- Shiba Inu price slid lower again this week as global markets rolled over after hawkish comments from the FED and ECB.

- SHIB received a firm rejection last week at the top side and is continuing its fade.

- Expect to see $0.00000712 to be tested at the earliest next week.

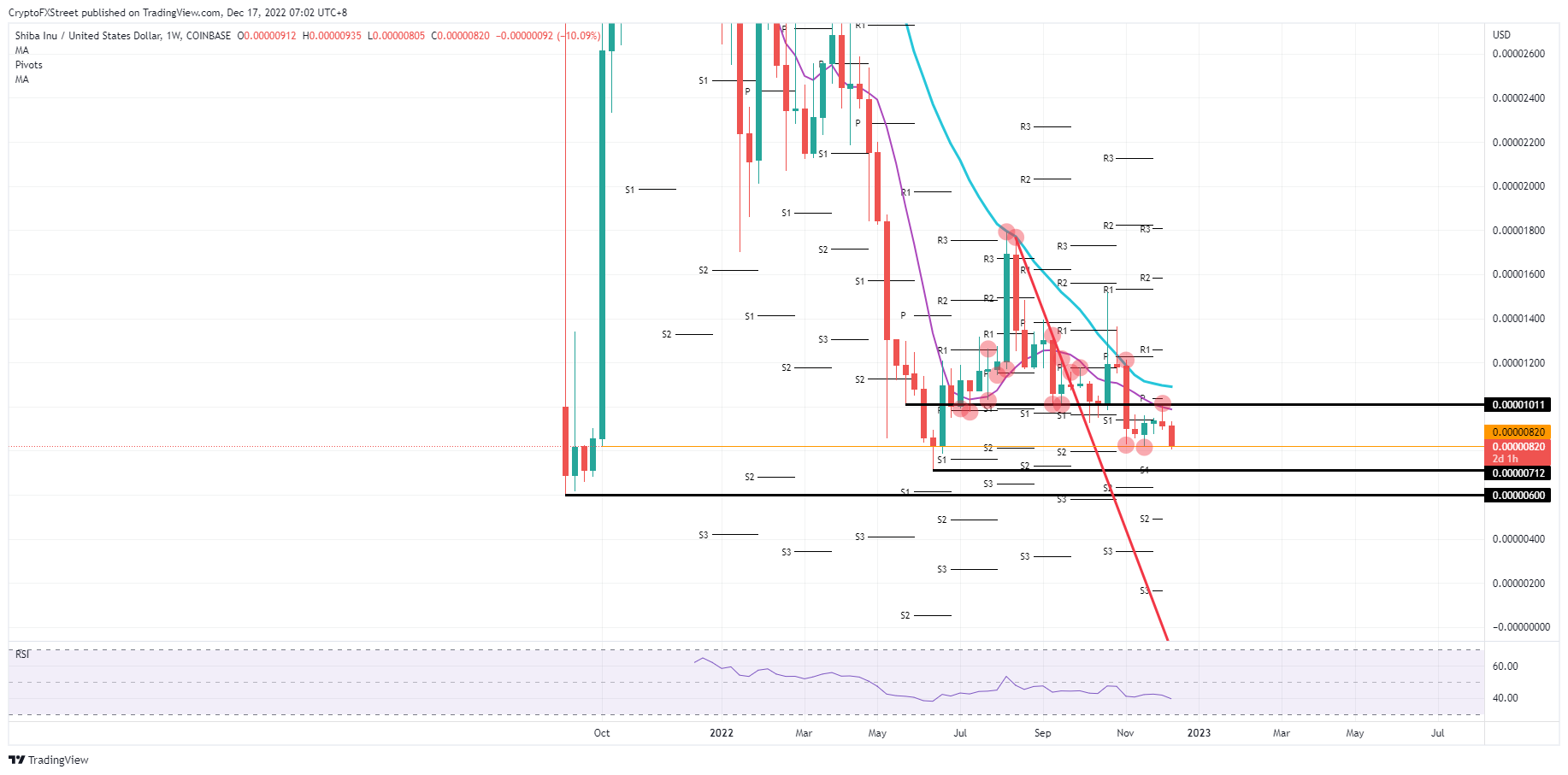

Shiba Inu (SHIB) looks to be done for this year after price action enters further into the lower territory from its attempt to break out of $0.0001000 earlier in December. For the second week in a row, a red candle looks inevitable after traders received a firm rejection from the topside against the 55-day Simple Moving Average (SMA) and the pivotal level near $0.00001011. With harsh warnings from the two biggest central banks across each other from the Atlantic Ocean, markets seem to be wrong-footed and setting the record straight will be hurtful.

SHIB will see its whales stranded

Shiba Inu price was no match for the mighty force of the Central Banks this week as both the US Federal Reserve and the European Central Bank made an appearance this week with a rate decision and their forecasts and outlooks on their economy. Both statements warned how quickly their balance sheets will be cleaned up, with a surprise from the European Central Bank that wants to get rid of its bond holdings by the end of 2023. This triggered dismal markets, with equities down and cryptocurrencies facing headwinds from several angles.

SHIB is thus on its way first towards the slightly supportive level at $0.00000820, which triggered a bounce twice for November. Once that breaks, the road is open for another 13% decline near $0.00000712, testing the low of June. With only two weeks to go, it looks doubtful that a sudden turnaround could still pop up and salvage this situation for the remainder of 2022.

SHIB/USD weekly chart

That earlier mentioned level at $0.00000820 could also be sticky and trigger the third bounce after already two bounces in November. That would send price action back towards $0.00001011 and break above that 55-day SMA and pivotal level. This would set traders up for the challenge of facing the 200-day SMA at $0.00001093 going into next week.