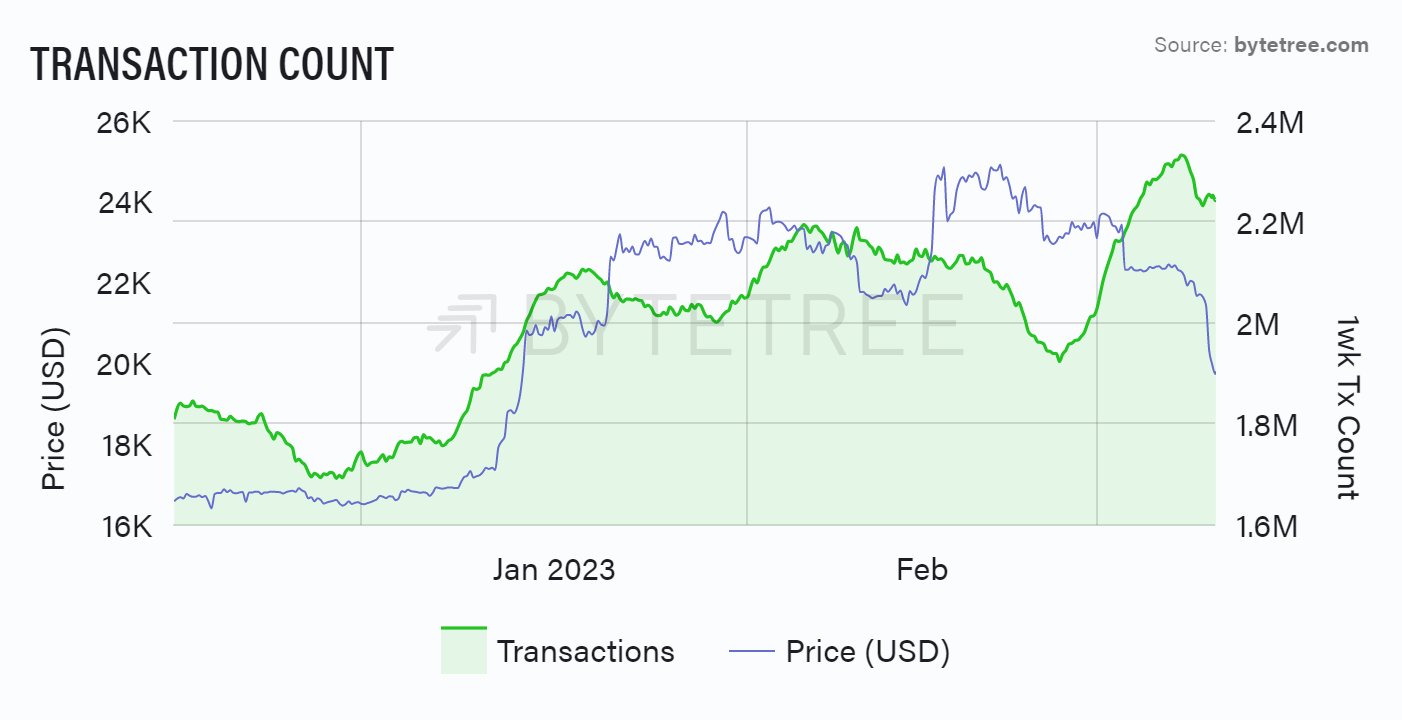

Bitcoin network is in good health, the recent dip is not isolated to BTC

Technical experts at ByteTree argue that the recent decline in Bitcoin price is not isolated to BTC. It is a marketwide correction in response to inflationary pressures and tumultuous events relating to crypto-friendly banks.

Bitcoin transaction count

As seen in the chart above, the BTC on-chain transaction count has materially improved since the start of the year, while on-chain fees show a similar improvement. The overall health and miner revenue generation in Bitcoin is steady and this points at the possibility of a recovery in the largest cryptocurrency by market capitalization.