Grayscale Bitcoin Trust (GBTC) has seen $484 million in outflows on Friday as GBTC holders capitalize on open redemption options. With it Bitcoin price has also dropped upwards of 7%.

In hindsight, the Grayscale Bitcoin Trust (GBTC) held over $25 billion worth of Bitcoin, which had been locked up for years because there was no option for selling. With the recent spot BTC ETF approvals, which inclined toward cash creates, the redemption option opened. This provided leeway for GBTC holders to exit the trust after years, which means selling the BTC on the open market.

According to data from Arkham Intelligence, Grayscale sent 4,000 BTC worth $183 million to a Coinbase Prime deposit address, suggesting that investors may be switching their assets to other ETFs or selling normally.

Also Read: Bitcoin Weekly Forecast: BTC crashes as GBTC dumps, but bullish outlook still not under threat

After trading of spot BTC ETFs began on Thursday, the numbers were shocking, with the latest reports showing that trading volume hit $4.5 billion during the first day of trading. Based on the report, about 50% of this was attributed to Grayscale’s GBTC.

Here’s the #Bitcoin ETF Cointucky Derby data via trading volume on day 1 (more volume will continue for a little while).

Total Volume was over $4.6 Billion with $GBTC about half of it. BlackRock & Fidelity went 1 & 2 absent GBTC. pic.twitter.com/t70MzyQfZW

— James Seyffart (@JSeyff) January 11, 2024

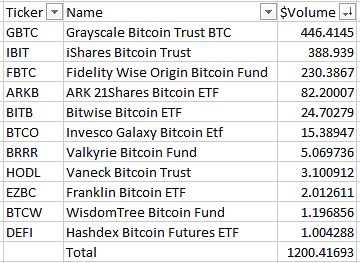

Recent reports revealed that after the landmark approval on Wednesday, Spot BTC ETF trading volume hit $1.2 billion in 20 minutes, and almost $2 billion within the hour. Grayscale‘s GBTC led the train with $446 million, followed by IBIT and Fidelity’s FBTC in third place while Ark Invest’s ARKB took fourth place.

Spot BTC ETF trading volumes

According to James Seyffart, flows likely comprised the lion’s share of the trading volume, save for GBTC.

Lot of questions. No way to know how much of this is flows. We will potentially know this evening. Though I would bet a significant portion of it is indeed flows. Would also bet that a lot of the GBTC trading volume is outflows.

— James Seyffart (@JSeyff) January 11, 2024

Eric Balchunas says these are “unreal first-day numbers” and expects the record to be broken today.

Almost a good hour after this tweet and the number still isn’t 2.3 billy.. it did however hit $1b and $1.8b if you incl $GBTC, which are UNREAL first day numbers (records will be smashed today). My source is a consolidation of all the exchange feeds via Bloomberg terminal. FYI! https://t.co/emqwEY0Hke

— Eric Balchunas (@EricBalchunas) January 11, 2024

CryptoQuant data shows that Coinbase’s Bitcoin trading volume over the counter (OTC) reached $7.7 billion on Thursday, marking the second-largest level in history.

In principle, this means that Bitcoin purchases over-the-counter may be related to the approval of Spot BTC ETF, with crypto exchange trading volume reaching $52 billion, levels last seen on March 21, 2023.

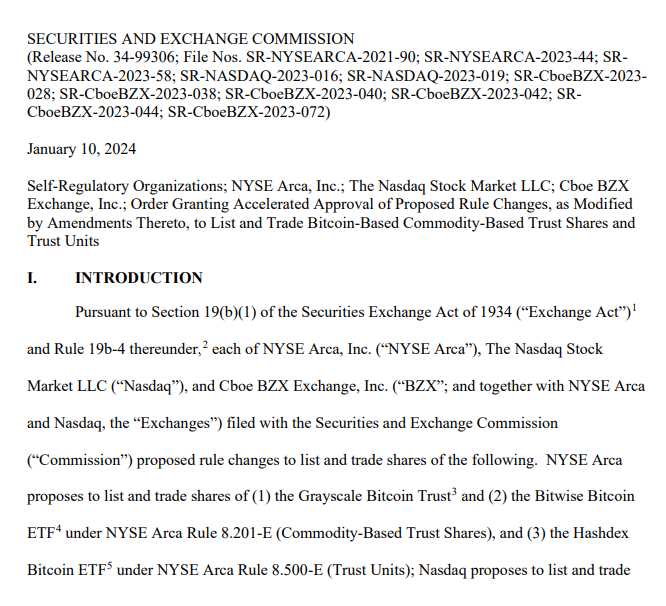

SEC approves all spot BTC ETF applications on January 10

In a landmark decision, the US SEC has approved all Bitcoin spot ETFs in a single, unprecedented decision on Wednesday, January 10.

This unexpected green light for the long-awaited financial instruments, confirmed in an official announcement, ignites immediate euphoria across the cryptocurrency industry.

SEC approves all spot BTC ETFs

The US SEC surprisingly gave the green light to the 11 spot ETF applications submitted by major players like Grayscale, Bitwise, Hashdex, Valkyrie, Ark 21Shares, Invesco, Fidelity, and others.

The decision comes after months of intense industry lobbying and a recent flurry of amended 19b-4 filings, hinting at growing pressure on the SEC to act.

The approval marks a paradigm shift, granting direct access to Bitcoin via ETFs for millions of institutional and retail investors who previously lacked options.

Notably, the Chicago Board Options Exchange (CBOE) had jumped the gun, announcing the listing of spot ETFs ahead of the approval and highlighting that trading would commence on Thursday. January 11.

Indeed, trading could begin on Thursday, with a bunch of the prospectuses going effective as S-1’s approvals are being checked off.

We’re seeing a bunch of these prospectuses going Effective. S-1’s approvals are being checked off.

✔️19b-4 Aprrovals

✔️ Effective Prospectuses (S-1’s)These things will indeed begin trading tomorrow. There are no more steps needed pic.twitter.com/YmYyw8b0C9

— James Seyffart (@JSeyff) January 10, 2024

Despite Spot BTC ETF approvals, the SEC does not endorse Bitcoin

Nevertheless, even though the commission greenlit the spot BTC ETFs, chair Gary Gensler said in a statement that it is not an endorsement of Bitcoin.

While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.

It comes after Gensler cautioned market participants about the risks of crypto investing, listing possible incompliance, market risk, and fraud, as part of the dangers.

If you’re considering an investment involving crypto assets, be cautious.

Crypto asset securities may be marketed as new opportunities but there are serious risks involved.

Read @SEC_Investor_Ed‘s Director Take:

— Gary Gensler (@GaryGensler) January 9, 2024

The original link to Spot BTC ETF approvals was taken down

The US Securities and Exchange Commission (SEC) has removed the original link showing that all Bitcoin exchange-traded funds (ETFs) have been approved.

Approval link taken down

Grayscale to list GBTC to NYSE Arca as SEC approves spot Bitcoin ETFs

With this development, Grayscale has received the necessary regulatory approvals to uplist GBTC to NYSE Arca, with a spokesperson noting that they would be sharing a press release later.

“I am happy to confirm that the Grayscale team has received necessary regulatory approvals to uplist GBTC to NYSE Arca, and we will share a press release with additional information shortly” ~ Grayscale spokesperson

— Frank Chaparro (@fintechfrank) January 10, 2024

Crypto markets react to ETF approval

Bitcoin price has dipped almost 1% in the immediate aftermath of the news and currently trades at $45,976.

BTC/USDT 1-hour chart

Source