- THORChain price is up 120% in a remarkable rally beginning October 20, testing levels last seen in May 2022.

- However, the uptrend could be exhausted for RUNE as the altcoin is massively overbought. A 20% slump is possibly on the cards.

- This bearish outlook will be invalidated once the altcoin records a decisive daily candlestick close above the $3.500 psychological level.

THORChain (RUNE) price has been on an epic surge beginning late October, recording a remarkable breakout that catapulted the market value of the cryptocurrency to levels last seen during the Terra UST era.

Also Read: THORChain exchange surpasses $200 million in total volume after swap pause

THORChain price running on fumes

THORChain (RUNE) price is up 120% beginning October 20 and 20% in the last 24 hours, coming along with a 150% increase in trading volume. However, the rally seems to be exhausted as RUNE faces a crucial barricade at $3.485, levels last tested in May 2022.

Based on the Relative Strength Index (RSI) outlook, RUNE is massively overbought. However, the momentum indicator remains northbound, showing that the upside potential is still plausible, but it all depends on whether the bulls can still put up a fight.

If the THORChain price is able to break past the immediate and crucial resistance at $3.485 and close above it, it could pave the way for RUNE to extend above the $0.3500 psychological level, with a decisive move above this level invalidating the bullish thesis.

RUNE/USDT 1-day chart

However, should traders succumb to their profit appetite after the epic climb, THORChain price could retrace its steps, moving south below key levels. What begins with a slip below the $3.000 psychological level could culminate in a retracement back into the consolidation phase between the $2.155 support level and the $1.384 support level, writing off all the ground covered since the October rally began.

THORChain on-chain metrics support the thesis

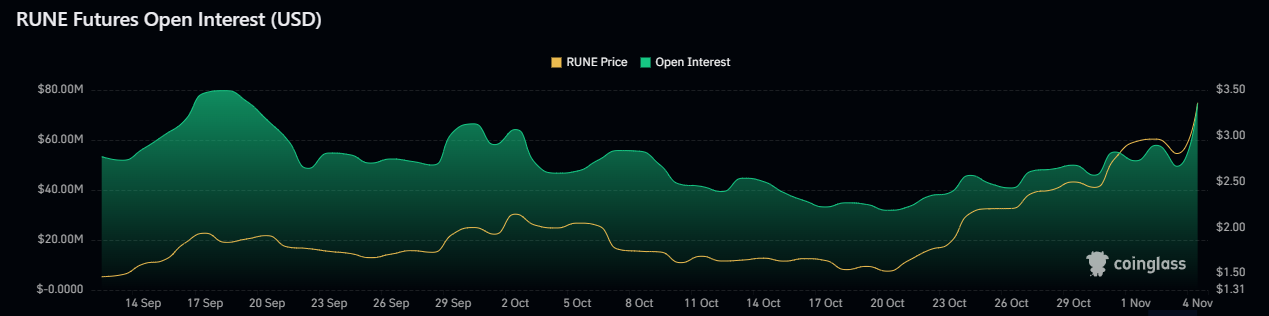

Based on data from Santiment, social dominance for the RUNE cryptocurrency is shrinking, suggesting the altcoin is not being mentioned a lot on social media. If at all there is chatter, it is possibly over its epic surge as investors anticipate a correction. This stance is corroborated by the rising open interest, defining the sum of all open long and short positions.

After the 120% climb, the odds of more traders taking short positions for RUNE relative to those taking long positions, are higher.

RUNE Santiment

Coinglass data indicates a 51% increase in open interest within 24 hours, rising from $49.50 million on November 3 to $74.64 million on November 4. The volume of shorts on Binance exchange alone is thrice the volume of longs as traders anticipate a pullback.

RUNE Open Interest

Source

%20[03.48.53,%2004%20Nov,%202023]-638346568686276334.png)