- USD/JPY bears are testing structure support that guards yesterday’s closing price.

- Bears will remain in control while below the micro-trendline resistance.

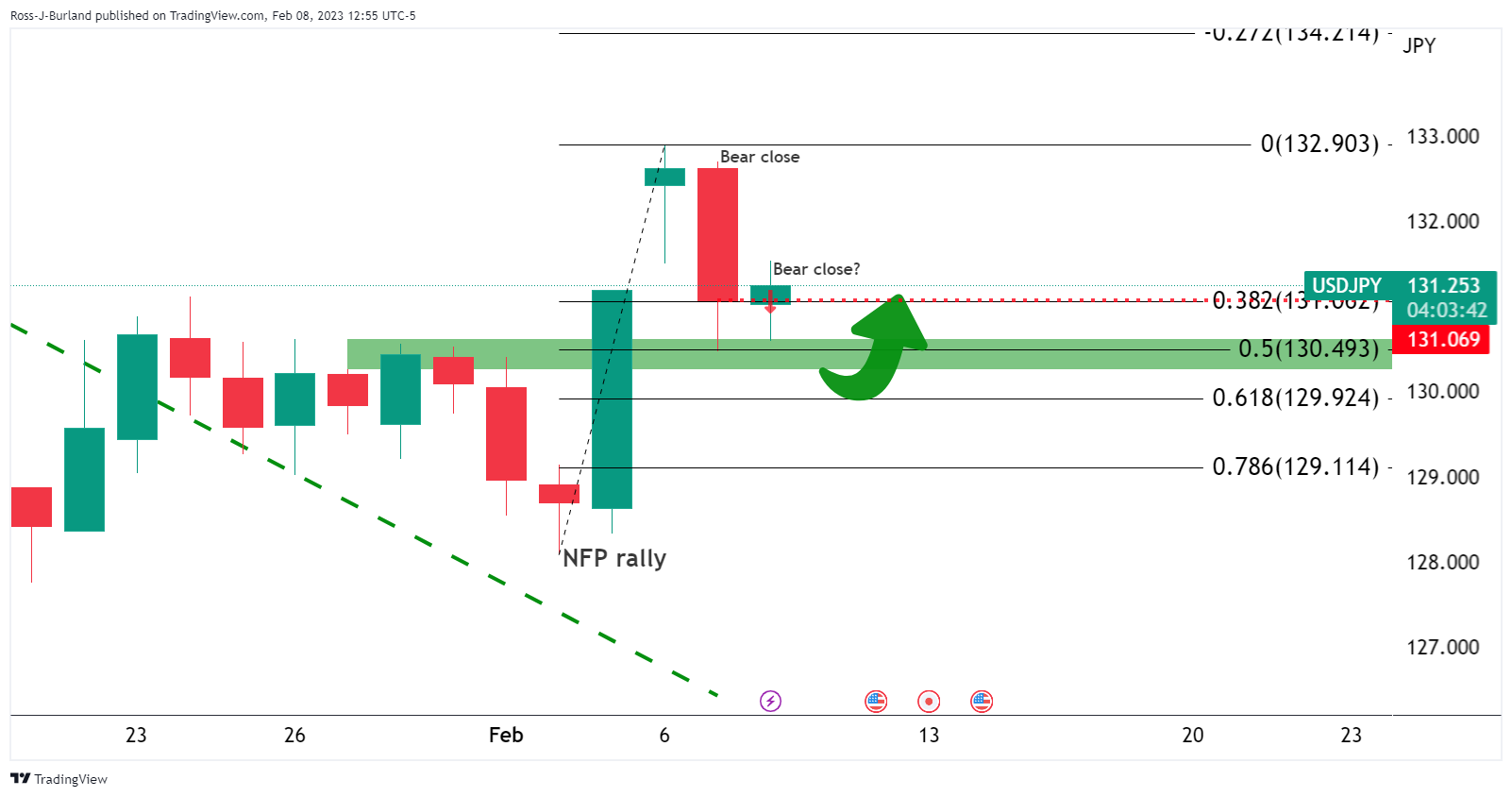

USD/JPY is starting to break down the bullish structure and the bears are moving in as the US Dollar comes under pressure following a Federal Reserve-speaker-fueled rally in the US session. The following illustrates a bias to the downside based on the week’s closing prices so far with Tuesday snapping the Friday Nonfarm Payrolls-induced rally that had led to two days of higher closes.

USD/JPY daily charts

The thesis is bullish now that the price has broken to the backside of the old bearish trendline resistance. However, following Friday’s bullish breakout, a correction is in play and the question is how far has this got to run still?

The thesis is that it is more common, following such a strong bearish close that the next day(s) will continue lower on the momentum of the first day. Therefore, Wednesday would be a high probability short set-up:

However, so far the bulls have been able to make a comeback on the day, moving in on the London session’s lows around 130.60 and driving the bears all the way back to a high of 131.53 in the US session. For the thesis to play out, the bears need to get back below Tuesday’s closing price of 130.99 and at the time of writing, there are some 20 pips to go. The ATR is around 170 pips and the range of the day so far has been 94 pips so there is room for a further push from the bears.

USD/JPY M15 chart

The bears are testing structure support that guards yesterday’s closing price but they will remain in control while below the micro-trendline resistance.