- VanEck, an investment giant, believes Bitcoin miners will go bankrupt despite a slowdown in the Federal Reserve’s liquidity tightening measures.

- This goes against the overall outlook on Bitcoin which turned bullish after the US inflation report showed a slowdown in price increases.

- Experts at VanEck have predicted an 82% drawdown in Bitcoin price from its all-time high of $69,000, to a target at $12,000.

VanEck, a global investment manager, has a bearish outlook on Bitcoin despite slowing inflation and monetary policy tightening by the US Federal Reserve. Experts at VanEck believe Bitcoin could nosedive to the $12,000 level with the recent wave of miner bankruptcies.

VanEck expects an 82% drawdown in Bitcoin price from its all-time high

VanEck, a US asset manager and investment giant, is bearish on Bitcoin despite the recent US inflation report. The US Bureau of labor statistics released the inflation report on Tuesday, fueling a bullish outlook among risk asset holders and crypto traders.

The report showed a slowdown in inflation and led to expectations the US Federal Reserve will slow the pace of its liquidity tightening measures. This should lead to a weaker US Dollar and affirm a bullish narrative for Bitcoin and crypto.

In contrast to the conclusion from the US inflation report, experts at VanEck argue that Bitcoin price could witness a massive drawdon. Matthew Sigel, head of digital assets research at VanEck told Coindesk,

Bitcoin will test $10,000-$12,000 in Q1 amid a wave of miner bankruptcies, which will mark the low point of the crypto winter.

Bitcoin miners have been hit by declining profitability and are caught between rising operational costs and the bear market. Since miners’ profitability is closely tied to Bitcoin prices, VanEck believes a wave of miner bankruptcies could increase the selling pressure on BTC.

Bitcoin miner bankruptcies could push BTC prices lower

Bitcoin miners were hit by declining profitability since the beginning of 2022. Miners’ sell Bitcoin rewards to cover their operation costs and the increasing cost of electricity and bleeding BTC price has dented their profit-making ability.

Miners solve complex mathematical puzzles to verify transactions on the blockchain. Based on data from crypto intelligence platform Glassnode, the total BTC balance held by miners in their wallets has declined by nearly $444 million or 25,000 Bitcoin since July 2022.

This indicates a rising trend of miners cashing out their Bitcoin rewards as companies engaged in mining face a crunch. VanEck predicted restructuring, mergers and bankruptcies among miners and mining companies in Q4 2022 and Q1 2023. This is expected to increase pressure on Bitcoin price and BTC could plummet to $10,000 to $12,000 level.

A decline to $12,000 would mark an 82% drawdown in Bitcoin price from its all-time high of $69,000.

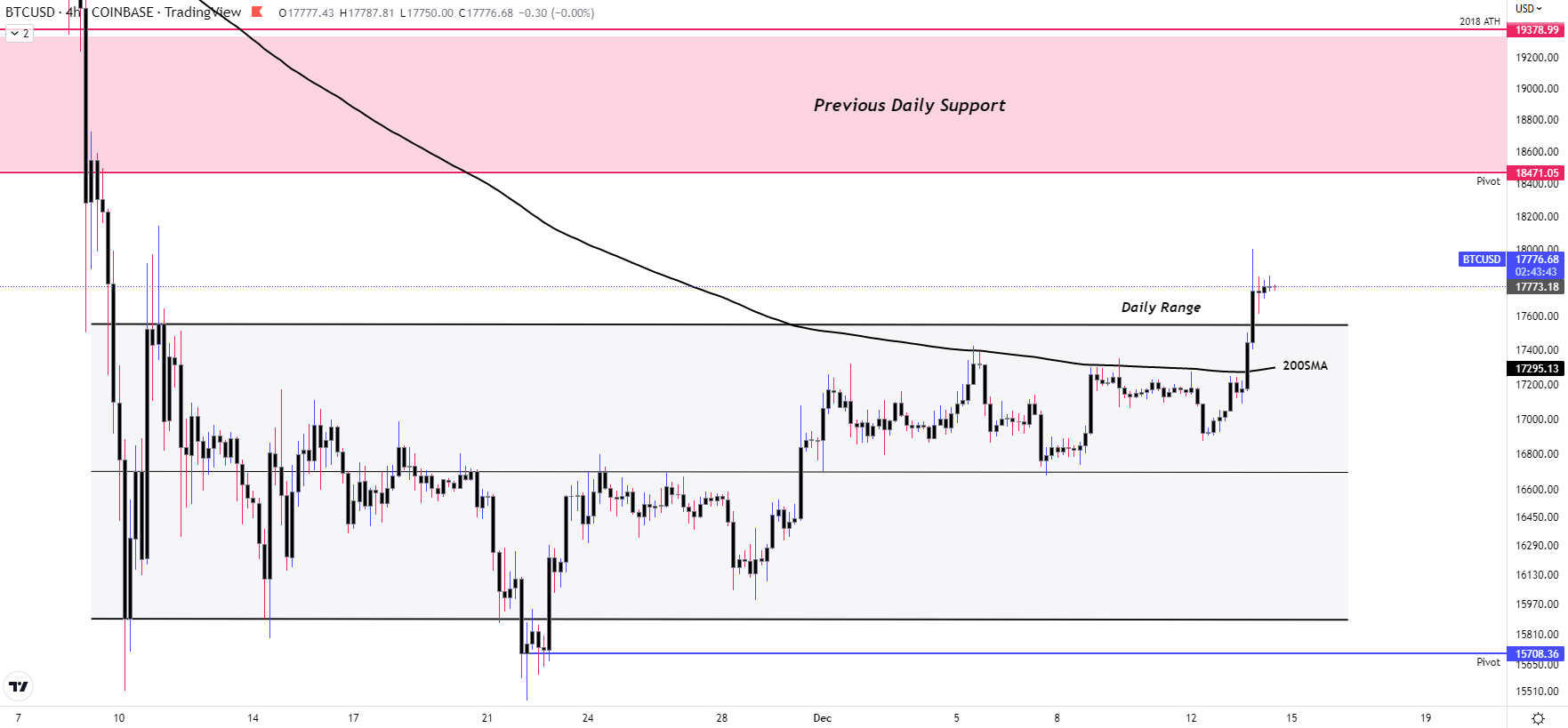

52kskew, a technical analyst, holds an opposing view on Bitcoin price. The expert argues that BTC could target $18,400 after testing resistance at $17,500.

BTC/USD price chart

Bitcoin’s first strong break above the 200-day Simple Moving Average (200-day SMA) since October 25 is a bullish indicator for the asset’s price.