- XRP’s intraday breakout gets snuffed out below the 100-period EMA on the 4-hour chart as volatility intensifies.

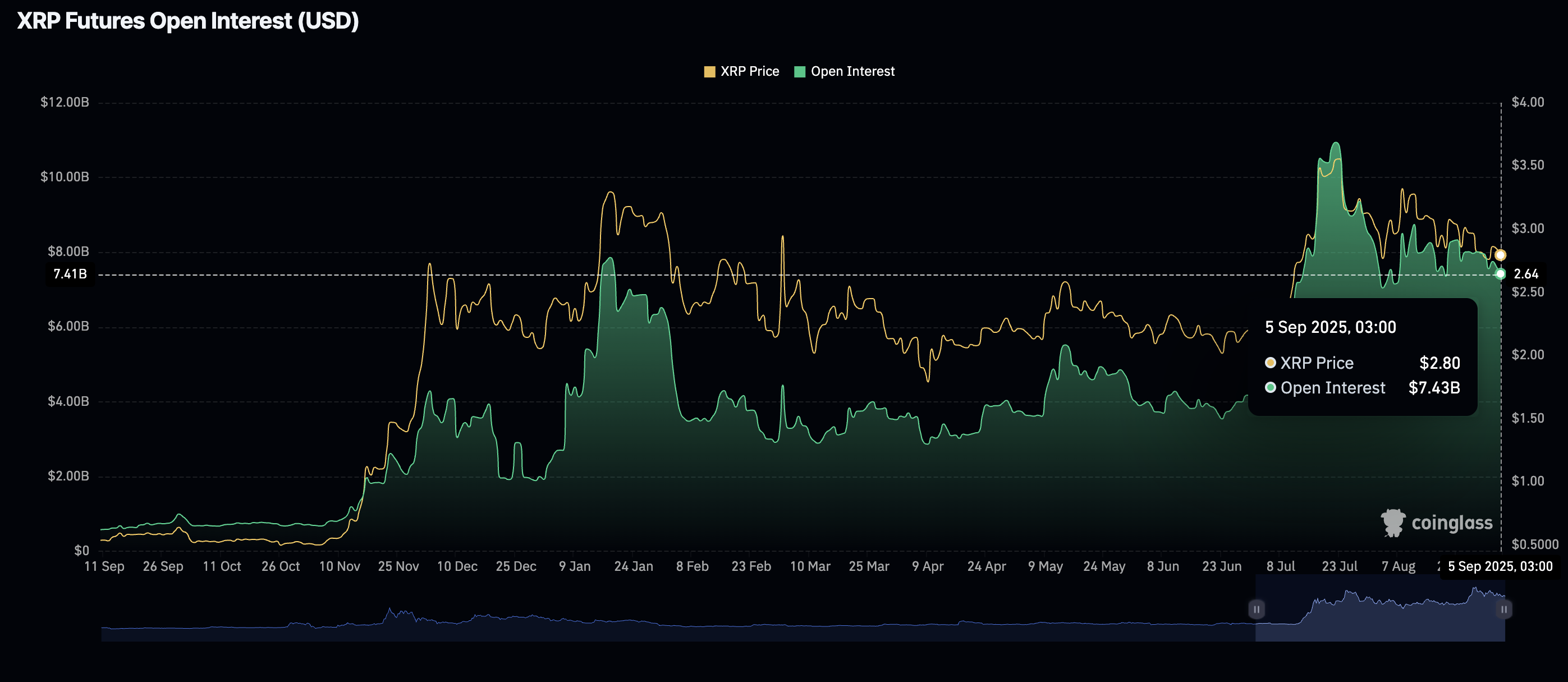

- XRP faces declining retail demand as Open Interest corrects to $7.4 billion.

