Bitcoin slips but holds above $95,000, weighed down by declining retail demand. Ethereum trades narrowly between the 100-day EMA support and the 200-day EMA resistance. XRP edges lower for the third consecutive day, driven by a persistently weakening derivatives market.

United States CFTC Gold NC Net Positions up to $251.2K from previous $227.6K

Bitcoin slips but holds above $95,000, weighed down by declining retail demand. Ethereum trades narrowly between the 100-day EMA support and the 200-day EMA resistance. XRP edges lower for the third consecutive day, driven by a persistently weakening derivatives market.

United Kingdom CFTC GBP NC Net Positions increased to £-25.3K from previous £-30.5K

Bitcoin slips but holds above $95,000, weighed down by declining retail demand. Ethereum trades narrowly between the 100-day EMA support and the 200-day EMA resistance. XRP edges lower for the third consecutive day, driven by a persistently weakening derivatives market.

Eurozone CFTC EUR NC Net Positions fell from previous €162.8K to €132.7K

Bitcoin slips but holds above $95,000, weighed down by declining retail demand. Ethereum trades narrowly between the 100-day EMA support and the 200-day EMA resistance. XRP edges lower for the third consecutive day, driven by a persistently weakening derivatives market.

Gold slides below $4,600 as profit-taking grows, Fed cut doubts rise

Gold (XAU/USD) registers losses of over 0.70% on Friday as traders take profits, as in the last two weeks, data in the US has shown the labor market is not as weaker as expected. Therefore, traders are turning skeptical that the Federal Reserve (Fed) might go for two cuts, as reflected by the swaps markets. XAU/USD trades at $4,580 at the time of writing.

Bullion retreats as resilient US data, easing geopolitical risks push traders to cut aggressive Fed easing bets

Market mood is turning negative as US President Donald Trump shook the markets, as he seems reluctant to nominate the National Economic Council Director Kevin Hassett for the Fed Chair post. “I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event.

In the headlines, the US Dollar jumped while Gold prices dipped to $4,560 before returning to current price levels. Polymarket reported that the favorite to become the next Fed Chair is Kevin Warsh, as his odds moved from around 40% to 60%.

Meanwhile, geopolitical risk premia continued to ease as reports emerged that Israeli Prime Minister Benjamin Netanyahu told Trump to hold off an attack on Iran. However, in a second call, according to AXIOS, Netanyahu asked Trump to hold off military action to give Israel more time to prepare for a potential Iranian retaliation. Additionally, US officials said that military action is not off the table if Tehran resumes killing protesters.

Data-wise, US Industrial Production rose 0.4% in December, exceeding estimates of a dip of 0.1%, revealed the Federal Reserve.

Fed officials crossed the wires, led by Governor Michelle Bowman and Boston Fed President Susan Collins. It is worth noting that policymakers will begin their blackout period on Saturday.

Upcoming US data next week

The US schedule will feature housing data, Initial Jobless Claims, the final reading of GDP for Q3 2025, the Fed’s favorite inflation gauges, the Core Personal Consumption Expenditures (PCE) Price Index, Flash PMIs and Consumer Sentiment.

Daily digest market movers: Bullion poised for minimal weekly gains as Dollar recovers

- The US Dollar Index (DXY), which tracks the American currency’s performance versus six peers, is up 0.03% to 99.38. US Treasury yields are soaring following the Hassett headline, with the 10-year T-note yield up nearly five basis points at 4.219%.

- US economic data showed a mixed inflation picture, with consumer prices stabilizing while producer prices turned hot. On an annual basis, headline CPI held at 2.7% in December, virtually unchanged from November, whereas PPI accelerated to 3%, up from 2.8% the prior month, highlighting lingering cost pressures upstream.

- Also, the labor market signaled resilience. Last Friday’s Nonfarm Payrolls report was solid despite undershooting forecasts, while the Unemployment Rate edged down to 4.4%, below the Fed’s 4.5% projection. Reinforcing that strength, Initial Jobless Claims fell from 207K to 198K, pointing to fewer Americans filing for unemployment benefits.

- Fed Governor Michelle Bowman said that the central bank should not pause its easing cycle and that it should cut rates again, given the labor market risks. Boston Fed President Susan Collins praised central bank independence, adding that “a central bank that, while accountable, has the independence required to make the tough calls that may be unpopular in the short term.”

- Given the backdrop, traders trimmed the chances for further easing by the Federal Reserve. Prime Market Terminal data shows 43 basis points of easing expected towards the end of 2026.

Technical analysis: Gold price retreats below $4,600, eyes on $4,550

Gold consolidates below $4,600 after hitting a four-day low of $4,537, but it has managed to edge past $4,550. The Relative Strength Index (RSI) shows a shift from bullish to neutral momentum, but bears seem to be gathering strength. If RSI clears its neutral line, XAU/USD could challenge its latest cycle low of $4,407 hit on January 8.

