- Grayscale filed its opening briefing on October 12 in the lawsuit it brought against the Securities and Exchange Commission.

- According to Grayscale, the SEC has been treating spot Bitcoin ETFs with “special harshness.”

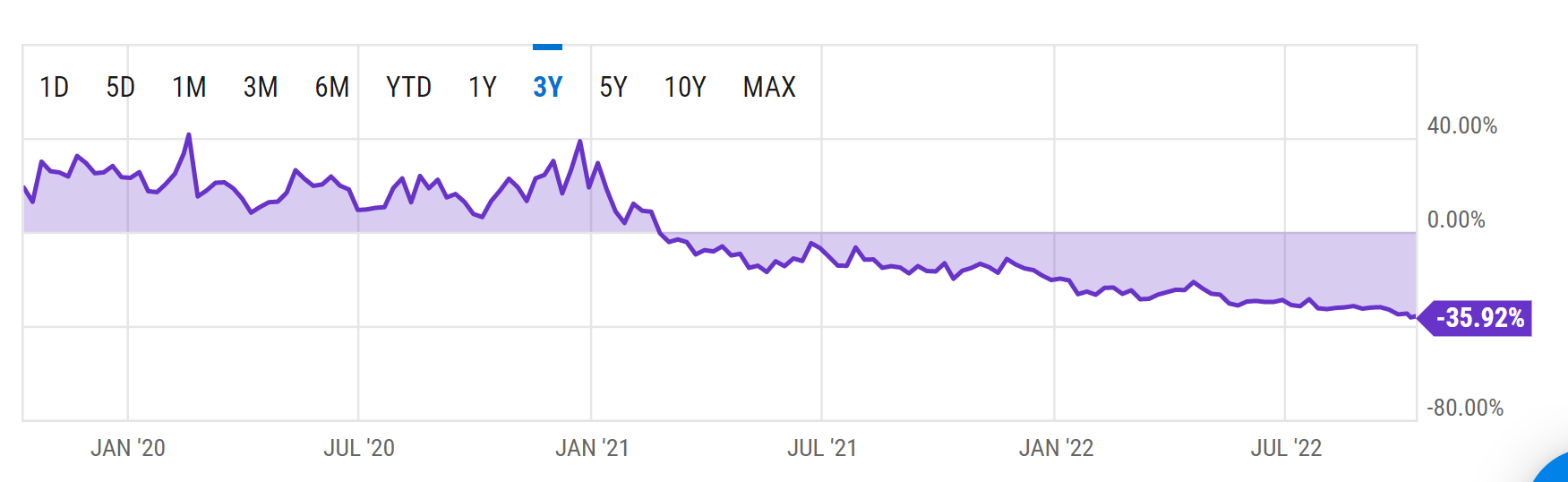

- The Grayscale Bitcoin Trust is currently trading at its highest-ever discount of 35.92%.

Crypto is one of the most quickly spreading investment vehicles to appear in traders’ and investors’ portfolios. However, those who prefer to do the same with the safety of regulations from an overseeing body should go for something like an Exchange-Traded Fund (ETF).

Thus to improve inclusivity, Grayscale has been fighting for months now, with the first real development taking place on Wednesday.

Grayscale sues the SEC

Earlier on October 12, Grayscale took to the social media platform Twitter to reveal that the asset management company had an important reveal until midnight. Grayscale, in a tweet, stated,

“We believe the SEC arbitrarily tr eats spot #Bitcoin ETFs differently from ETFs that hold Bitcoin futures, even though they carry the same protections and risks, and deriving their price from the same underlying $BTC markets.”

The company went on to proclaim that the test of the market presented by the SEC does not have to be the final world or considered the only valid test. Being stringent towards spot BTC ETFs, Grayscale highlighted that the SEC is just treating spot Bitcoin ETFs with “special harshness”.

As the case builds on further, with the SEC’s point of view coming in, the final briefs have been scheduled for December 21 this year.

GBTC at its worst

The Grayscale Bitcoin Trust (GBTC), wanting to turn into an ETF, comes at a time when the performance of the asset has been only declining with every passing day. Slipping into a discount, GBTC stopped trading at a premium back in February and currently is at its highest discount of 35.92%.

The worsening market conditions are to be blamed for the fall of GBTC’s premium and the subsequent fall in crypto products’ demand. That situation needs to improve if it wants to go on somewhere,