- The US Securities & Exchange Commission has failed to provide adequate clarity on how several crypto tokens are labeled as securities.

- Crypto traders ask what the next steps are and whether these assets can be registered as securities and traded on Nasdaq.

- Researchers believe that the SEC’s classification would force a closing of several altcoin pairs and result in the delisting on crypto exchanges.

The US Securities & Exchange Commission (SEC) initiated a regulatory clampdown on digital assets on June 5, filing lawsuits against Binance and Coinbase. The regulator updated its allegations against the two exchanges, labeling several cryptocurrencies as “securities.”

The SEC tagged as securities cryptocurrencies worth a combined market capitalization of $100 billion. While tokens identified as securities suffered a decline in price, holders and crypto market participants wonder what’s next for these assets and whether they can be registered and traded on exchanges like Nasdaq.

Also read: XRP price settles above $0.50, wiping out gains from Hinman documents release

What’s next for crypto tokens labeled as securities

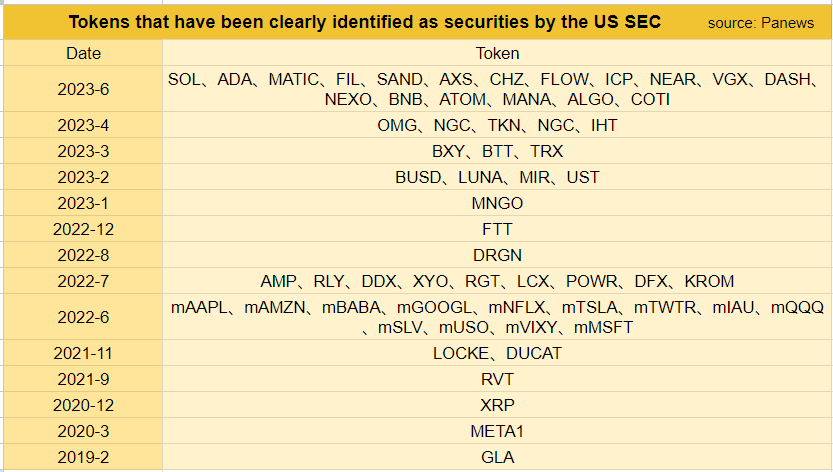

The US SEC has labeled more than 60 assets as securities and updated the list in the lawsuit against Coinbase and Binance. The immediate impact of SEC’s actions was a large-scale outflow of capital from altcoins and a decline in their prices.

Tokens identified as securities by the US SEC

Exchanges and social trading platforms like eToro and Robinhood considered the delisting of assets that the SEC tagged as securities. Market participants are speculating about what’s next for these cryptos.

A crypto trader (identified as @Javacrypto_) asked in a recent tweet whether these assets can get registered as securities and trade on platforms like Nasdaq. A review of the content of Hinman’s emails and internal messages of SEC executives revealed that there is a lack of clarity on the test or analysis that helps decide whether an asset is “sufficiently decentralized” or not. The release of the documents has increased the confusion among experts and analysts.

Security classification to affect US crypto exchanges and traders

Vetle Lunde, senior analyst at K33 Research, told Reuters that security classifications would affect all US-based crypto exchanges and result in a forced closing of various altcoin trading pairs.

The SEC’s move, therefore, makes it expensive for both the tokens deemed securities and the crypto exchanges that list them. Moreover, securities can only be traded by brokers on regulated exchanges involving clearing houses and transfer agents and physical certificates. This increases the hurdles for registration of the tokens as securities and creates new challenges for traders seeking to access and trade them.

Further, the SEC’s classification could hamper the DeFi ecosystem tokens, Ethereum-alternatives like Solana and Cardano, that support several assets on their blockchains.

The overall crypto market capitalization declined by 2.65% between June 5 and the time of writing, according to CoinGecko data.

Total crypto market capitalization chart

Further decline in market capitalization is likely, as altcoins crumble under selling pressure from the regulatory crackdown.