- Ethereum institutional whales have been depositing huge piles of ETH on Coinbase.

- Ethereum products recorded $14.4 million in outflows last week following increased doubts surrounding spot ETH ETF approval.

- Ethereum could see a slight increase this week in an attempt to balance a previous market inefficiency.

Ethereum (ETH) sustained its weekend sideways movement on Monday following a quiet market. However, institutional whales have been depositing the largest altcoin to Coinbase as ETH products also recorded $14.4 million in outflows last week.

Also read: Ethereum declines briefly, JP Morgan sees a spot ETH ETF approval despite recent Wells notice

Daily digest market movers: Increased whale activity, outflows, hacker dump

Ethereum whales have been making large moves in the past 24 hours. Here are the key market movers for ETH:

- In a recent whale move on Monday, an eight-year-old Ethereum wallet moved 4,153 ETH worth $12.17 million to Coinbase, according to Spot On Chain. Considering that the whale bought 12,427 ETH from Poloniex at an average entry price of $11 eight years ago, they’ve seen nearly a 27,000% growth. The whale address currently holds 2,566 ETH and has a profit of about $28.5 million.

- A large institutional investor also dumped 30,807 ETH worth $91.19 million on Coinbase Institutional recently, according to Whale Alert. This was followed by three transactions where other whales deposited over 11,000 ETH to Coinbase Institutional. While these deposits may signify a potential sell-off, Coinbase Institutional also saw a few ETH whale withdrawals of more than 7,000 ETH each.

Read more: Ethereum needs a bullish trigger, Joseph Lubin blasts the SEC

- Following the continued low engagement of the Securities & Exchange Commission (SEC) with applicants for ETH spot ETFs, Ethereum products saw outflows of $14.4 million last week, according to CoinShares. Bloomberg analyst Eric Balchunas commented earlier that a spot ETH ETF may not happen until late 2025. He stated that the SEC would likely see a change in leadership that’s more friendly to crypto if Trump wins the US Presidential election in November.

- Meanwhile, a hacker who stole 150,000 ETH by exploiting a vulnerability in Parity’s (Polkadot’s parent company) multisig wallet in 2017 appears to be laundering portions of the stolen funds again. According to Cyvers Alerts, the hacker moved $3,050 ETH worth $9 million to eXch crypto exchange through consolidated addresses. The hacker still retains 83,017 ETH—worth $246.6 million—of the stolen funds.

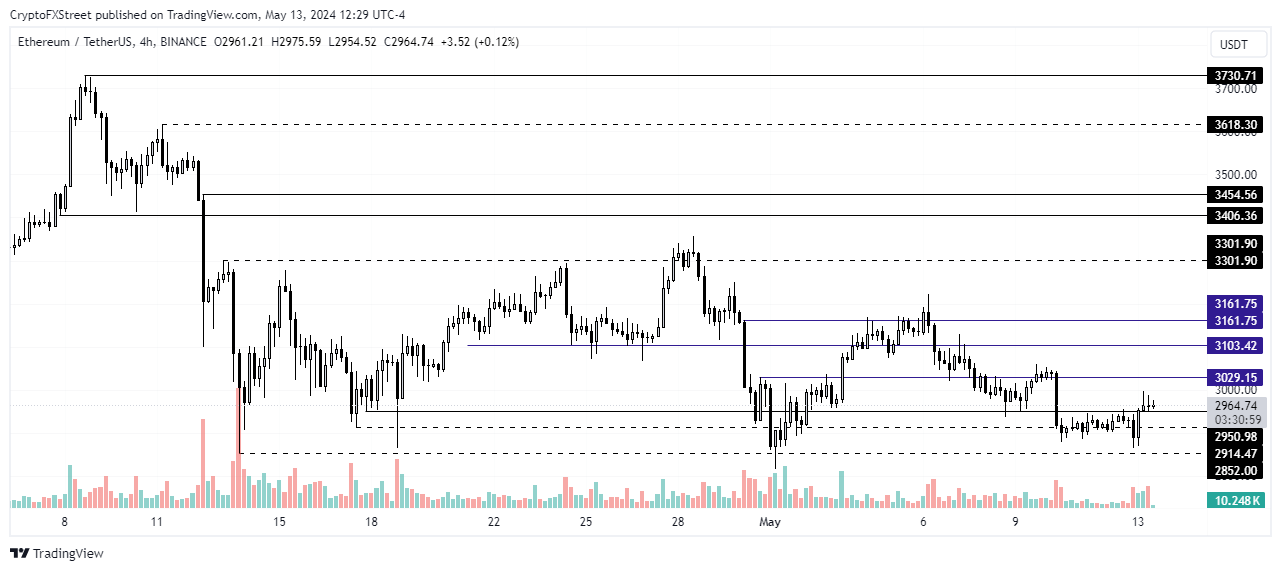

ETH technical analysis: Ethereum to increase slightly

Ethereum traded fairly sideways over the weekend after posting a liquidity void on Friday. As traditional markets open on Monday, ETH appears to continue the horizontal trajectory, hovering just below the $3,000 level. Considering the $3,010 price level is the average purchase price for most short-term holders, it’s proving to be a strong support for ETH.

ETH/USDT 4-hour chart

However, an 11% decrease could cause most short-term holders to panic into selling, potentially triggering a massive sell-off. On the other hand, an 11% increase could trigger a bullish momentum for Ethereum.

ETH liquidations also slowed down to $30.8 million on Monday, with long liquidations only $5 million higher than shorts. In the short term, ETH could see a slight increase over the next few days in an attempt to balance the price inefficiency on Friday, extending from $3,045 to $2,905.

Bitcoin’s recent signs of a potential bullish reversal could also push ETH higher due to their positive correlation. It’s also important to watch out for US Federal Reserve Chair Jerome Powell’s speech on May 14 and the US CPI inflation report on May 15 as they may cause heightened volatility in the market.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Source