- BALD meme coin reached $100 million market within 48 hours of launch, crossing $25 million liquidity in a LeetSwap-based pool.

- The BALD deployer exhibited malicious behavior and generated a net profit greater than 3,100 ETH tokens.

- The BALD rug pull triggered a mass sell-off in the Base-based DEX LeetSwap’s token LEET, nearly 52% losses for holders overnight.

BALD emerged as the latest meme coin in the crypto ecosystem, drawing degen crypto traders to speculate over massive gains within the first 48 hours of its launch. The meme coin reached a market capitalization of $100 million within two days with $25 million in liquidity added to the token’s liquidity pool on LeetSwap.

Here is a deep dive into the timeline of events concerning BALD’s rug pull by its developer on LeetSwap exchange.

FXStreet has extensively covered BALD since its launch:

BALD developer rug pulled the token, wiping out millions of dollars in value

Gary Gensler, chair of US financial regulator the Securities and Exchange Commission (SEC), once referred to the crypto ecosystem as “the wild West.” In line with Chair Gensler’s quote, a meme coin on Coinbase’s Layer 2 chain BASE, was rugged by its developer.

BALD meme coin’s rug pull wiped out $100 million in the token’s market capitalization, and the token’s price dropped nearly 93% from its all-time high of $0.0938. Analysts on crypto X (formerly Twitter), analyzed the transactions associated with the addition of liquidity to the pool and its massive withdrawal from the pool.

Developer lured traders by adding massive liquidity to the pool

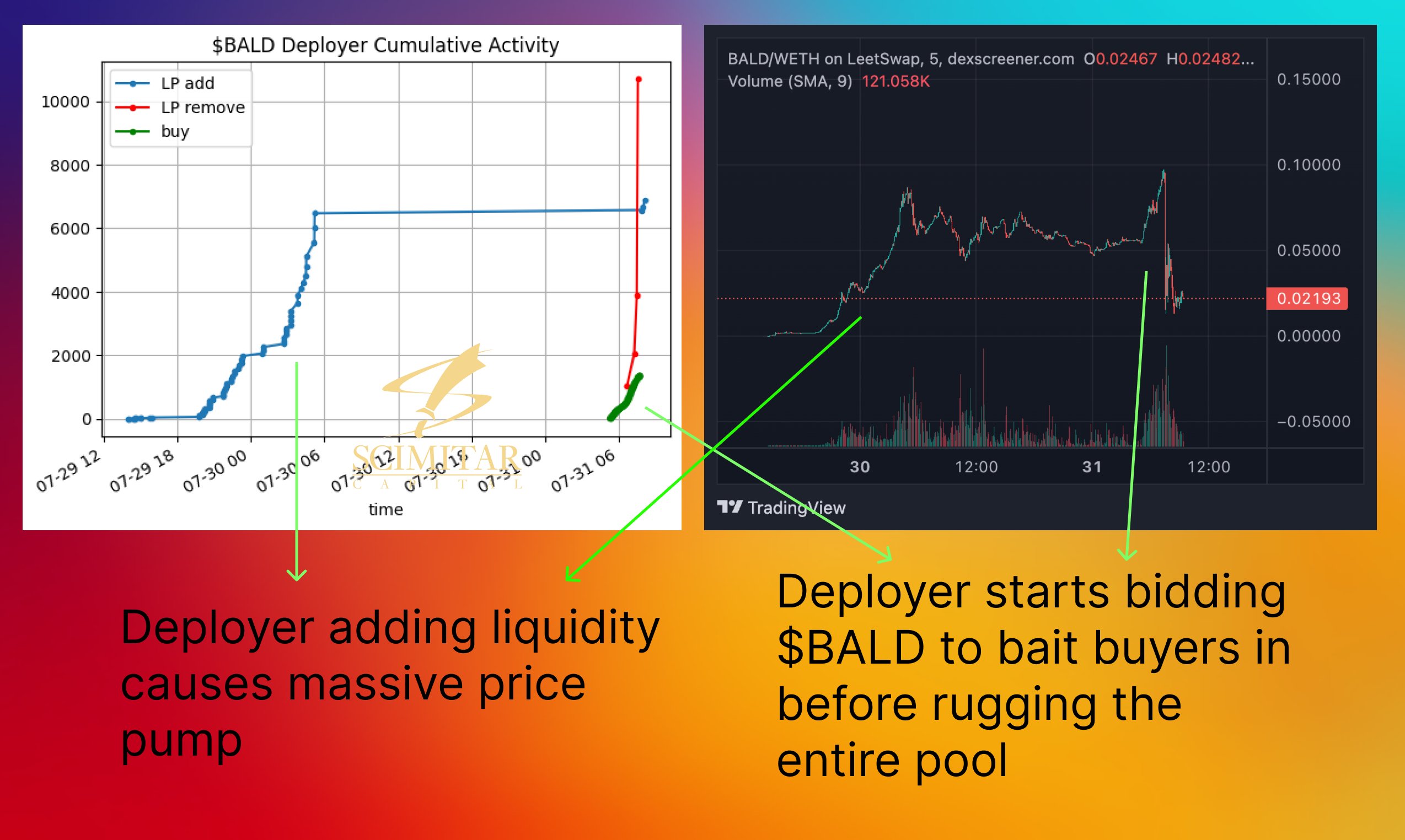

BALD deployer cumulative activity that lured degen traders to the pool

BALD’s developer, known by the Twitter handle @BaldBaseBald, added over 6,700 ETH ($12.5 million worth of liquidity) in the first 24 hours – a surprising amount of capital for a meme coin on a new chain.

The addition of a large volume of liquidity fueled bullish sentiment among crypto traders, driving the token’s price higher and encouraging traders to add their funds to the pool. The catch was that Base mainnet has not been launched yet, and bridged funds cannot be bridged back, meaning liquidity added to the pool is locked.

Speculation was rampant among crypto traders

X was abuzz with speculation of Samuel Bankman-Fried or Coinbase CEO Brian Armstrong himself being the entity behind the handle @BaldBaseBald. Popular analysts and influencers like @HsakaTrades fueled the speculation through their recent tweets.

Gentlemen, these last few days have been a long month.

• Vyper exploit

• Curve pools hack

• Mich liq nearing

• Alameda rugs everyone again with Bald

• Leetswap exploit

• SEC v Richard Heart

• Cryptowatch sunsetting

• XRP ruling questioned

• FTX restart confirmed pic.twitter.com/IKYZw1LKcN— Hsaka (@HsakaTrades) August 1, 2023

With speculation rife in the crypto community, the deployer stopped adding liquidity to the pool, and BALD price started stagnating. The deployer drove the token’s price higher before draining the pool. The first round of withdrawals involved 10,500 Ether worth nearly $20 million. The developer’s grand P&L was close to $6 million worth of Ethereum.

Complete timeline of BALD rug pull

LeetSwap DEX’s role in BALD rug pull

The decentralized exchange on Coinbase’s Layer 2 chain BASE halted swaps in all pools on its platform. BALD’s rug pull resulted in a bloodbath for LEET token holders.

LEET price declined upwards of 50% from its all-time high of $32.01.

We are working with on-chain security experts to try and find a way to recover the locked liquidity.

If you did not lock your liquidity you are free to remove it from the pools.

— LeetSwap (@LeetSwap) August 1, 2023

The exchange informed users that an investigation is underway. If they have not locked their liquidity, they are free to move it and secure it from the risk of exposure to similar exploits in the future.

Like this article? Help us with some feedback by answering this survey:

Source