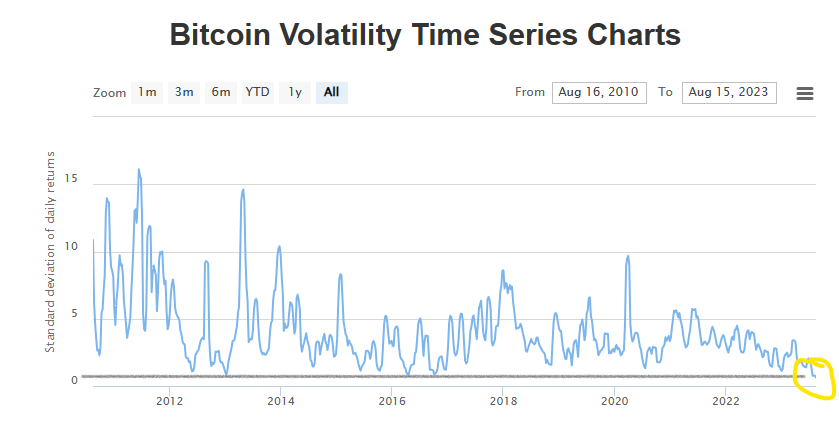

- Bitcoin volatility is now at an all-time low, a move that has historically preceded large price impulses.

- BTC longs now apply pressure on shorts, increasing their buying power with $200 million in leveraged bets.

- While the derivatives increase longs’ potential returns, it exposes shorts to higher losses if the price defies them.

- Notably, periods of extremely low volatility provide moves that are not to be faded.

Bitcoin (BTC) volatility has hit an all-time low, coming on the back of an extremely bored market, possibly due to the lack of proper impulse or catalyst. With extremely low volatility, money-making opportunities have shrunk, even for the most patient investors.

Also Read: Bitcoin and US stock market correlation shoots up: Is BTC at Fed’s mercy again?

Bitcoin volatility shrinks, longs use leveraged bets to drive activity

Bitcoin (BTC) continues to move within a narrow range, with the overall fluctuations between highs and lows not leaving enough room for traders to rake in significant profits. The ultra-low volatility has influenced longs to take leveraged bets on shorts, offering up to $200 million in debt in an attempt to maintain a balance between their contract prices and the current price of BTC.

To explain leveraged bets for the layperson, the longs have let the shorts use debts to increase their buying power, which is expected to fuel a price surge because of increased demand. Short traders are expected to buy more BTC for speculation with the additional funds.

If it plays out as the longs have planned it, then this group of traders has potential returns coming their way because their take profits could soon be triggered, and their pockets will be filled in the selloff.

On the other hand, short traders face unparalleled risks if the narrative plays in favor of long traders. This is because their positions (buys) could soon transform into outsized losses when Bitcoin price rises. To make matters worse, they would still need to return the $200 million debt, with possible interest and transaction fees, among other expenses.

Bitcoin volatility time series

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Anticipating Bitcoin’s next big move with historical volatility patterns

Either way, based on the take-profit selloff that could play out for longs, or the fresh buys incoming as short traders exit their positions (buy), experts anticipate that a possible big move is underway for Bitcoin price. If history is enough to go by, then the expectation of a big move is accurate, considering the breakouts BTC indicated every time the volatility fell that low.

BTC volatility against price

However, there is always the chance that the turnout defies expectations, as it happened in 2018 when both Bitcoin volatility and price skyrocketed. In such a state, however, the market would be highly uncertain, and the price can change dramatically in either direction and within a short period.

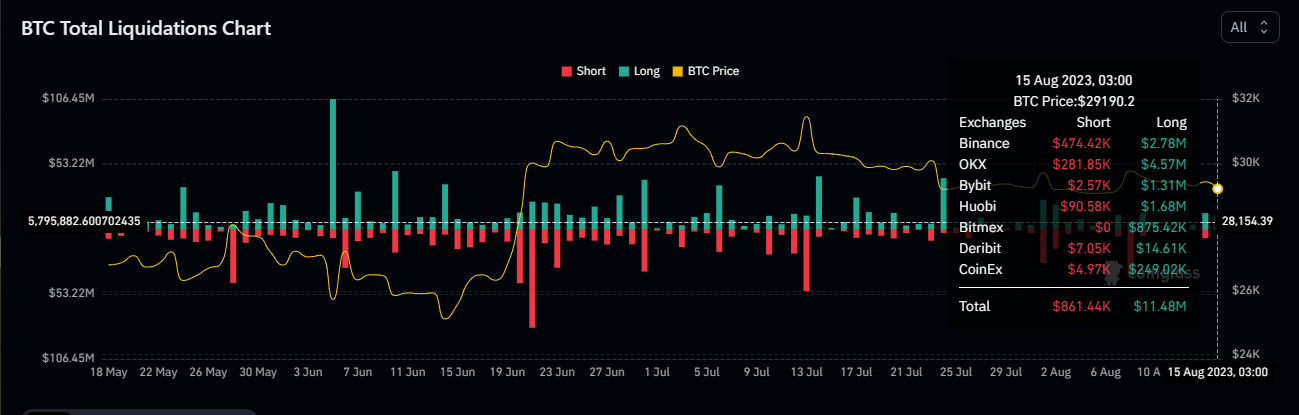

Bitcoin liquidations

Data provided by CoinGlass shows that FUD on August 15 wiped out traders holding long positions, resulting in total losses of around $121 million. This was because of the liquidation of their holdings over the last 24 hours. This sent the crypto market capitalization down by $14 billion to $1.16 trillion at the time of writing.

This slump came on the back of Binance Exchange shutting down its regulated buy-and-sell cryptocurrency arm, Binance Connect.

Dear Biswappers,

The Biswap team keeps abreast of the latest DeFi news and aims to inform you right away.

After a thorough consideration, @binance has made a difficult decision to disable @Binance_Connect on 15 August due to its provider closing the supporting card payments… pic.twitter.com/HcooyLn4sg

— Biswap (@Biswap_Dex) August 15, 2023

While the impact was mainly felt among altcoins, BTC did not go unscathed, with almost $12 million worth of long positions liquidated.

BTC liquidations

Based on the chart above, almost $3 million worth of long positions were liquidated on Binance alone, meaning the exchange closed the leveraged positions because of a partial or total loss of the initial margin.

As traders reacted to the news, Bitcoin price soared to the $29,500 range before a quick pullback to $29,178 at the time of writing.