Conversely, if Bullion clears $4,600, buyers could remain hopeful of challenging the all-time high (ATH) at $4,643 before targeting $4,700.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

US Dollar Weekly Forecast: Recovery gathers extra momentum

The week that was

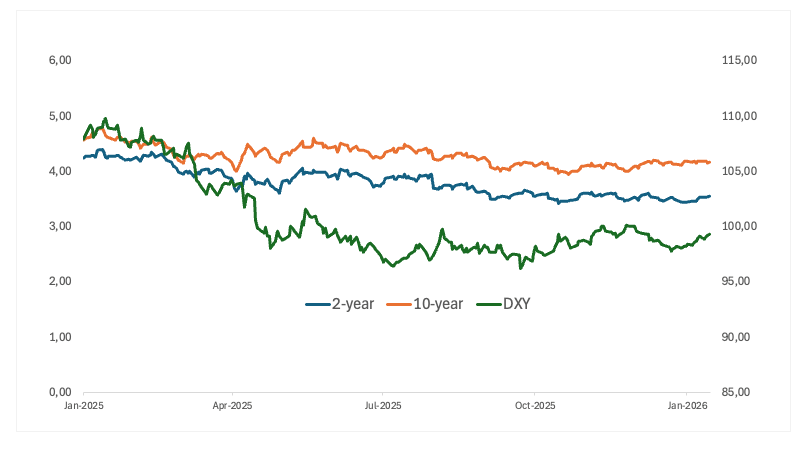

It was another constructive week for the US Dollar (USD), with the US Dollar Index (DXY) extending its steady climb and remaining firmly on the front foot so far this year. Indeed, the DXY pushed decisively back above the 99.00 mark, doing so with a fair degree of conviction.

Beyond the broader recovery, the index also managed to reclaim its key 200-day Simple Moving Average (SMA) around 98.70, a technical development that could open the door to further gains in the near term.

On the policy side, commentary from Federal Reserve (Fed) officials once again reveals a divided Committee on the path ahead for interest rates. That said, renewed concerns about the Fed’s independence helped temper enthusiasm for the Greenback, maybe preventing an even stronger rally.

The move higher in the USD was mirrored by a solid rebound in US 2-year yields. Elsewhere along the curve, the belly remained largely in consolidation mode, while the long end managed a modest recovery in the latter part of the week.

Fed officials strike a cautious balance as policy debate widens

Recent remarks from Fed rate setters underline a growing divergence within the Committee over the appropriate timing of rate cuts, even as most policymakers agree that inflation is easing only gradually and policy must remain restrictive for now. While some officials are increasingly open to easing later this year if forecasts play out, others remain firmly focused on the risk that inflation proves more persistent than expected.

On the more dovish side, Anna Paulson (Philadelphia, voter) argued that further rate cuts later this year would be appropriate if the outlook evolves as anticipated. She expressed cautious optimism on inflation, which she expects to be close to 2% by year-end, and described current policy as only slightly restrictive. Paulson sees US growth around 2% this year, albeit uneven, with inflation moderating further and the labour market stabilising into 2026, an economy that is “bending but not breaking”.

Similarly, Austan Goolsbee (Chicago, non-voter) said the Fed should remain focused on bringing inflation down, while pointing to continued resilience in the labour market. His comments kept the door open to rate cuts later this year, provided disinflation continues and labour-market conditions remain solid.

FOMC Governor Michelle Bowman (permanent voter) sent a more nuanced message. She said that the Fed should be ready to cut rates again if the labour market weakens quickly, which it could. Bowman, on the other hand, stressed that her base case is still positive: steady growth and a return to near-full employment as policy becomes less strict over time. She also pointed out that the risks of inflation are going down, especially as the effects of trade tariffs wear off.

On the other hand, some officials spoke in a very hawkish way. Neel Kashkari (Minneapolis, voter) said that rates should stay the same for now because the economy is strong enough to show that policy is not too tight. He said that cutting too soon could be a bad idea because inflation is still high and trade tariffs could keep prices high for longer, potentially keeping inflation above target for two to three more years.

Raphael Bostic (Atlanta, non-voter) echoed this concern, stating that the fight against inflation is “not over yet” and that policy should remain restrictive. Bostic also warned that fiscal tailwinds, including tax cuts introduced last year, could support growth into 2026 and sustain demand-driven inflation pressures.

The most hawkish remarks came from Jeff Schmid (Kansas City, voter), who argued forcefully against rate cuts, describing inflation as still “too hot.” Schmid warned that policy and fiscal dynamics risk adding further momentum to demand that already exceeds supply, and reiterated his view that recent labour market cooling is structural rather than cyclical, something that easier monetary policy would not fix.

Bottom line: While a gradual shift towards rate cuts later this year remains possible, particularly if inflation continues to edge lower, the overall message from Fed officials suggests no urgency to ease. The Committee remains divided, with inflation risks and the durability of disinflation still central to the policy debate.

So far, implied rates point to no more than around 45 basis points of easing this year, while a rate cut at the January 28 gathering is practically ruled out.

