- Ethereum whales are accumulating the altcoin, sitting on $132.1 billion in ETH.

- Whales control 52% of Ethereum’s circulating supply, supporting ETH price gain thesis.

- ETH price eyes new yearly highs after overcoming the key resistance zone between $1,899 and $2,052.

Ethereum’s large wallet investors have a bullish outlook on the second largest asset by market capitalization. ETH whales have consistently added the altcoin to their holdings in the past year. ETH price rallied past the psychological barrier at $2,000 on November 9.

Also read: Dogecoin price eyes recovery as whales scoop up DOGE

Ethereum whales accumulate the altcoin

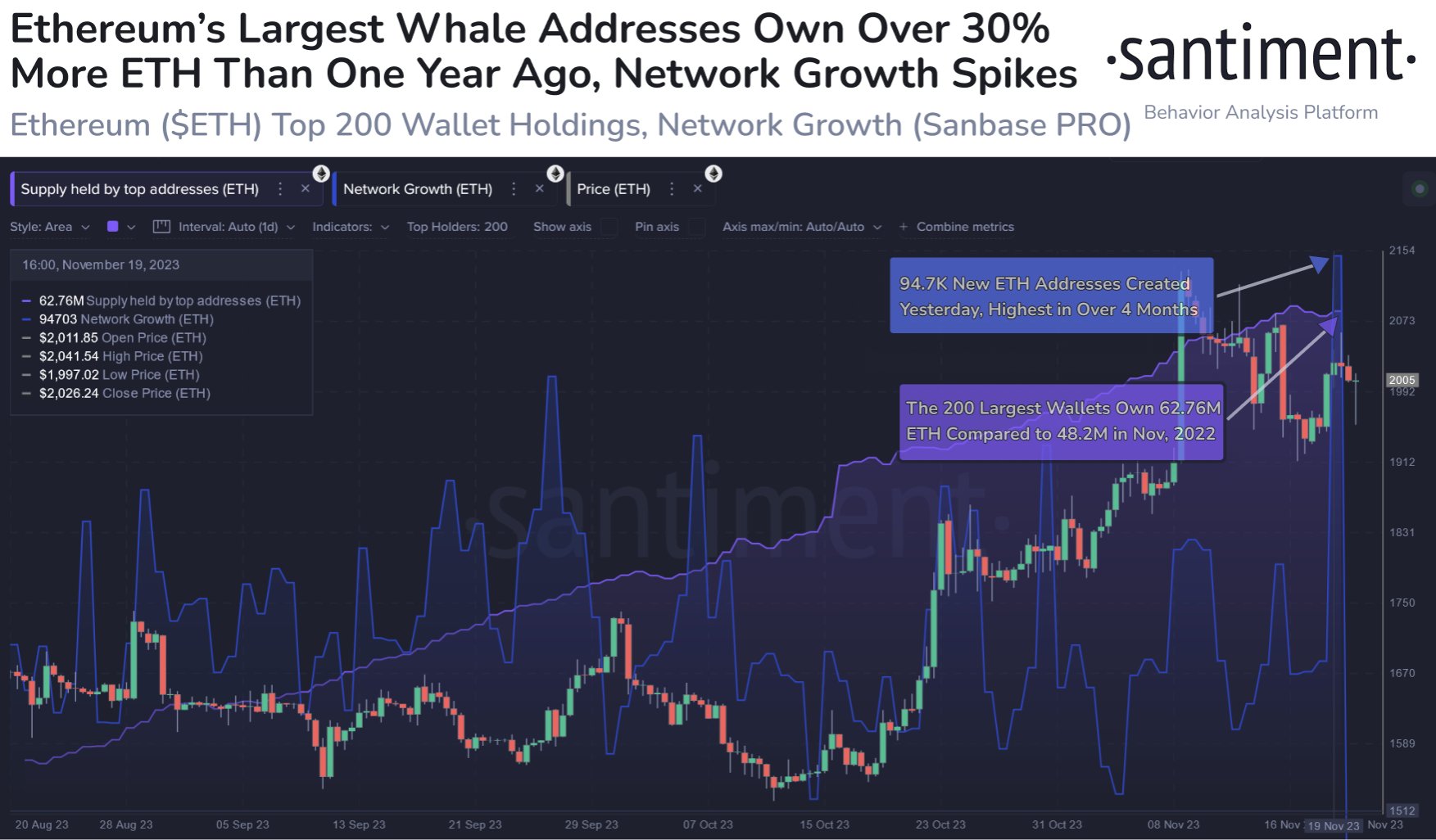

Ethereum’s 200 largest wallets have accumulated a total of 62.76 Ether tokens, worth $132.1 billion. The whale wallet holdings have climbed 30.3% since November 21, 2022, based on Santiment data. These large wallet investors’ holdings represent 52% of the altcoin’s circulating supply, therefore whale wallet activity is likely to have a direct impact on the asset’s price.

