XAU/USD Current price: $1,868.85

- Political tensions between the United States and China undermine the market mood.

- US Treasury yields soared as stocks fell, backing demand for the US Dollar.

- XAU/USD is technically bearish in the near term, with near-term support at $1,860.

Spot gold remains under selling pressure after falling to $1,860.20 a troy ounce at the beginning of the day. The bright metal peaked on Monday at $1,881.35, from where it resumed its decline amid the broad US Dollar demand. The Greenback extends its post-NFP rally on the back of speculation the United States Federal Reserve will keep hiking rates for some time, while the chances for a potential cut for year-end lost ground.

Additionally, political tensions between Washington and Beijing weighed on the market mood, further fueling demand for the American currency. An apparent surveillance balloon from China flew through US skies last week, with the saga ending after President Joe Biden’s administration took it down on Saturday. As a result, diplomatic relations between both countries were temporarily interrupted as the United States postponed Secretary of State Blinken’s forthcoming trip to China.

Meanwhile, US Treasury yields advance. The 10-year note currently yields 3.62%, up 9 bps, while the 2-year note offers 4.43%, up 13 bps. Stock markets, on the other hand, trade in the red, US indexes losing some ground after their European counterparts settled in the red.

XAU/USD price short-term technical outlook

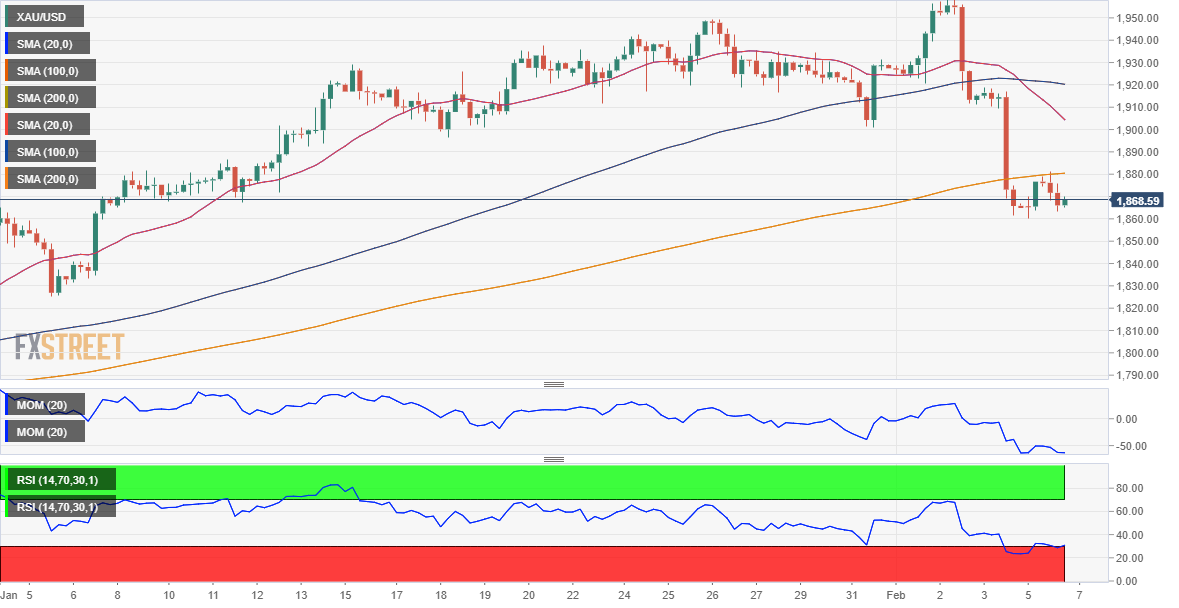

XAU/USD currently trades around $1,868, hovering around Friday’s close. The daily chart shows that the risk skews to the downside, as the pair remains far below a now flat 20 Simple Moving Average (SMA) while the longer moving averages remain far below the current level. Technical indicators, in the meantime, remain within negative levels but lack apparent directional strength.

In the 4-hour chart, the bearish case is clearer. The pair is developing below all of its moving averages, with sellers rejecting advances at around a mildly bullish 200 SMA, currently at $1,877. The 20 SMA accelerates its decline above the latter while below the 100 SMA. At the same time, technical indicators maintain their downward slopes within oversold readings without signs of bearish exhaustion.

Support levels: 1,860.20 1,847.60 1,835.10

Resistance levels: 1,882.00 1,896.45 1,910.20