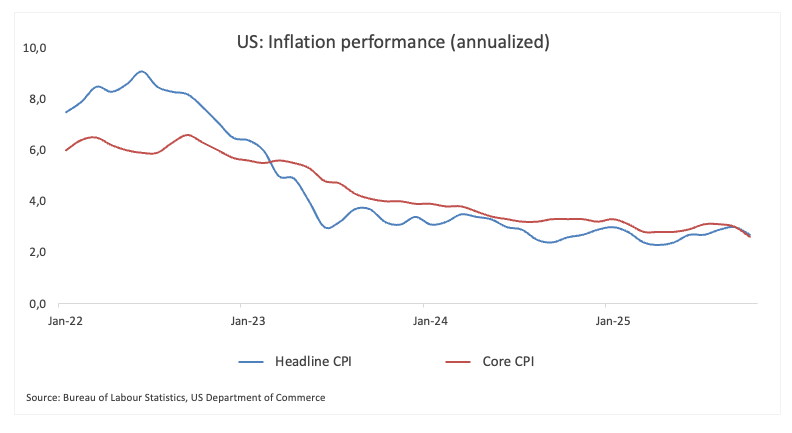

Falling US inflation: A mirage?

The latest US inflation data showed both the headline Consumer Price Index (CPI) and the core print advancing by 2.7% and 2.6%, respectively, in the year to December, both prints matching their previous month’s advance.

Investors saw this set of data releases as a confirmation of further interest rate cuts in the upcoming months, despite the impact of US tariffs on the cost of living of Americans still remaining far from clear, and several Fed officials still warning that inflation does remain elevated and quite above the bank’s 2.0% goal.

Threats to the Fed’s independence weigh on the buck

Earlier in the week, the Greenback suffered another bout of weakness following reports that the Justice Department could seek to indict Chair Jerome Powell over remarks he made to Congress about cost overruns tied to a renovation project at the Federal Reserve headquarters.

On this, Powell pushed back, describing the move as a pretext aimed at gaining leverage over interest-rate decisions, something President Trump has openly advocated.

Adding to the uncertainty, Trump said that potential candidates to succeed Powell could be named in the coming weeks.

What’s in store for the US Dollar

The spotlight next week will be firmly on US PCE inflation, alongside the flash PMI readings, which should offer an early snapshot of how business activity is shaping up at the start of the year.

There will be no fresh signals from the Fed, however, as officials have now entered the customary blackout period ahead of the late-January policy meeting.

Technical landscape

After bottoming out around 97.70 on December 24, the US Dollar Index (DXY) has staged a solid rebound. The recovery has seen the DXY not only regain the 99.00 handle, but also push decisively back above its key 200-day Simple Moving Average (SMA) near 98.70.

That break higher keeps the technical bias constructive and opens the door to a potential retest of the November 2025 peak at 100.39. A clear move through that level would shift attention towards the May 2025 high at 101.97.

Looking south, the first level of support is at the December low of 97.74. If there is a bigger sell-off, the index could go back to the 2025 bottom at 96.21 (September 17). If it breaks through that level, it will meet deeper support at the February 2022 floor at 95.13, and then at the 2022 valley at 94.62.

The Relative Strength Index (RSI) is still close to 63, and the Average Directional Index (ADX) is close to 19, which means that the current trend still has some strength.

-1768588752546-1768588752550.png&w=1536&q=95)

Bottom line

The US Dollar has found a second wind over the past couple of weeks, with momentum clearly tilting back in its favour, at least for now. Part of that support comes from a cluster of Fed officials who continue to lean hawkish, helping to anchor the greenback in the near term.

Policymakers appear especially focused on the labour market, watching closely for any signs of material weakness. But inflation remains very much part of the equation. Price pressures are still running hotter than the Fed would like, and if progress on disinflation stalls, expectations for early or aggressive rate cuts could quickly be pushed further down the road.

That would point to a more cautious Fed and a firmer Greenback, regardless of the political backdrop.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

WTI Oil recovers as Iran tensions ease, supply glut limits upside

West Texas Intermediate (WTI) US Oil trades around $59.80 per barrel on Friday at the time of writing, up 1.60% on the day. The Crude Oil is recovering part of the ground lost over the previous two sessions as investors reassess geopolitical risks in the Middle East following more cautious remarks from the White House regarding Iran.

US President Donald Trump said he had stepped back from the threat of military action after receiving assurances that no further executions would take place and that violence would subside. According to several sources cited by Reuters, Israel and other regional allies also urged Washington to delay any intervention, fearing retaliation that could destabilize the region. These developments have helped reduce, at least in the near term, the geopolitical risk premium embedded in Oil prices.

This improvement in sentiment comes after markets had feared a rapid escalation that could disrupt Iranian Oil production or affect key shipping routes in the Gulf. Iran remains a major player within the Organization of the Petroleum Exporting Countries (OPEC), and any significant interruption to its supply would have immediate repercussions on the global market balance. However, several analysts note that geopolitical risks have not fully disappeared, keeping investors on alert.

