- The Real World Asset sector has garnered attention and mentions from crypto analysts, the narrative is making a comeback.

- Tokens CFG, ONDO, MKR and others have seen up to 50% corrections recently.

- Several top RWA projects are in the Solana ecosystem.

Bitcoin halving and developments in the AI sector are the key narratives this cycle. The Real World Asset (RWA) tokenization narrative gathered steam with BlackRock’s tokenized asset fund launch on Ethereum in March 2024.

Analysts have identified RWA tokens that have experienced up to 50% correction.

RWA tokens likely in the “buy the dip” zone for traders

The RWA narrative is a relatively new one in the crypto ecosystem. RWAs refer to tangible assets, this could range from bonds to real estate properties, outside of the virtual world. The concept of RWAs on the blockchain has gained popularity.

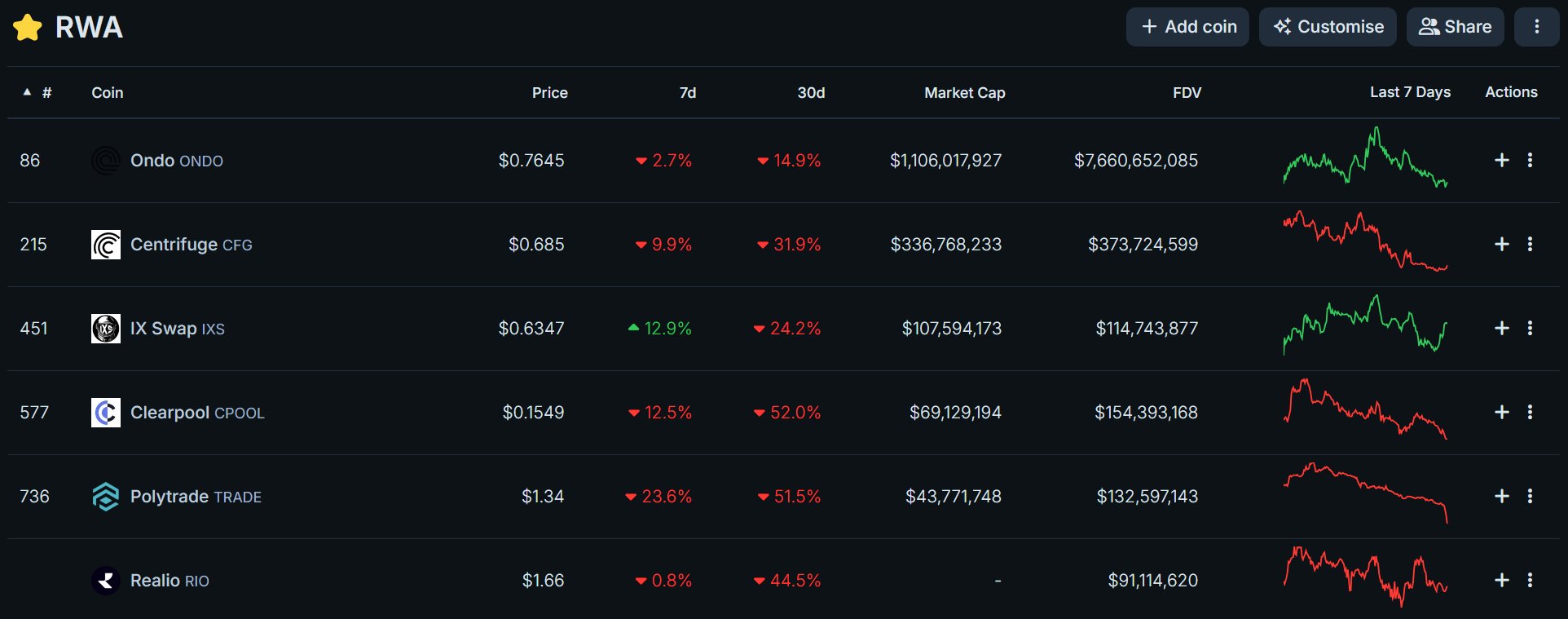

Centrifuge (CFG), Ondo (ONDO), Maker (MKR), Polytrade (TRADE), Clearpool (CPOOL), IX Swap (IXS), and Realio (RIO), are the projects listed by the analyst @InspectorDeFi. Market participants need to do their own research before making investment decisions in any of these assets.

RWA price performance in the past 30 days

Since these assets have faced between 14% and 52% correction in the past thirty days, they are likely in the “buy the dip” zone for traders. If the RWA narrative makes a comeback, these cryptocurrencies could see recovery rallies.

Several popular RWA projects are in the Solana ecosystem. The following chart shows different RWA assets divided by categories.

Crypto intelligence tracker CoinGecko recently released an RWA report and noted that currently, the majority of RWAs are USD-pegged stablecoins. The top three USD stablecoins alone make up 95% of the market, Tether (USDT) stads at $96.1 billion, USDC (USDC) at $26.8 billion, and Dai (DAI) at $4.9 billion.

Commodity-backed RWAs hit $1.1 billion in market capitalization and Gold remained a top commodity. Tokenized US treasuries observed a spike in popularity during the crypto bear market. The market capitalization of these assets increased 782% in 2023. The pace of growth in market cap has since stalled in 2024, with growth at 1.5% in January.

Source