With G10 central banks largely quiet this week, the spotlight shifts to Hungary’s MNB and South Korea’s BoK. Both are expected to keep rates unchanged, though the BoK may soon be forced to ease as trade pressures weigh on domestic growth.

Bank of Korea (BoK) – 2.50%

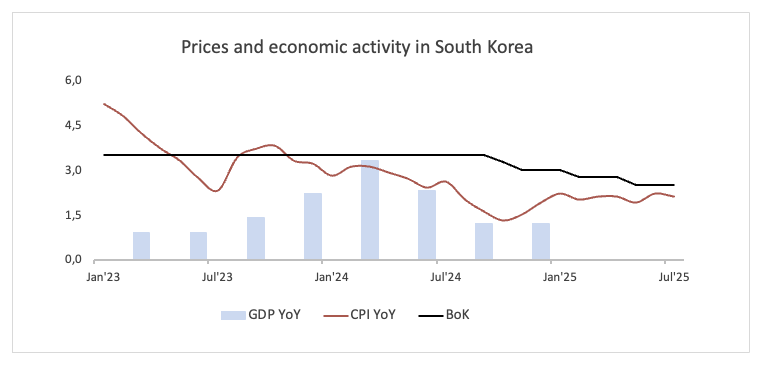

South Korea’s central bank kept its benchmark rate unchanged at 2.50% on July 10, but most policymakers signalled that a cut is likely within the next three months as the economy struggles under the weight of US tariffs.

Asia’s fourth-largest economy shrank unexpectedly in the first quarter. Like many export-driven nations, it has been hit hard by Washington’s aggressive tariff policy, raising expectations that more monetary support will be needed.

In fact, Minutes from that meeting showed board members agreed that tariffs are adding “significant” uncertainty to the outlook, and several argued that easing rates soon would help cushion the slowdown.

Investors see the BoK keeping a steady hand this week, leaving its policy rate at 2.50%. However, there is around 75% chance of a 25 basis point rate cut forecast for the October 23 meeting.

Upcoming Decision: August 28

Consensus: Hold

FX Outlook: FX Outlook: The South Korean won (KRW) has lost some momentum after hitting fresh highs against the US Dollar (USD) in late June. USD/KRW, which briefly slipped below 1,350, levels not seen since October 2024, bounced back in August to trade above the 1,400 mark. For now, mounting anxiety over US trade policy is likely to keep the KRW under scrutiny.

Hungarian Central Bank (MNB) – 6.50%

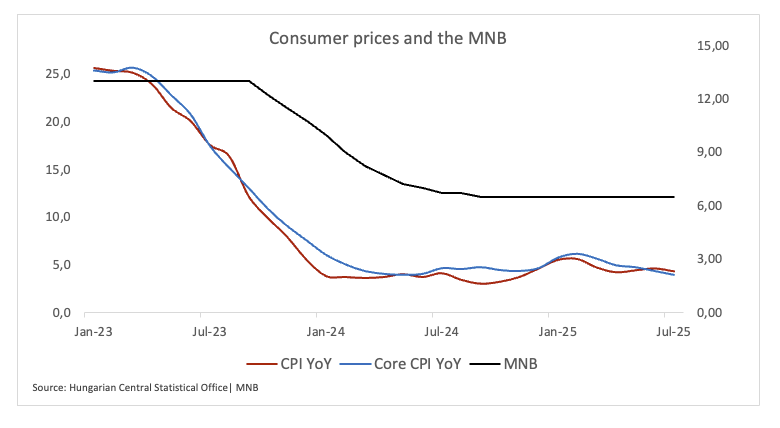

Hungary’s central bank (MNB) kept its benchmark rate unchanged at 6.50% on July 22, holding steady for the 10th month in a row as stubbornly high inflation leaves little room for easing.

The MNB said it does not expect to hit its 3% inflation target until early 2027, warning that households still see price pressures as sticky,, a mindset it considers crucial to break.

In addition, growth remains tepid, with the economy projected to expand just 0.8% this year despite government efforts to spark activity.

Furthermore, Minutes from the July meeting showed policymakers were unanimous in leaving rates on hold, arguing that strong underlying inflation means tight monetary conditions must stay in place for now.

So far, market participants largely anticipate that the central bank will maintain its base rate at 6.50% this week, while implied rates suggest around 15 basis points of easing by year-end.

Upcoming Decision: August 26

Consensus: Hold

FX Outlook: The Hungarian Forint (HUF) has relinquished part of its recent strong gains vs. the single currency, propelling EUR/HUF from the area of yearly troughs near 392.60 (August 20) to the proximity of the 398.00 hurdle. Looking at the broader picture, while below its key 200-day SMA around 403.50, the outlook for the cross should remain tilted to the negative side.