Despite this geopolitical support, market fundamentals continue to weigh on the medium-term outlook for WTI US Oil. Many analysts maintain a cautious, or even bearish, stance due to expectations of ample supply in 2026, despite earlier OPEC projections pointing to a more balanced market. Recent data on US crude inventories have also revived concerns about oversupply, against a backdrop of demand that is still seen as fragile.

From a structural perspective, Shell released its Energy Security Scenarios 2026 report on Thursday, outlining a bullish long-term outlook for global energy demand. According to the report, primary energy needs could be significantly higher by 2050, supporting Oil growth over the long run, Reuters reported. This long-term view, however, contrasts with short-term sentiment dominated by oversupply dynamics.

In addition, Reuters reported that the United States seized another Venezuela-linked Oil tanker in the Caribbean, bringing the total number of vessels targeted under US sanctions on Venezuelan Oil to six. The move came ahead of a scheduled meeting between Donald Trump and opposition leader María Corina Machado, highlighting Washington’s continued enforcement of sanctions, although the immediate impact on global supply remains limited.

Overall, the current rebound in WTI US Oil mainly reflects temporary relief on the geopolitical front, while concerns over global supply and demand conditions continue to restrain the prospects for a more sustained upside move.

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Ripple Price Forecast: XRP edges down amid rising exchange reserves, market weakness

Ripple (XRP) is edging lower toward the pivotal $2.00 level at the time of writing on Friday, marking three consecutive days of declines. The sell-off extends across the crypto market, with Bitcoin (BTC) falling toward $95,000 and Ethereum (ETH) pressing down on support at $3,300.

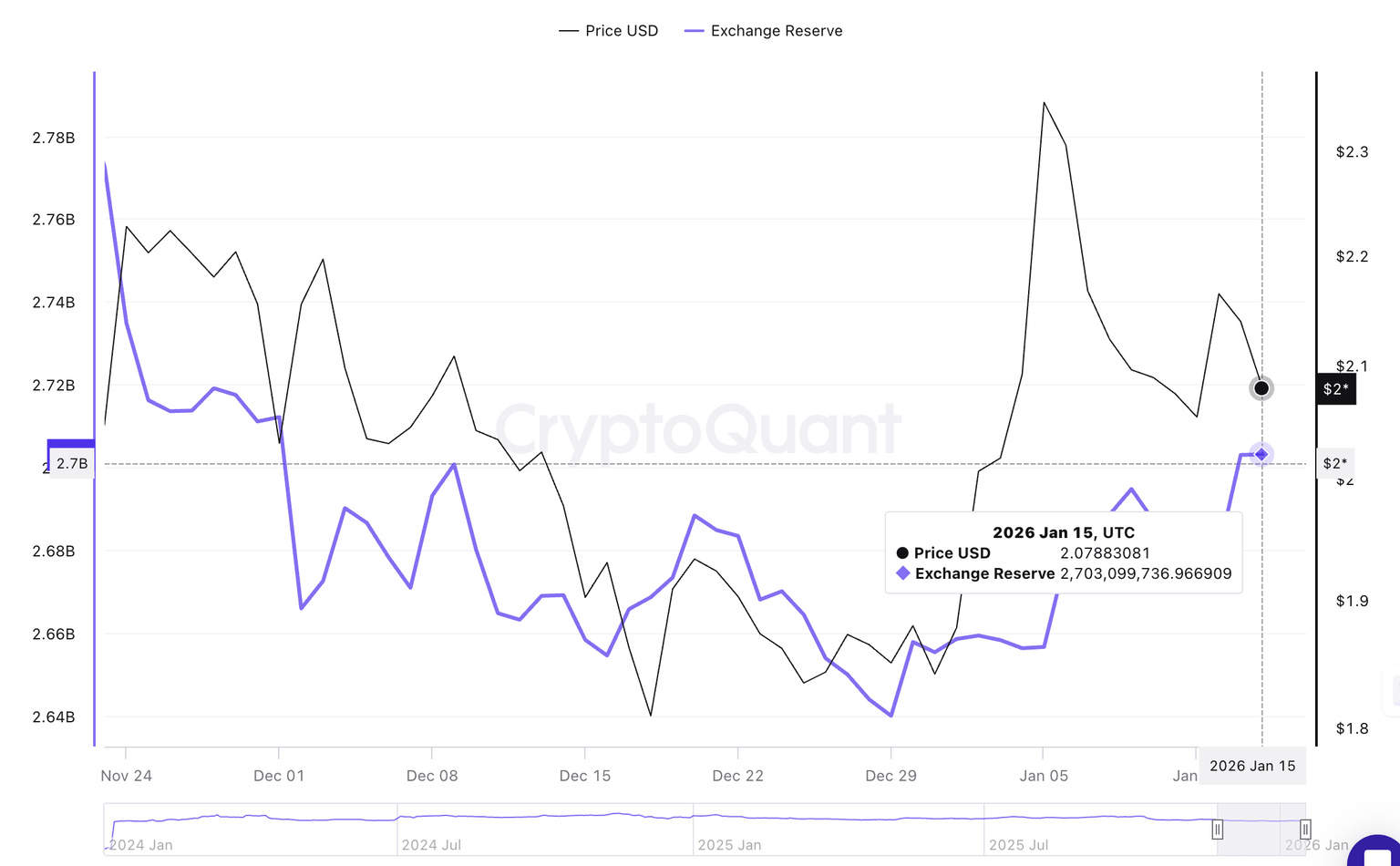

XRP under pressure as exchange reserves surge

The number of XRP coins held across exchanges has increased to 2.7 billion as of Thursday, from 2.67 billion on Monday. Looking back, XRP exchange reserves stood at 2.64 billion on December 29, suggesting holders are transferring the tokens with the intention of selling when the price rises.

