- Solana price tanks over 10% for the week as a negative close looks inevitable.

- SOL nears a crucial point that could, once broken, see a 55% nosedive move.

- With many headwinds, it will only take one negative catalyst to enter the danger zone.

Solana (SOL) price is erasing most of the gains from January as headwinds were piling up throughout the week, with another element to be added almost every day. With the risk sentiment near full risk-off and several elements not to be binary at all, it looks difficult to see any upside. Traders will need to brace for drastic price action and possibly more pain in the coming days and weeks.

Solana price swings from one moving average to the other one

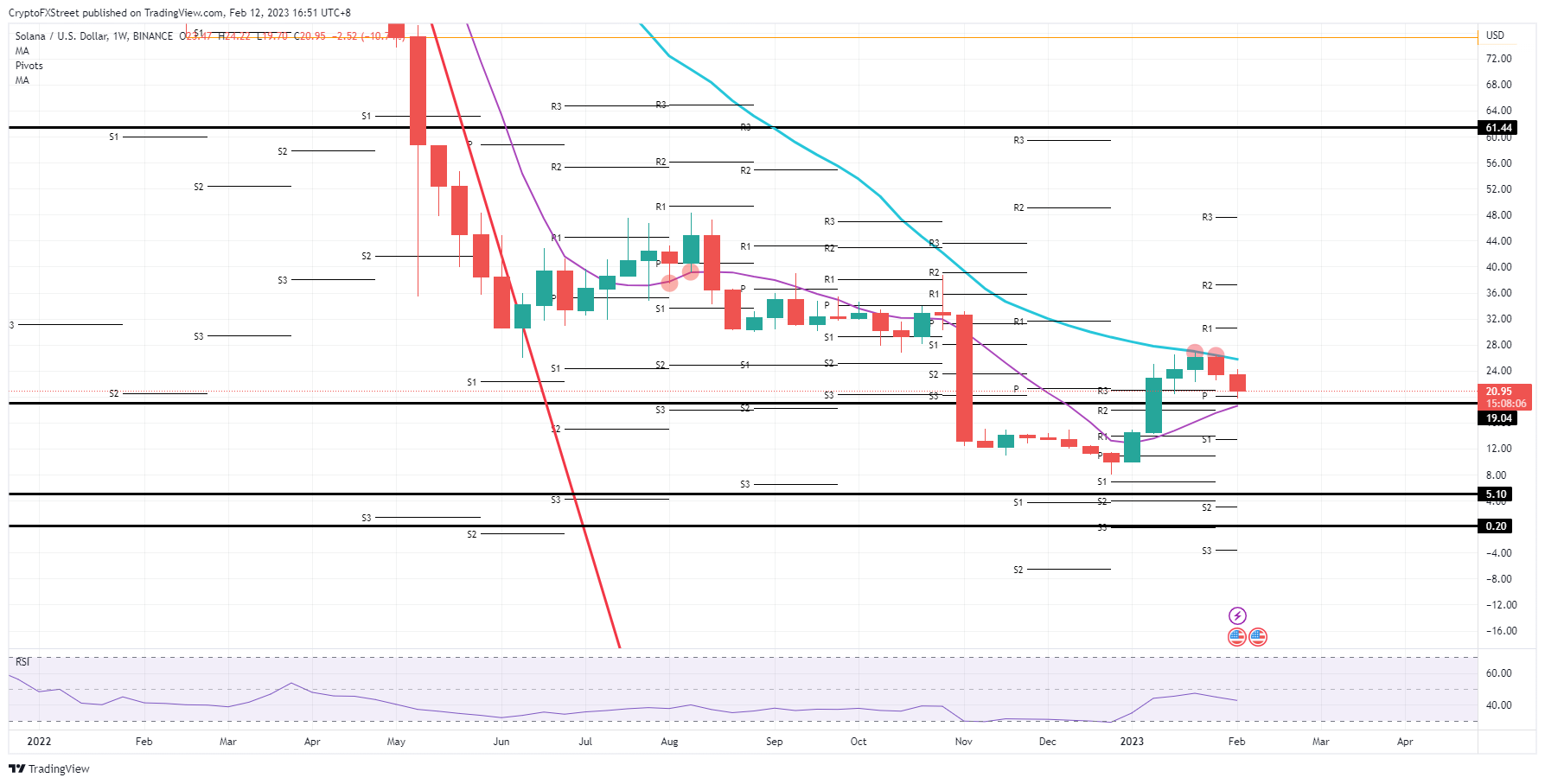

Solana price received last week a firm rejection against the 200-day Simple Moving Average (SMA) and saw losses mounting while bulls are awaiting support from the 55-day SMA. With SOL still technically in a dead cross trade, bears have the upper hand and momentum to build further pressure. Add to that the tailwinds from this week with harsh central bank messages, geopolitics in Ukraine and Russia and the energy prices that are picking up again, and the sum of all this does not look positive.

SOL traders need to watch $19.04, a historic pivotal level and the 55-day SMA area that should provide ample support. Unfortunately, with the large headwinds, it would only take one of those elements to pop up again to trigger a break to the downside. That would mean a big downward move of catastrophic proportions towards $5.1.

SOL/USD weekly chart

With the double belt of support and the risk premium already priced in, that could be enough for a bounce and jump higher. Certainly, with the war around its first anniversary, some war fatigue is happening on both sides of this war. Expect a swing back up to the 200-day SMA at any moment, awaiting another external catalyst to break through it to the upside.