94,700 new Ethereum wallets that were created on November 21, mark the largest spike since July 2023, and support the narrative of ETH price gains.

ETH whale accumulation

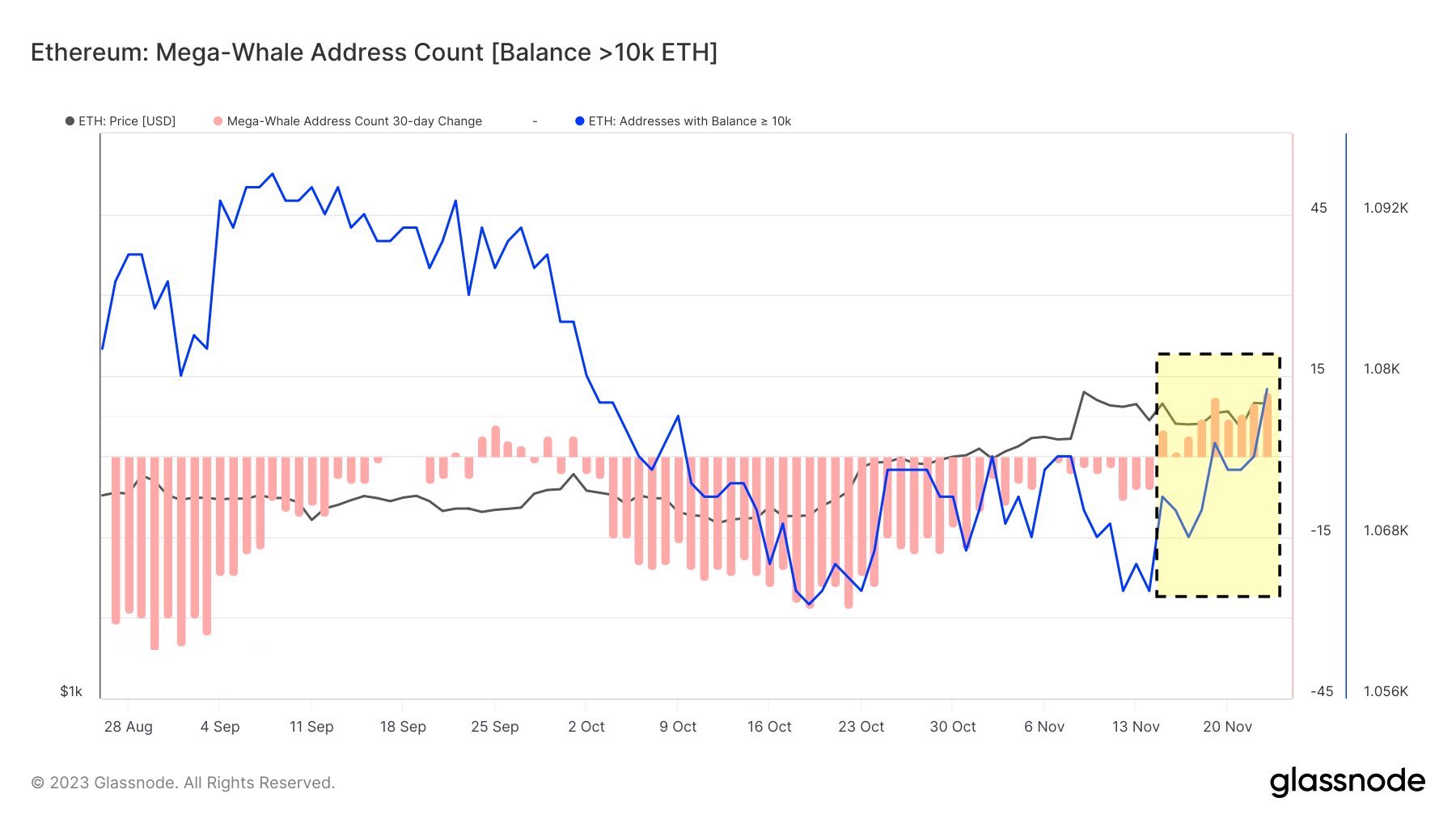

Data from on-chain tracker Glassnode reveals that for the first time in the past nine months, large wallet addresses have accumulated the altcoin steadily. The nine month accumulation spree is therefore likely to strengthen ETH price uptrend. It represents increasing buying pressure from whales.

As seen in the Glassnode chart below, both whale address count and addresses with balance greater than 10,000 ETH observed a spike since November 14.

Ethereum whale address count and price

The asset rallied past a key resistance zone between $1,899 and $2,052, where 4.9 million ETH wallet addresses scooped up 41.35 million Ether tokens. At the time of writing, Ethereum price is $2,080.19. The altcoin faces minimal resistance, in the zone between $2,141 and $2,505. ETH finds strong support in the $1,899 to $2,052 zone, consistent demand from large wallet investors could therefore push the altcoin to new yearly highs.

Global In/Out of the Money

Ethereum price yielded 6% weekly gains and 16% gains for holders in the past month.

Source