According to CryptoQuant, rising exchange reserves indicate higher selling pressure, which could pose an increased risk to price recovery.

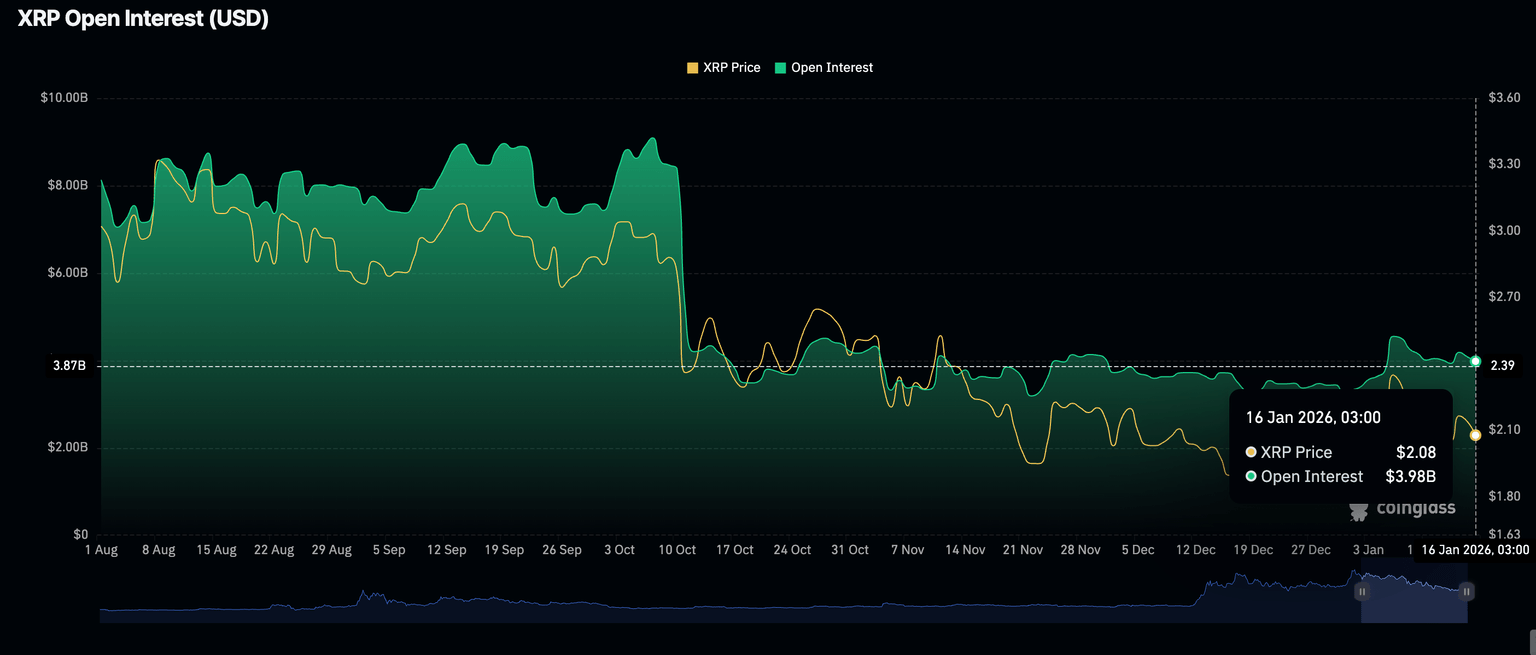

Meanwhile, demand for XRP derivatives has remained weak, falling to $3.98 billion on Friday from $4.08 billion the previous day. The OI peaked at a yearly high of $4.55 billion on January 8, a move that happened a couple of days after XRP rose to $2.42. Further decline in the OI could drive the prices lower.

