- Over 91% of MNT is in profit following slight gains on Thursday.

- Most investors are still holding onto their tokens despite MNT setting several new all-time highs between March and April.

- MNT needs a catalyst before it can rally back toward April highs.

Ethereum Layer 2 Mantle (MNT) investors are holding onto their tokens despite the increase in the percentage of coins in profit after rising nearly 4% on Thursday.

MNT holders have yet to book profit

Mantle saw a 3.7% gain on Thursday after announcing a strategic partnership with Dune Analytics. The partnership will allow users to gain insights into Mantle’s on-chain metrics via Dune dashboards.

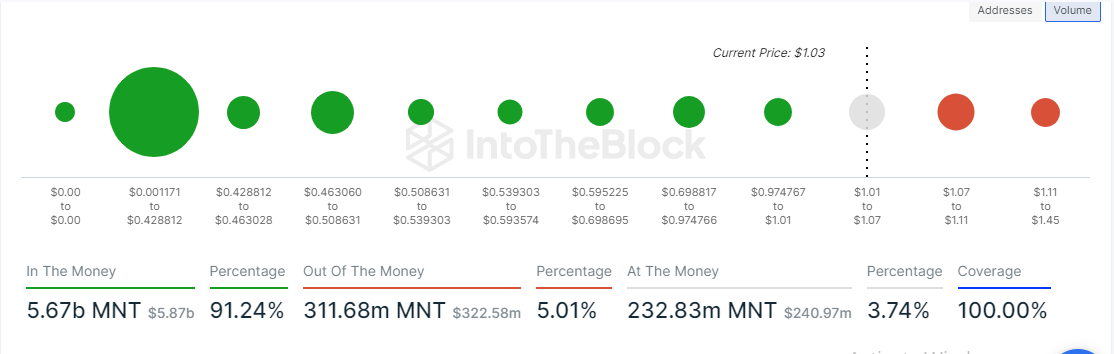

The recent gain has seen the total number of in the money MNT coins rise more than 91%, according to data from IntoTheBlock.

In/Out of the Money reveals the total number of addresses in profit or loss based on their average purchase cost. An address is in the money if its current price is higher than its average cost and vice versa if it is lower.

MNT Global In/Out of the Money

A closer look reveals that 61% of coins purchased between $0.8 and $1.19 are in the money, while 38% are out of the money. Investors who bought during MNT’s rally to new all-time highs in March and April are the only ones at a loss. This suggests that most investors are holding onto their tokens.

MNT’s high staking yield may be why holders are not selling yet, as they are looking to boost their earnings. However, the incentives to sell may grow higher if MNT sees around a 40-46% rally that pushes it near its all-time high of $1.54.

The launch of spot ETH ETFs could give MNT such a push, considering its closeness with the Ethereum ecosystem. Additionally, Mantle’s total value locked (TVL) has been growing, rising 54% in the past 30 days. This indicates increased interest among investors in the Mantle L2 chain.

However, it’s important to note that most MNT in circulation is held by whales, meaning the token could face a serious dump if it reaches a considerable high that propels them to book profit.

Mantle’s 30-day MVRV is at 5.7%, meaning addresses that bought the coin within the last 30 days are only 5% up on their investment. Hence, a sell-off is unlikely at this stage.

MNT will likely see slight gains and begin a sideways movement in the coming days until it sees a price catalyst.

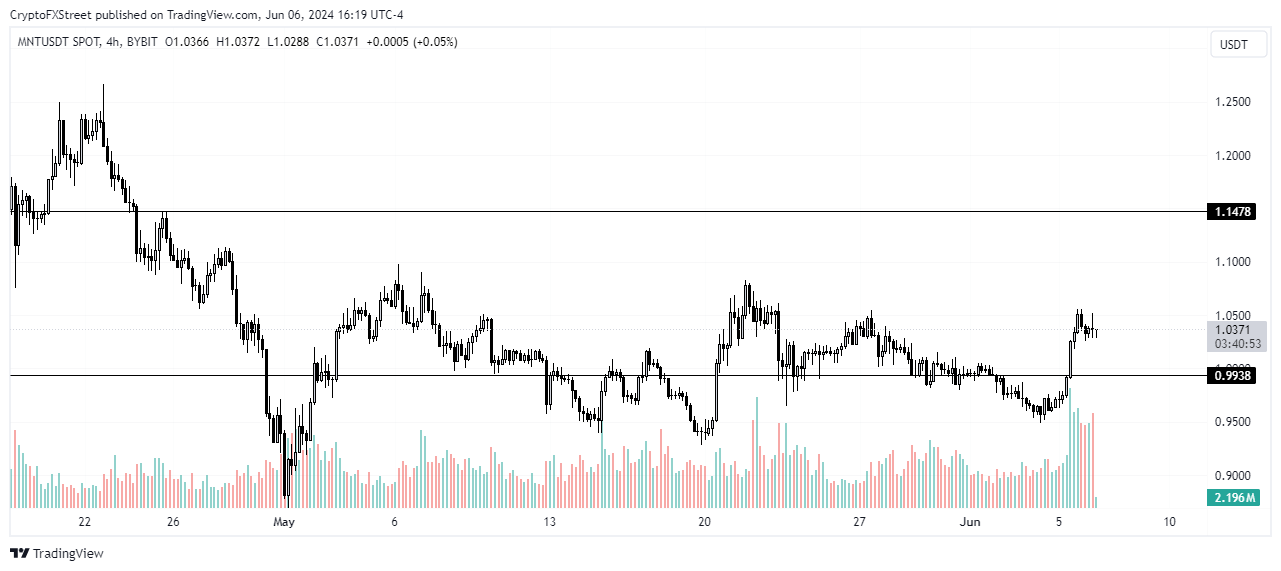

MNT/USDT 4-hour chart

In case of a bearish move, MNT will fall to collect liquidity around $0.99. MNT will be primed for a surge to tackle its previous all-time high if it rallies more than 8% to overcome the $1.14 resistance of April 26.

Source