- Ethereum price shows a retest of FVG and a critical support level at $1,845.

- A bounce from the aforementioned level could trigger a 9.7% upswing to $2,022.

- A four-hour candlestick close below $1,772 will invalidate the bullish thesis for ETH.

Ethereum price shows strong signs of a bounce after retesting a stable support structure. This move from ETH could be the beginning of an uptrend that tags the seven-month high.

Also read: US Nonfarm Payrolls turn out to be a non-event for Bitcoin and Ethereum

Ethereum price ready to take control

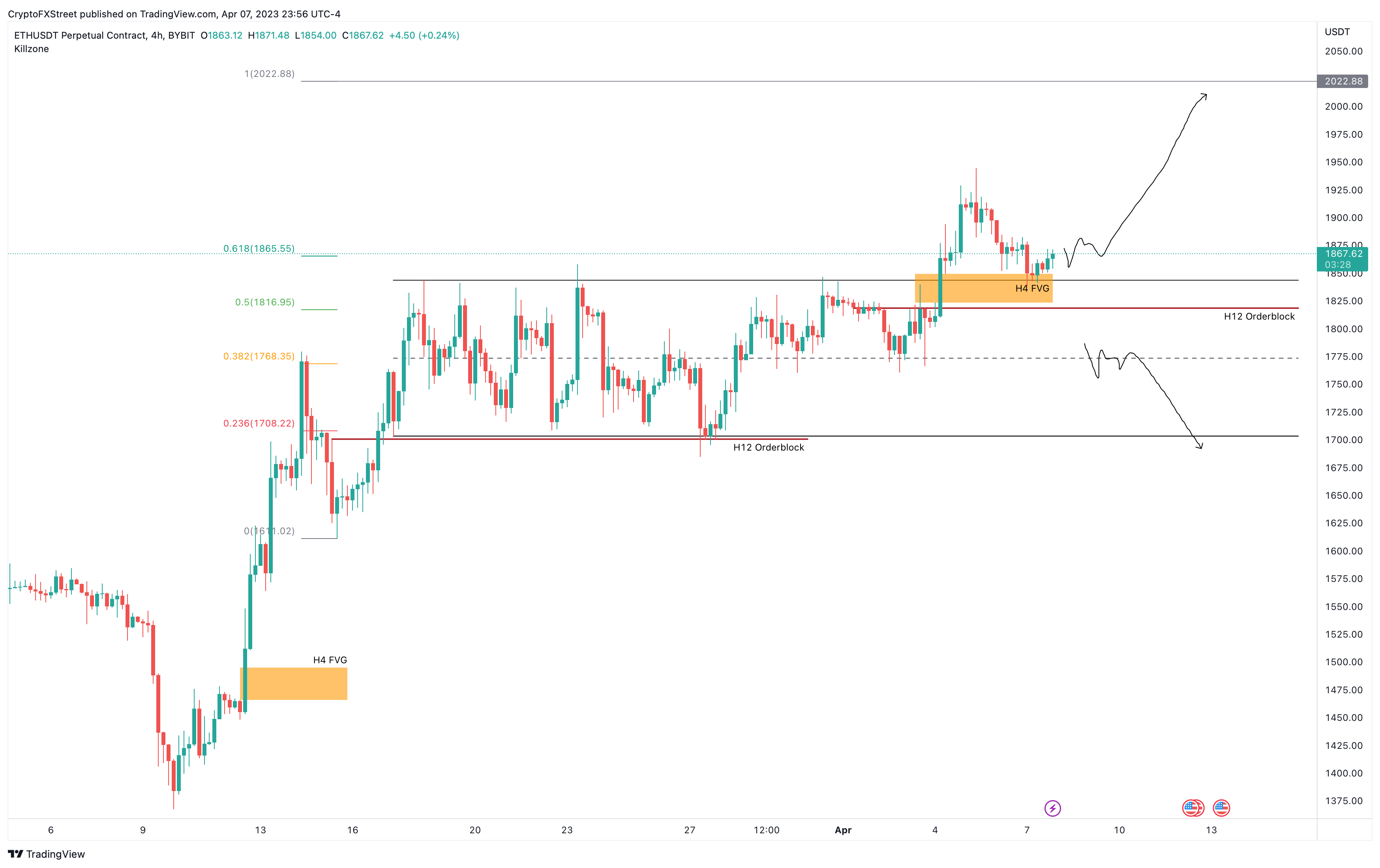

Ethereum price traded inside a range, extending from $1,703 to $1843 from March 17 to April 4. On April 5, a four-hour candlestick produced a decisive close above the range high, confirming a breakout. This move pushed ETH to $1,944 but retraced quickly to tag the recent flipped level.

So far, Ethereum price has tagged the four-hour Fair Value Gap (FVG), created on the breakout candlestick and bounced off the range high, confirming a demand from buyers. If this holds up over the weekend, there could be a bullish move at the start of the next week that pushes ETH higher.

The likely candidate, as seen from the Fibonacci extension tool, is the 100% Fib level at $2,022, which would represent a 9.7% upswing for Ethereum price.

ETH/USDT 4-hour chart

While the bullish outlook for Ethereum price is logical and is likely to occur if market sentiment favors buyers. However, a sideways movement would not be surprising, considering the recent outlook.

If Ethereum price produces a four-hour candlestick close below $1,772, it will invalidate the bullish thesis for ETH and eye a retest of the range low at $1,703. A decisive flip of the said barrier could trigger a steep 12% correction to the four-hour FVG, extending from $1,494 to $1,465.

Read more: MATIC and MINA protocol ride the zk hype ahead of major Ethereum upgrade