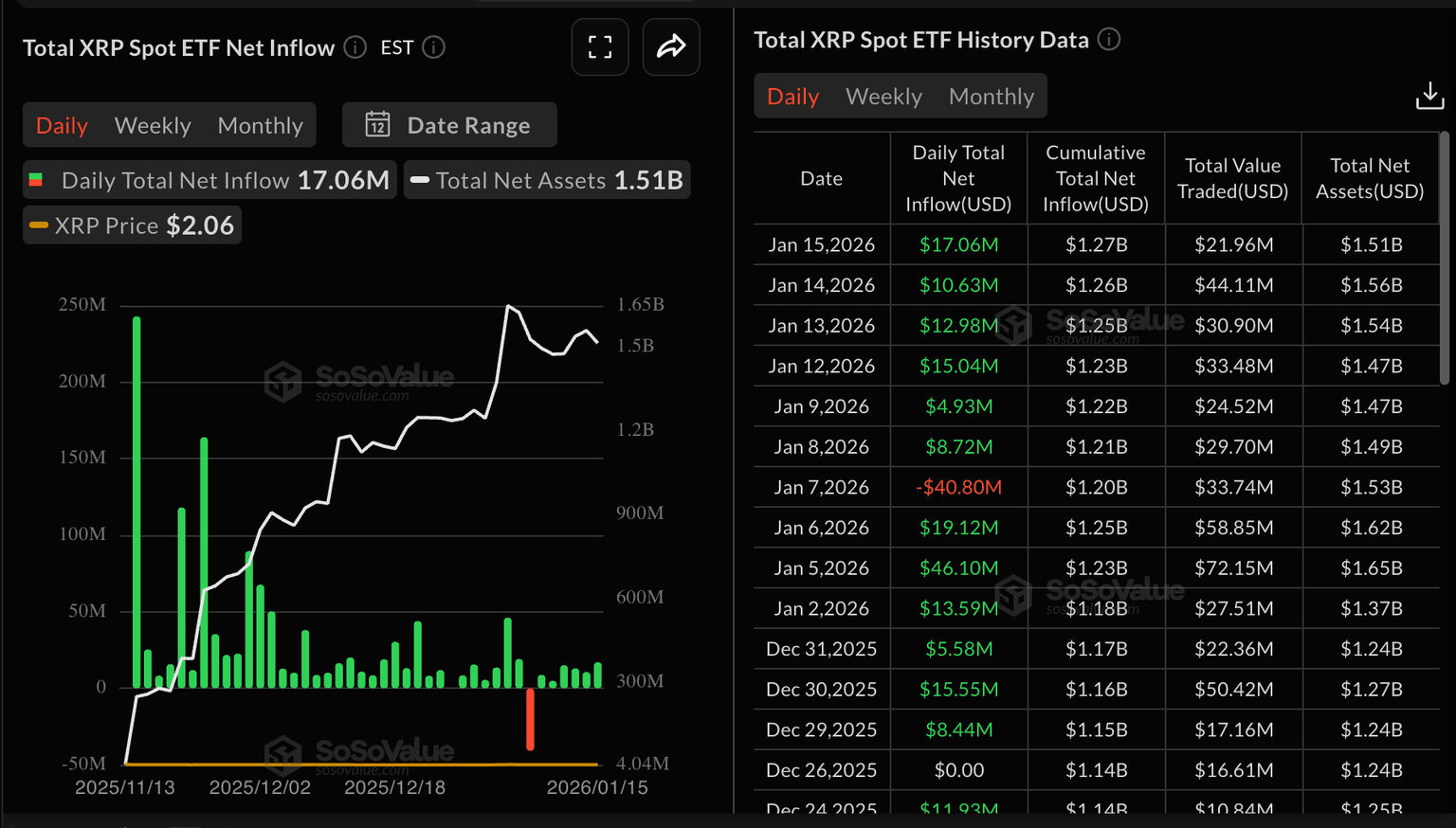

Despite the three-day price correction, institutional sentiment remains relatively positive, as reflected in steady inflows into XRP spot Exchange Traded Funds (ETFs).

US-listed XRP ETFs recorded approximately almost $17 million in inflows on Thursday, up from almost $11 million on Wednesday, according to SoSoValue data. The cumulative inflow stands at $1.27 billion, and the net assets at $1.51 billion, indicating steady investor confidence.

