- Gold price struggling to find demand amid a pause in the US Dollar downside.

- Market mood turns cautious while US Treasury yields hover near weekly troughs.

- With the Fed Minutes out of the way, all eyes remain on US employment data.

Gold price is looking to build on the previous rally above $1,850, as bulls gather pace for the next push higher. The bright metal is struggling to find fresh demand, as investors turn cautious and flock to safety in the US Dollar. Meanwhile, the US Treasury bond yields are holding near weekly lows, limiting any downside for Gold buyers. The US Dollar incurred steep losses on Wednesday, as the mixed US ISM Manufacturing PMI data and US Federal Reserve (Fed) Minutes failed to impress. Even though the Fed Minutes showed that the officials are committed to fighting inflation and expect higher interest rates to remain in place, markets continue pricing a dovish Fed pivot by the end of 2023, as recession risks amplify. Attention now turns toward the US employment data, as it will provide further insight into the Fed’s policy path this year.

Also read: XAU/USD outlook: Bulls accelerate on expectations for more dovish Fed

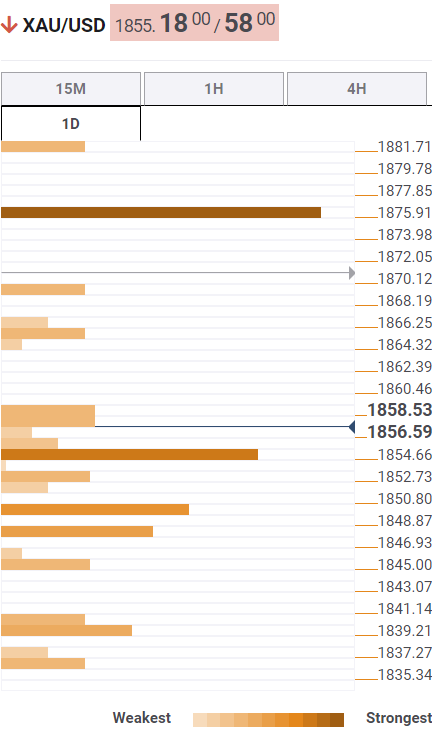

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is challenging the bullish commitments at $1,854, which is the convergence of Fibonacci 38.2% one-day and pivot point one-week R2.

A firm break below the latter will call for a test of the pivot point one-month R1 at $1,850. The next immediate support is seen at the Fibonacci 61.8% one-day at $1,847.

The last line of defense for Gold buyers is placed at the Bollinger Band one-day Upper at $1,845.

Alternatively, if buyers regain momentum, then the Fibonacci 23.6% one-day at $1,857 will offer stiff resistance.

The next upside target is envisioned at the $1,860 round number, above which the previous day’s high at $1,865 will be put to test.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.