Reports indicate that the US Securities and Exchange Commission (SEC) has come out early to delay another series of Bitcoin Spot ETF filings, this time by Cathie Wood’s Ark Invest and 21Shares.

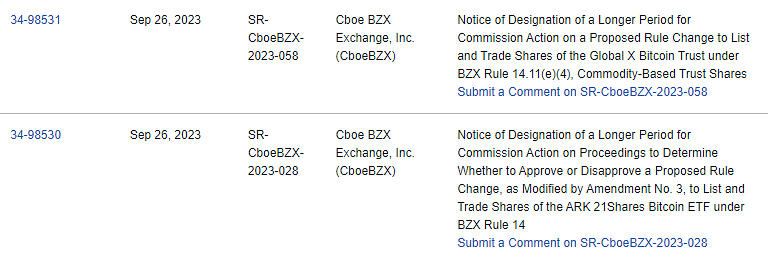

While the filing was due on September 29, the financial regulator came out three days prior, giving a “notice of designation of a longer period for commission action to determine whether to approve or disapprove a proposed rule change…”

SEC delays Ark Invest and 21Shares filing

The delay has experts concluding that a decision may not be due until November 11.

ETF specialist and analyst at Bloomberg Intelligence James Seyffart says, “This may put the hammer down for any hopes of an ETF approval this year. If they went on Ark/21 shares already, we may see delays on all the other filings today too. BlackRock, Bitwise, VanEck, Invesco, Wisdomtree, Fidelity & Valkyrie a all due in mid Oct “

GlobalXETFs has also suffered an early delay, despite its deadline being on October 7.

There is also speculation that the letter from US lawmakers to the SEC Chair Gary Gensler has something to do with the super early decision.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Source