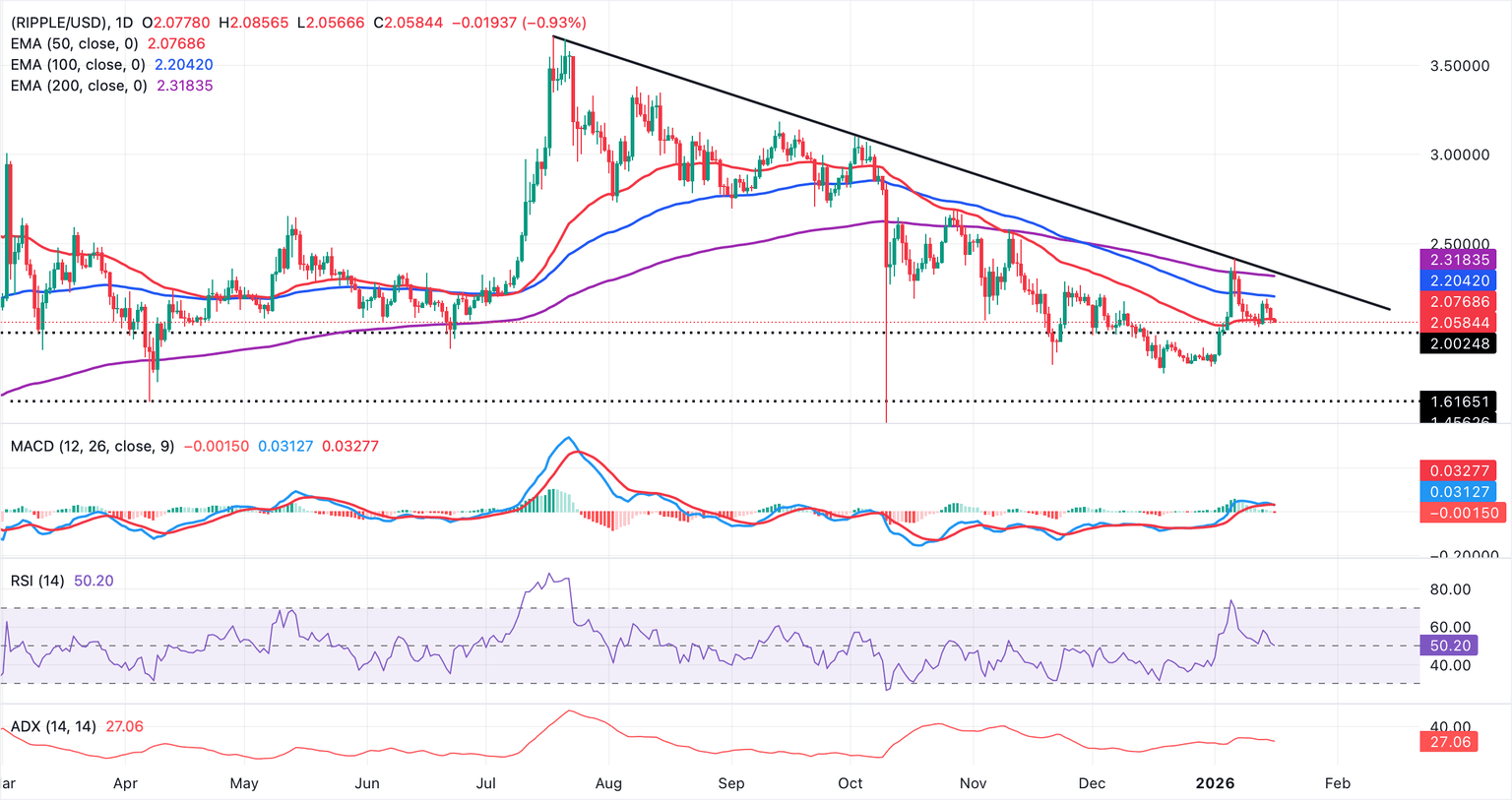

Technical outlook: XRP decline persists as $2.00 support holds

XRP is trading at $2.06 at the time of writing on Friday, as headwinds weigh on the cross-border money remittance token. The 50-day Exponential Moving Average (EMA) at $2.08 caps the immediate upside, preserving the bearish bias.

The Moving Average Convergence Divergence (MACD) has crossed below the signal line on the daily chart, while the histogram bars have turned negative, suggesting downward pressure is building. Bearish influence is poised to increase if the Relative Strength Index (RSI) at 50 on the same chart extends its decline below the midline.

However, closing above the 50-day EMA at $2.08 would ease immediate pressure and open room toward the 100-day EMA at $2.20 and the 200-day EMA at $2.32. Failure to reclaim these barriers keeps the path of least resistance downward.

Ripple FAQs

(The technical analysis of this story was written with the help of an AI tool.)

Silver Price Forecast: XAG/USD falls to near $91.00 due to risk-on sentiment

Silver price (XAG/USD) extends its losses for the second successive session, trading around $91.00 during the European hours on Friday. Silver price loses ground amid decreasing safe-haven demand, which could be attributed to easing concerns over geopolitical risks and Federal Reserve (Fed) independence.

US President Donald Trump said he had stepped back from threats of military action after receiving assurances that further killings would not occur and executions would be halted. Market sentiment was also supported by reports that Israel and other regional allies urged Washington to delay any action, amid concerns over potential retaliation.

The safe-haven demand for Silver weakens as the risk-on mood improves after President Trump said he has no plans to dismiss Fed Chair Jerome Powell despite reported Justice Department indictment threats. Moreover, the US and Taiwan signed a trade agreement on Thursday aimed at boosting American semiconductor production in exchange for lower tariffs.

Silver, a non-interest-bearing asset, loses its shine as Thursday’s US Initial Jobless Claims data reinforced the likelihood that the Fed will keep interest rates on hold for the coming months. According to the CME Group’s FedWatch tool, Fed funds futures continue to price in about a 95% probability that the US central bank will keep rates unchanged at its January 27–28 meeting. Fed funds futures have pushed expectations for the next rate cut back to June, reflecting stronger labor market conditions and policymakers’ concerns over sticky inflation.

