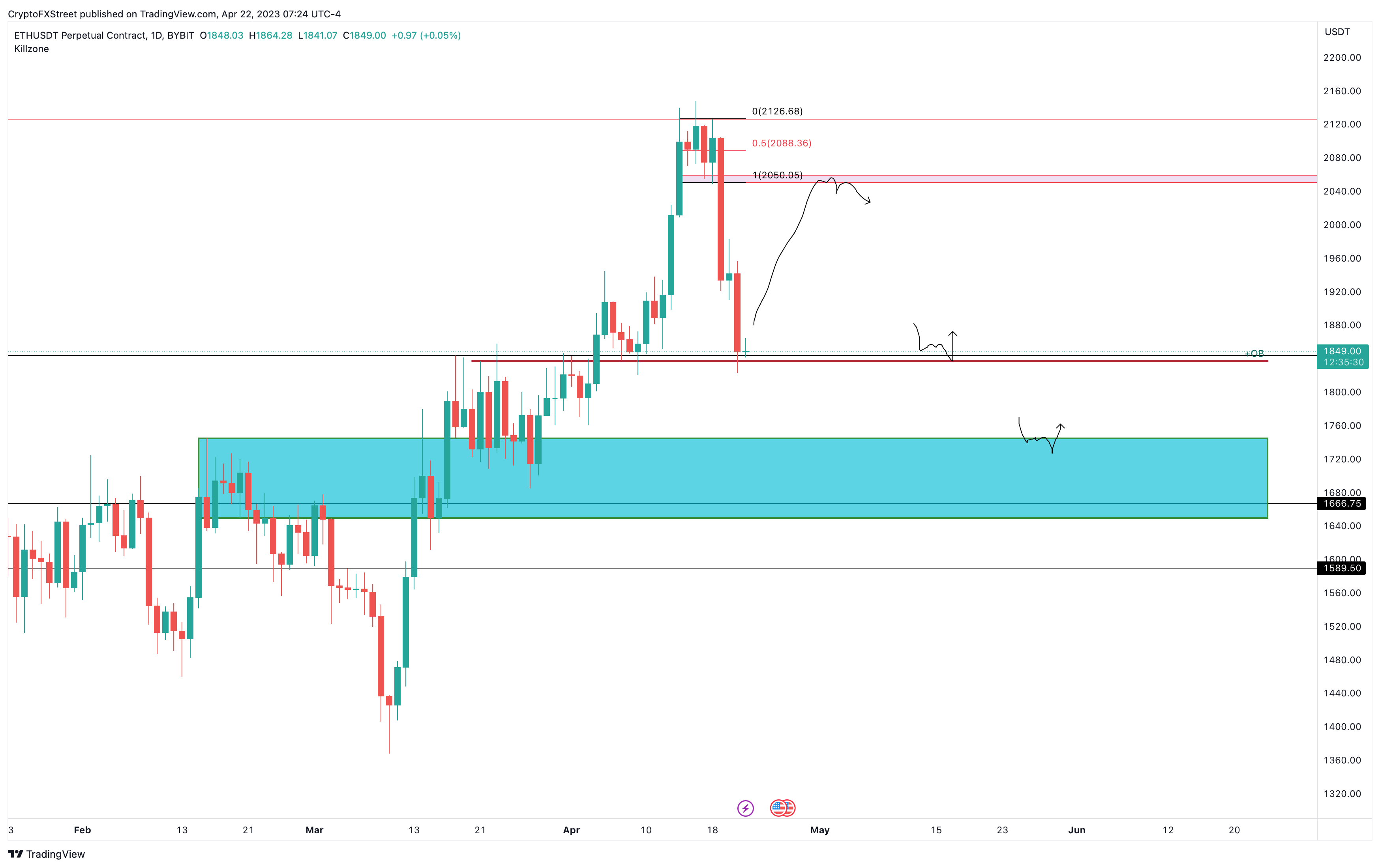

- Ethereum price has shed roughly 13% in the last five days, after forming a local top at $2,147.

- As ETH pauses around $1,843, investors can expect a pullback to $2,050 before its next descent.

- Invalidation of the bearish thesis will occur if Ether produces a higher high above $2,147.

Ethereum price shows clear signs of a bearish regime after it collapsed from a local top formation on April 16. This descent seems to have hit a blockade, which opens ETH up for a minor pullback.

Also read: Ethereum price could establish a massive move as the Shanghai upgrade augurs well for ETH

Ethereum price slides lower

Ethereum price set up a local top at $2,147 on April 16 after the 52% rally began on March 11. As investors continued to book profits, ETH kept sliding lower. So far, ETH has shed nearly 13% as it hovers around the $1,843 support floor.

Due to the low volatility conditions of the weekend and the nature of the aforementioned support level, a recovery rally might be possible for Ethereum price.

Investors should expect a temporary bounce in Ethereum price that will allow sidelined bears another chance to short ETH at a higher level. The recovery rally could propel the smart control token to $2,050, which opens up the path for traders to open a long scalp position before getting a chance to open a swing short position.

After retesting the $2,050 barrier, investors can expect Ethereum price to continue its descent ad tag the bullish breaker, extending from $1,744 to $1,649.

ETH/USDT 1-day chart

On the other hand, if Ethereum price continues to climb higher during its recovery phase and produces a higher high above the current local top at $2,147, it will invalidate the bearish thesis. Such a development could see ETH revisit the $2,200 and higher levels.