- EUR/USD gathers extra downside traction below parity.

- ECB raised rates by 75 bps, as widely anticipated.

- Market participants now look to Lagarde’s press conference.

The selling bias in the single currency grabbed extra impulse and forced EUR/USD to break below the key parity level on Thursday.

EUR/USD shifts the focus to Lagarde

EUR/USD remains offered after the ECB walked the talk and hiked rates by 75 bps at its event on Thursday.

Indeed, the central bank raised the interest rate on the main refinancing operations, the interest rate on the marginal lending facility and the deposit facility to 2.00%, 2.25% and 1.50%, respectively.

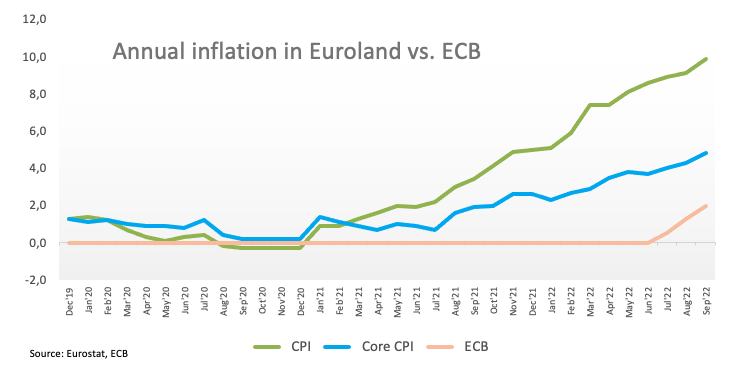

The ECB reiterated that it intends to keep raising rates to endure inflation returns to the bank’s 2% target. In addition, the ECB said that it will reinvest principal payments from maturing securities at least until the end of 2024.

Moving forward, market participants will now closely follow the usual press conference by Chairwoman Lagarde and the subsequent Q&A session.

What to look for around EUR

EUR/USD’s upside momentum meets an initial hurdle around 1.0100 and managed to bounce off the sub-parity area soon after the ECB interest rate decision.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The resurgence of speculation around a potential Fed’s pivot seems to have removed some strength from the latter, however.

Furthermore, the increasing speculation of a potential recession in the region – which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany GfK Consumer Confidence, Italy Consumer Confidence, ECB Interest Rate Decision, ECB Lagarde (Thursday) – France/Italy/Germany Flash Inflation Rate, Germany Preliminary Q3 GDP Growth Rate, EMU Final Consumer Confidence, Economic Sentiment

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.69% at 1.0011 and the breakdown of 0.99704 (weekly low October 21) would target 0.9631 (monthly low October 13) en route to 0.9535 (2022 low September 28). On the upside, there is an initial hurdle at 1.0093 (monthly high October 27) followed by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 10).