Initial Jobless Claims unexpectedly fell to 198K in the week ended January 10, below market expectations of 215K and down from the prior week’s revised 207K. The data confirmed that layoffs remain limited and that the labor market is holding up despite an extended period of high borrowing costs.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold’s moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Silver Price Forecast: XAG/USD rally hits pause as US defers import tariffs on critical minerals

Silver price (XAG/USD) trades over 2% lower to near $90.40 during the Asian trading session on Friday. The white metal struggles to extend its rally after posting a fresh all-time high near $93.90 on Wednesday.

The asset has come under pressure as the United States (US) deferred tariffs on imports of critical minerals. On Thursday, US President Donald Trump ordered Trade Representative Jamieson Greer and Commerce Secretary Howard Lutnick to “enter into negotiations with trading partners to adjust the imports of critical minerals so that such imports will not threaten to impair the national security of the economy”, Reuters reported.

The statement indicates that the US is insufficient to become self-reliant for its needs of critical minerals, which is used in various industries.

Earlier, the Silver price rallied as traders loaded it significantly in fear of the imposition of tariffs on its imports.

Technically, the scenario is favorable for the Silver price in the long run, as it highlights its necessity by the US.

Additionally, firm expectations that the Federal Reserve (Fed) will hold interest rates steady in the policy meeting later this month have also weighed on the Silver price. Theoretically, a pause in the Fed’s monetary easing campaign weighs on non-yielding assets, such as Silver.

Silver technical analysis

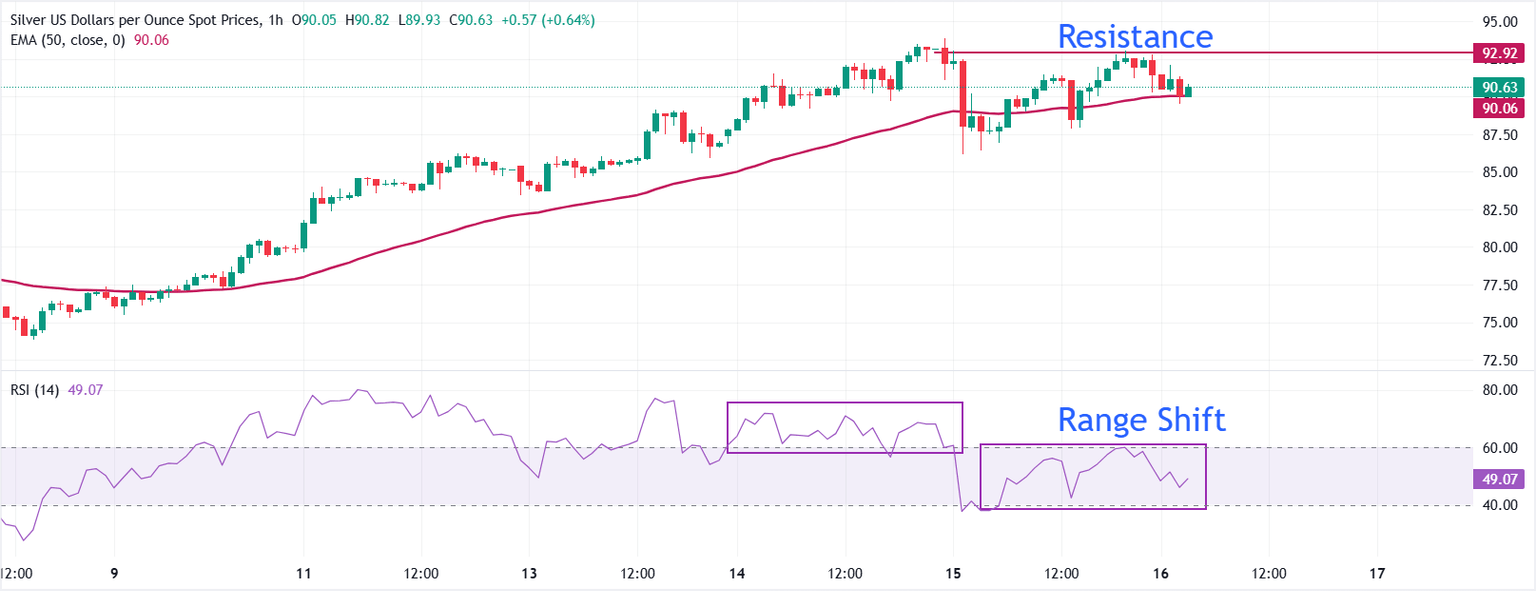

XAG/USD trades lower at $90.63 as of writing. The 50-hour Exponential Moving Average (EMA) rises and sits at $90.06, supporting the short-term uptrend as the price holds above it. The 50-hour EMA’s upward slope underscores an improving trend-following support.

The range shift move by the 14-hour Relative Strength Index (RSI) from the 60.00-80.00 zone to the 40.00-60.00 area suggests that the bullish momentum has terminated at least for now.

Going forward, the all-time high of $93.90 will remain a key barrier for the Silver price. On the downside, the price could fall to the January 13 low of $83.62 if it breaks below the January 15 low of $86.19.

(The technical analysis of this story was written with the help of an AI tool.)

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold’s moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.