- Grayscale initiated its legal proceedings against the Securities and Exchange Commission in October 2022 over the rejected conversion of GBTC into ETF.

- Grayscale replied to SEC’s rejection, saying the regulatory body had exceeded its authority.

- Grayscale Ethereum Trust premium recovered by almost 13% in the last two weeks after falling to its all-time low last month.

Grayscale has been attempting to reach common ground with the Securities and Exchange Commission (SEC) for more than a year now. However, after exhausting all measures, the crypto asset management company took the regulatory body to court, claiming harsh and unfair discrimination against Bitcoin spot ETF.

Grayscale puts its fists up

Grayscale on Friday discussed the Reply Brief filed by the asset management company. The reply brief focused primarily on countering the claims made by the SEC in its brief in December 2022.

The SEC had previously claimed that the spot ETF is susceptible to “fraud and manipulation” since such ETFs lack federal oversight. Bitcoin Futures ETFs, on the other hand, are monitored by the Chicago Mercantile Exchange (CME).

In response to the same, Grayscale stated that Bitcoin Futures and spot Bitcoin, as well as their corresponding indices, had a 99% correlation. Additionally, the SEC applied its “significance test” arbitrarily, exceeding its statutory authority in doing so. The brief read,

“The Commission is not permitted to decide for investors whether certain investments have merit—yet the Commission has done just that to the detriment of investors and potential investors it is charged to protect.”

As per Grayscale, the ongoing issues surrounding FTX, Celsius and its own parent company Digital Currency Group (DCG), are irrelevant to the case. Grayscale iterated that the lawsuit only focused on concluding that SEC acted “arbitrarily and capriciously, and discriminate against issuers, in denying the conversion of GBTC to a spot Bitcoin ETF”.

Going forward, both Grayscale and SEC have time until February 3 to file their final briefs post which the schedule for oral arguments will be decided.

Grayscale Ethereum Trust recovers

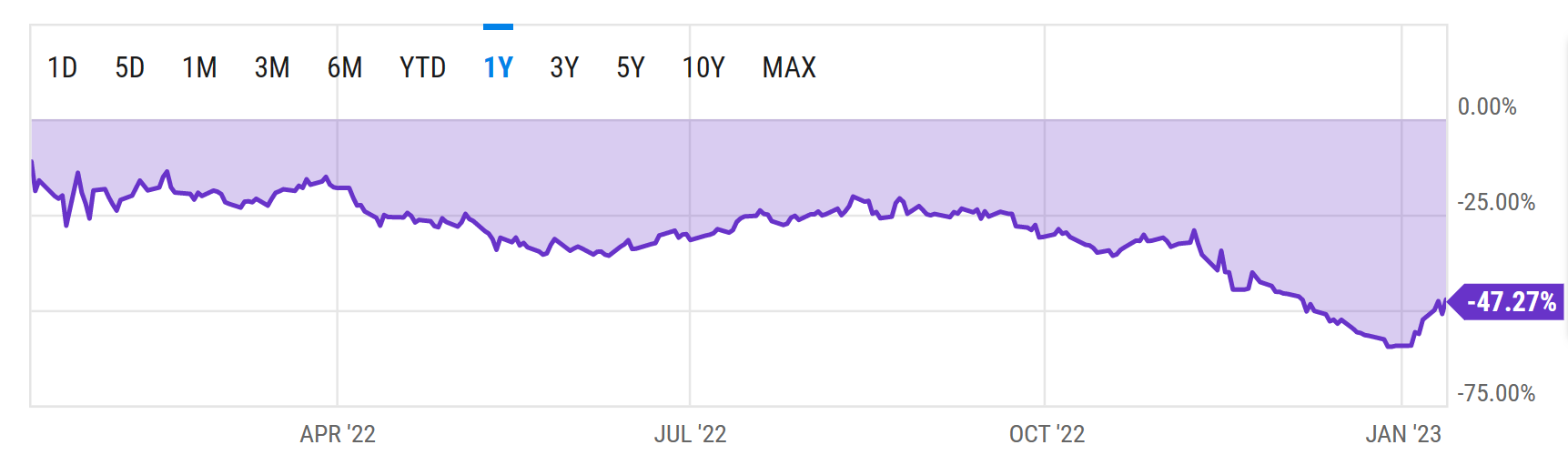

Grayscale Ethereum (ETHE) trust enjoyed the bullishness noted in the crypto market over the last couple of days as the value of ETHE jumped by 13%. Towards the end of December 2022, ETHE was trading at an all-time high discount of almost 60%, which has since come down to 47.27%.

Grayscale Ethereum Trust premium to NAV

Similar recovery has been observed in the case of Grayscale Bitcoin Trust (GBTC) premium as well. Rising from its all-time low of 48.89%, the GBTC premium is currently at 39.68%, thanks to Bitcoin price crossing $19,800 over the last few days.