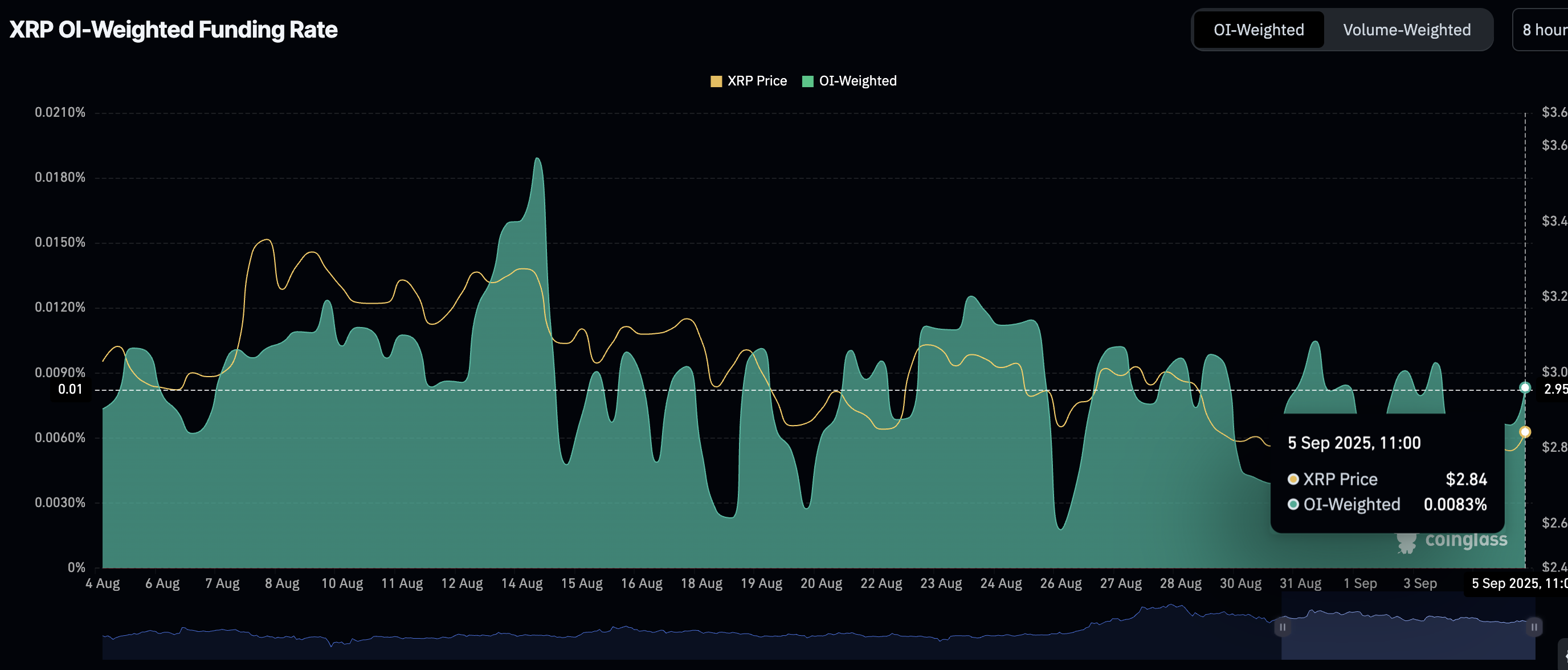

- Positive futures funding rates uphold the rising demand for leverage long positions in XRP.

Ripple (XRP) faces increasing selling pressure ahead of the weekend, trading at round $2.80 on Friday. An intraday recovery attempt lost momentum below a short-term resistance at $2.90, resulting in a brief flash drop toward the $2.80 support.

Market participants are closely monitoring key United States (US) economic data to gain insight into the Federal Reserve’s (Fed) monetary policy direction, especially with the Federal Open Market Committee (FOMC) meeting, where the interest rate decision is expected on September 17.

Risky asset classes, such as crypto and equities, will benefit from what would be the first rate cut of the year. However, traders may need to be content with volatility amid price fluctuations while managing risk in the days to come.

XRP faces declining retail demand as Open Interest shrinks

Retail demand for XRP has significantly decreased over the past few weeks, as evidenced by the futures Open Interest (OI) falling to $7.4 billion after peaking at $10.94 billion on July 22.

A persistent drop in OI, which tracks the notional value of outstanding futures contracts, indicates a lack of conviction in XRP’s ability to sustain a short-term recovery. With fewer traders participating in the market, the path of least resistance could remain downward, increasing the chances of XRP testing the support at $2.70.

XRP futures Open Interest | Source: CoinGlass

Still, a positive futures weighted funding rate of 0.0083% implies that more traders are increasingly leveraging long positions in XRP. If the funding rate rises in the upcoming days, risk-on sentiment could bolster XRP, allowing it to sustain the recovery above the $3.00 psychological level.

XRP Futures Weighted Funding rate | Source: CoinGlass

Technical outlook: XRP could extend its decline

XRP price is testing support at $2.80 after clawing back part of the intraday gains on Friday, reflecting the risk-off sentiment during the American session. The Relative Strength Index (RSI) at 46 and declining toward the oversold region indicates fading bullish momentum as the bears take control.

XRP/USDT 4-hour chart

The sideways movement in the Moving Average Convergence Divergence (MACD) indicator around the zero line indicates a tug-of-war between the bulls and the bears. If the MACD line in blue confirms a sell signal by dropping below the red signal line, the decline could accelerate to test support at $2.70.

If bulls regain control backed by investors buying the dip with support at $2.80 holding, a breakout above the 50-period EMA at $2.84 on the 4-hour chart could mark the beginning of an aggressive bullish push above the $3.00 pivotal level.

Cryptocurrency metrics FAQs

Source