- XRP breaks out to $3.38, supported by positive market sentiment.

- Ripple, US SEC file with the Second Circuit Court to dismiss appeals.

- XRP showcases a bullish technical picture with the MACD indicator maintaining a buy signal.

Ripple (XRP) holds near its intraday high of $3.38 on Friday, backed by a sudden increase in speculative demand after the United States (US) Securities & Exchange Commission (SEC) signaled a potential end to its five-year lawsuit.

The cross-border money remittance token shows signs of extending the rally toward its all-time high of $3.66, reached on July 18 and the following price discovery phase.

Ripple, SEC file to dismiss appeals

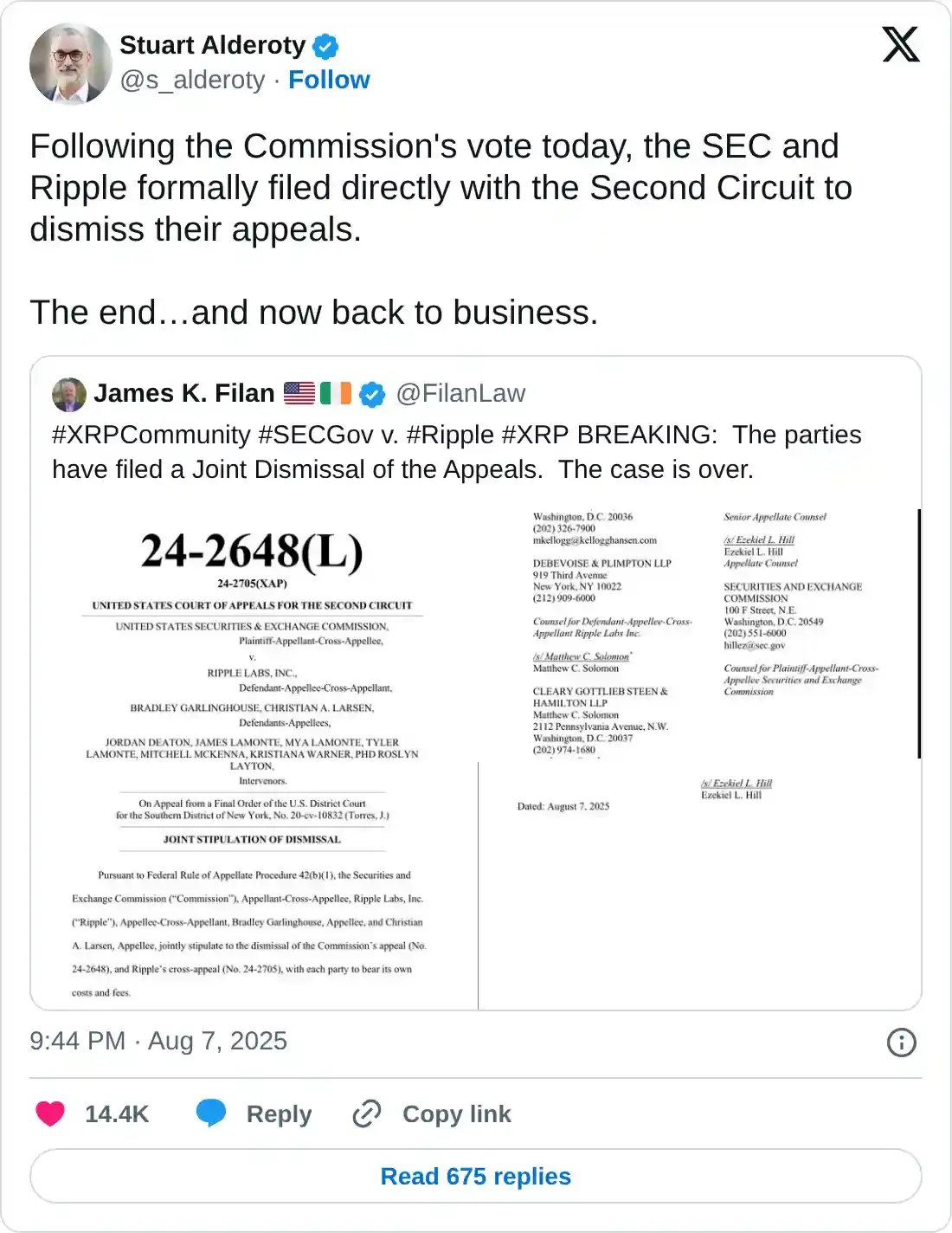

Ripple and the SEC have jointly filed directly with the Court of Appeals for the Second Circuit, requesting to dismiss their appeals.

According to the filing shared by Ripple’s Chief Legal Officer, Stuart Alderoty, each party is expected to settle its own fees and costs. The filing marks a major step toward the resolution of the legal standoff between Ripple and the regulator.

The SEC sued Ripple in 2020, alleging that the company sold unregistered securities in violation of US securities laws. A landmark ruling in 2023 found that the programmatic sale of XRP on third-party platforms like Binance and Coinbase crypto did not constitute unregistered securities. Still, the court found Ripple answerable for direct sales to institutions.

In recent months, Ripple and the SEC have explored settlement paths, especially after the blockchain startup was penalized $125 million, currently in an interest-earning escrow account.

A $50 million settlement was signed by both parties this year. However, Judge Analisa Torres of the District Court for the Southern District of New York rejected the joint motion seeking to end the lawsuit, citing an incomplete legal process.

The SEC is also expected to provide a status report to the court by August 15. However, the joint motion to the Second Circuit offers insight, suggesting that a resolution could be imminent.

Technical outlook: Can XRP sustain the uptrend?

XRP is consolidating gains at around $3.36 at the time of writing, following a rejection from an intraday high of $3.38. Interest in the token picked up the pace on Thursday, following the report regarding the joint motion with the SEC.

The Relative Strength Index (RSI), which is retreating into the bullish region after being slightly overbought at 75, indicates waning buying pressure, possibly due to profit-taking and sentiment in the broader crypto market.

Key support levels include $3.32, which was tested toward the end of July, the 50-period Exponential Moving Average (EMA) at $3.07, the 100-period EMA slightly below at $3.06 and the 200-period EMA at $2.95.

XRP/USDT 4-hour chart

On the other hand, the technical outlook could remain bullish if the Moving Average Convergence Divergence (MACD) indicator upholds a buy signal, triggered on Thursday when the blue line crossed and settled above the red signal line.

A daily close above the intraday high resistance at $3.38 could bolster the uptrend and potentially increase the chances of bulls accelerating the uptrend to the record high of $3.66 and the medium-term target of $4.00.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Source