- Near Protocol price has bounced off a key support level at $3.33 and eyes a potential bounce.

- Investors can expect NEAR to inflate by 13% and tag the $3.90 resistance confluence.

- A better buying opportunity would be a retest of the 12-hour demand zone, extending from $2.75 to $3.05.

- A daily candlestick close below the $2.57 support level would invalidate the bullish thesis.

Near Protocol (NEAR) price is bouncing off a relatively stable support level, which could evolve into a quick pullback rally. NEAR holders need to be patient if this plan does not work out as it could lead to an even better buying opportunity.

Also Read: Bitcoin spot ETF approval could come as soon as Tuesday, new filings hint

Near Protocol price at crossroads

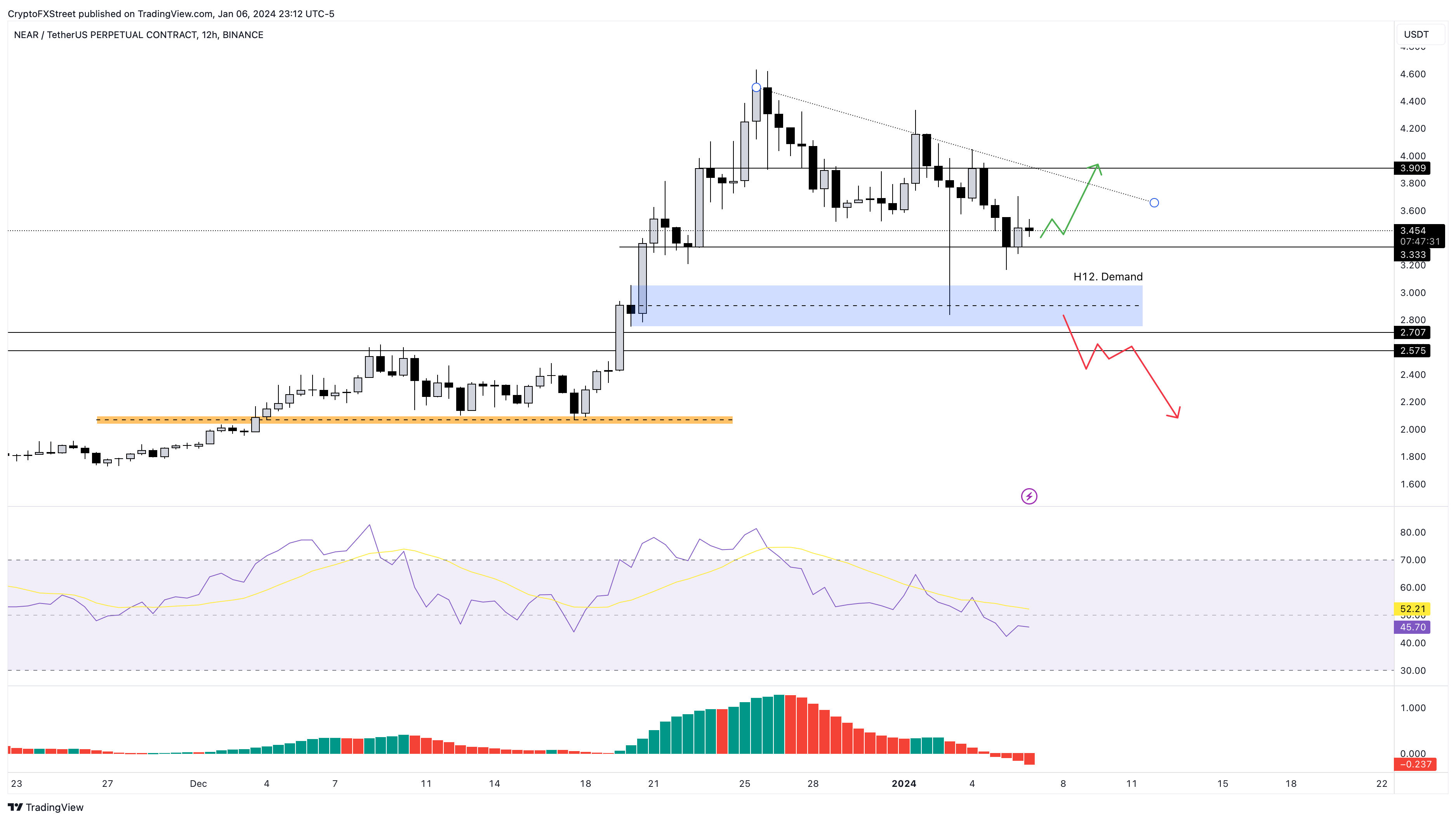

Near Protocol price is attempting to kickstart a recovery rally as it bounces off the $3.33 support level. Investors can expect a quick 13% upswing to $3.90 from where it currently trades at $3.45.

The reasoning behind this bullish idea comes after Near Protocol price swept the December 22, 2023, low at $3.20 and produced a bullish swing failure pattern that closed above the $3.33 support level.

Going forward, if NEAR bulls manage to hold above this level, it could lead to a quick 13% gain. In some cases, the altcoin might touch the $4.0 psychological level, bringing the total gain to roughly 16%.

This bullish outlook is a quick in/out trade as it involves the risk of the breakdown of the $3.33 support level. In such a case, Near Protocol price could slide down into the 12-hour demand zone, extending from $2.75 to $3.05.

This is another key area where sidelined buyers are likely to get interested in bidding, which could kickstart another recovery rally to $4.0.

NEAR/USDT 12-hour chart

Also read: BlackRock might be on track to create history with $2 billion inflows in spot Bitcoin ETF in a week

While the recovery rally outlook is a short-term play for intraday traders, NEAR price could slide lower on the daily timeframe. As mentioned above, investors can expect another 20% drawdown before the sidelined buyers are interested. But if the Near Protocol price produces a daily candlestick close below the $2.57 support level, it would create a lower low on a high timeframe and invalidate the bullish thesis.

In such a case, NEAR could slide 19% and encounter a support level at $2.06.

Source