- Dogecoin price has rallied 12% today while the rest of the market remains quiet.

- On-chain metrics suggest smart money may have already offloaded their positions.

- A breach above $0.096 would invalidate the bearish outlook.

Dogecoin price has surprised the market as the bulls produced a 12% surge on Friday, November 25. As the price consolidates near the upper bounds of a previous range, the technicals signal optimistic days ahead. The notorious meme coin is often referred to as a leading indicator amongst crypto traders. The recent rally also prompts investors with a vital question: Is it time to get back into the market?

Dogecoin makes a move

Dogecoin price currently auctions at $0.088 as the recent uptrend hike brings DOGE’s market value up 25% on the week. A Fibonacci retracement tool surrounding the November high at $0.148 and the November low at $0.073 shows today’s rally as piercing through the 23.6% Fib level. The 23.6 Fib level is often considered a weak Fib but can give context for the underlying bullish strength in the market. A daily close above the level should prompt an additional rally toward the 38.2% Fib level at $0.09. On the contrary, if the bulls fail to hold above the level, a sweep-the-lows event targeting new monthly lows would stand a fair chance of occurring.

DOGE.USDT 1-Day Chart

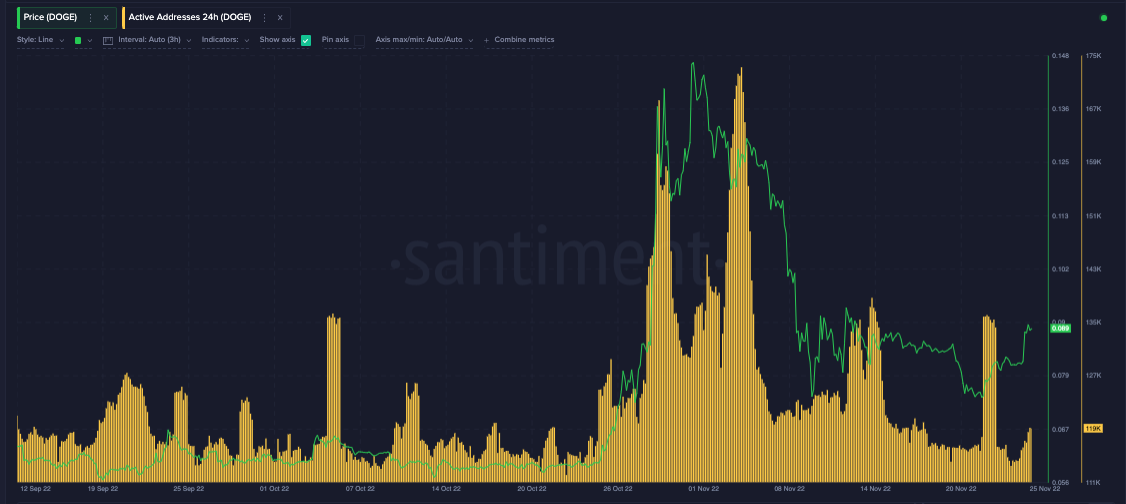

On-chain metrics may provide context for what is happening underneath the notorious meme coin’s hood. According to Santiment’s Active Addresses Indicator, the recent uptrend move shows fewer transactions when compared to the previous countertrend rally on November 22.

The indicator can be used to gauge crowd speculation around a digital asset. Based on the recent downtick in transactions, the smart money may have already offloaded their positions, and the current uptrend could be a suckers’ rally meant to entice retail bulls.

Santiment’s Price And Active Addressed Indicators

Considering these factors, the DOGE price could face significant resistance going into the weekend. A breach of the $0.085 level could be the signal that sidelined bears are looking for to target the November lows at $0.068. Invalidation of the bearish thesis would be the 38.2% Fib level at $0.096. A breach above the invalidation point could prompt a rally near the November highs at $0.148, resulting in an 80% increase from the current DOGE price.