- Ethereum supply on exchanges hit an all-time low, 8.04% of the asset’s total supply is in exchange wallets.

- ETH price gears up for a recovery alongside rise in active addresses on the Ethereum chain.

- ETH price sustains above psychological barrier at $2,000, despite consistent profit-taking activities of traders.

Ethereum, the second largest cryptocurrency by market capitalization, noted a considerable decline in its supply on exchange platforms. ETH tokens on exchanges have hit a new all-time low since Ether’s genesis.

Also read: Orbit Chain hackers ring in New Year with $81.4 million exploit

Ether on exchanges hits lowest level recorded

Ethereum supply on exchanges now accounts for 8.04% of the asset’s total supply according to Santiment data. This is the lowest level recorded since Genesis. The altcoin’s supply on exchanges typically influences the asset’s price. A reduction in supply is considered bullish as it supports the thesis of declining selling pressure on ETH.

Ethereum supply on exchanges and price. Source: Santiment

There is an increase in active addresses on Ether, as noted by Santiment’s active addresses metric, in the chart below. This supports a thesis for ETH price recovery.

Ethereum active addresses. Source: Santiment

Ethereum trades above $2,200 despite consistent profit-taking by ETH traders since October 2023. The Network Realized Profit/Loss chart indicates whether traders are realizing losses or gains in their ETH trades.

Network Realized Profit/Loss. Source: Santiment

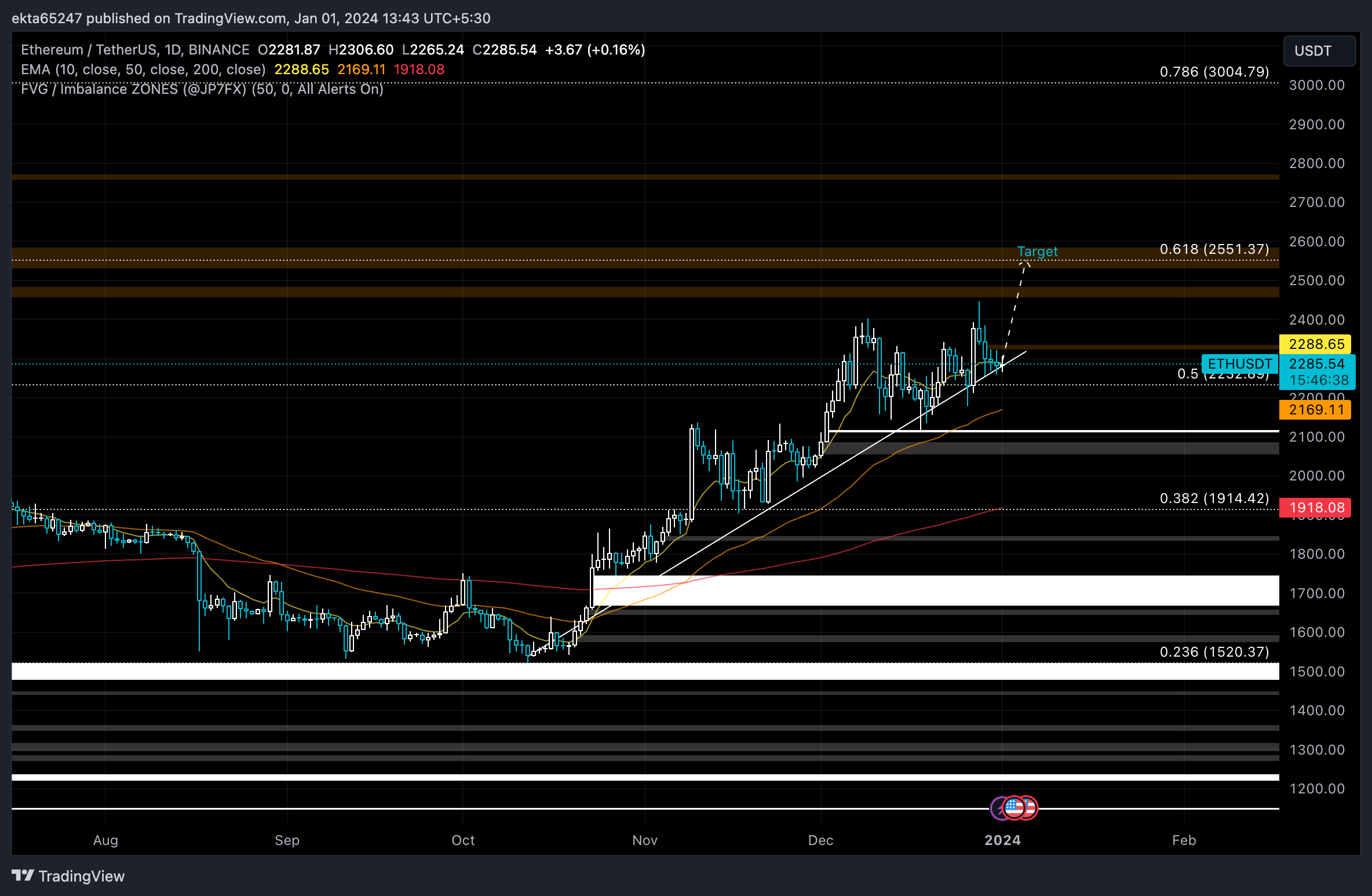

Ethereum price could make a recovery to $2,551, the 61.8% Fib level of ETH’s decline from its April ‘22 peak of $3,582 to June ‘22 low of $883.42. Ethereum price faces resistance at $2,458, and $2,500 as seen in the chart below.

ETH/USDT 1-day chart

A daily candlestick close below 50% Fib level at $2,232 could invalidate the bullish thesis for Ethereum price.

Source

%20[13.11.36,%2001%20Jan,%202024]-638396937103683367.png)

%20[13.12.11,%2001%20Jan,%202024]-638396937326348758.png)

%20[13.31.32,%2001%20Jan,%202024]-638396937558752692.png)