- Hong Kong issuers are allegedly working toward incorporating staking into their ETH ETFs.

- ProShares submits 19b-4 application for spot ETH ETF.

- Ethereum will likely continue its range-bound movement over the weekend.

Ethereum (ETH) is down more than 1% on Friday following news that Hong Kong will allow issuers to integrate staking features into their spot ETH ETFs. ProShares also submitted a 19b-4 application for a spot ETH ETF with the Securities & Exchange Commission (SEC).

Daily digest market movers: Hong Kong ETFs, ProShares join the train

Ethereum ETFs are the main subject of discussions surrounding the number one altcoin. Here are the latest market movers:

- Hong Kong asset managers are allegedly working toward incorporating staking features into their spot Ethereum ETFs, according to Animoca Brands co-founder and Executive Chairman Yat Siu. Hong Kong crypto ETFs have struggled to garner investors’ attention despite the excitement surrounding their initial launch.

However, with the added rewards of staking, Hong Kong ETH ETFs could be attractive to investors worldwide, especially as the SEC has signaled that it won’t permit issuers to offer staking if/when spot ETH ETFs go live.

Read more: Ethereum ecosystem active users spike 55% in Q1, 2x ETH ETF records impressive volume

- Asset manager ProShares submitted a 19b-4 form with the SEC on Thursday, stating intentions to issue spot Ethereum ETFs on the New York Stock Exchange (NYSE). The move puts ProShares as the latest member in the list of prospective spot ETH ETF issuers.

The SEC earlier approved the 19b-4 filings of eight issuers on May 23, including Van Eck, Bitwise, BlackRock, Fidelity, Franklin Templeton, Invesco & Galaxy, Grayscale and 21Shares. Following the approval, issuers submitted updated S-1 registration statements with the SEC, which the agency must approve before the ETFs go live.

Also read: Ethereum open interest surges by 50%, SEC Chair says ETH ETF launch will take more time

- SEC Chair Gary Gensler told Reuters on Wednesday that the timing for spot ETH ETFs to launch depended on how responsive issuers are to the SEC’s comment on their S-1s.

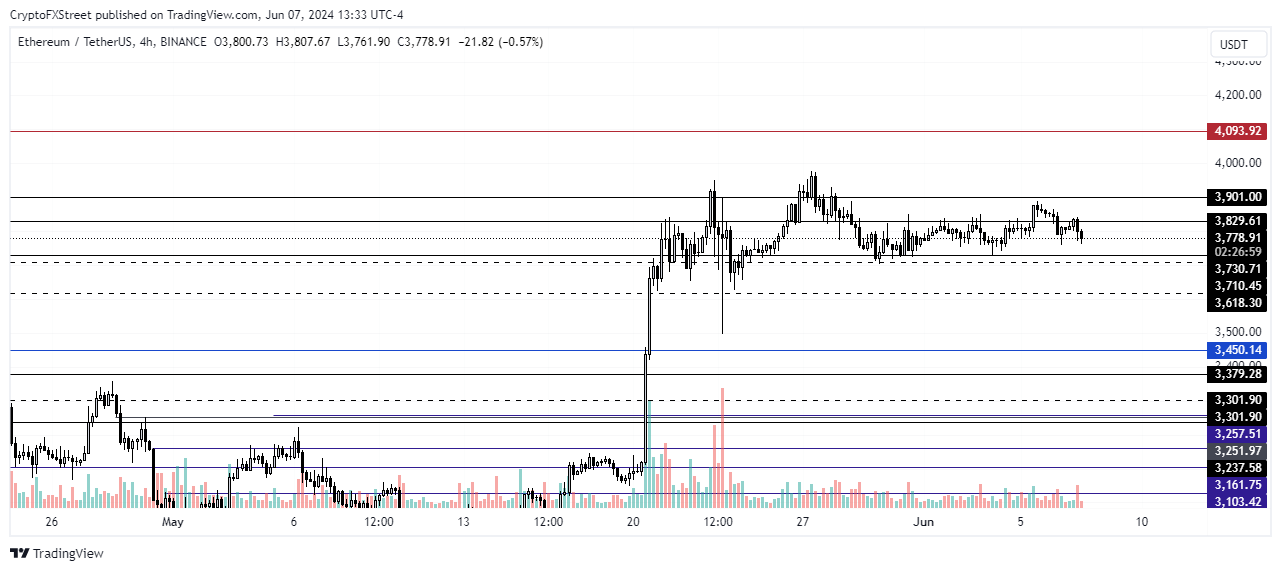

ETH technical analysis: Ethereum to sustain range-bound move over the weekend

Ethereum is trading around $3,781 as it continues its range-bound movement on Friday. The ETH long/short ratio is skewed toward shorts, with a 48% to 52% difference in the past 24 hours, according to data from Coinglass. This indicates a slight bias towards a bearish view, especially as ETH’s long liquidations are at $58.3 million compared to $7.3 million of short liquidations.

Read more: Ethereum leveraged ETFs go live as price fails to react

Considering current market conditions, Ethereum will likely stay above the $3,730 support.

ETH/USDT 4-hour chart

However, higher bearish sentiment will see the $3,618 support become the next key price to watch out for. ETH may sustain the horizontal move over the weekend and before beginning another attempt toward the $3,901 resistance.

A successful move above the resistance will see ETH begin a move to tackle the $4,093 yearly high before aiming for a new all-time high.

A daily candlestick close below the $3,300 level will invalidate the bullish thesis.

Ethereum development FAQs

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.

Source